The Futures Industry Association (FIA) held their most recent webinar entitled: The Next Progression of Derivatives Markets – Distributed Ledger Technologies and Decentralized Exchanges.

The webinar was hosted by attorneys from Perkins Coie.

Traditionally, cryptocurrency have been traded on centralized exchanges (CEX).

CEX was defined in the webinar in one slide as, “an exchange platform operated by a third party intermediary that is part of the transaction flow (e.g. as an escrow like intermediary). Such an exchange is custodial in that you must deposit your digital assets into an exchange account.”

A decentralized exchange (DEX) “is typically a non-custodial exchange where the user maintains their digital assets in their own digital wallet and simply utilizes to the exchange to execute peer-to-peer transactions.”

A CEX operates similarly to a clearinghouse, which steps in between a buyer and seller to guarantee all transactions.

On the other hand, CEX are vulnerable to cyberattacks.

In May 2019, Binance announced that hackers had stolen approximately $40 million worth of bitcoin on its centralized exchange.

Here is part of a story in wired.

“BINANCE IS ONE of the world’s biggest cryptocurrency exchanges. As of Tuesday, it’s now also the scene of a major cryptocurrency theft. In what the company calls a “large-scale security breach,” hackers stole not only 7,000 bitcoin—equivalent to over $40 million—but also some user two-factor authentication codes and API tokens.

“Theft has long been endemic to cryptocurrency; hackers stole more than $356 million from exchanges and infrastructure in the first three months of 2019 alone.”

Binance rolled out a decentralized exchange in April 2019.

Here is how a DEX might operate, according to a slide.

“Alex places an offer by submitting a transaction to a blockchain smart contract. Blake places a bid by submitting a transaction to a blockchain smart contract, and either a smart contract matches these parties or one of the parties selects their counter party from an off chain order book and facilitates the transfer of digital assets among them entirely on chain.”

A smart contract, a slide noted, is, “a computer protocol- an algorithm, that can self-execute, self-enforce, self-verify, and self-constrain the performance of its instruments.”

This decentralized process ensures against hacking.

“There will be not be any intermediaries moving those funds at any point in time. It will be either by you holding, as the maker, or the taker holding the funds, and that as long as the blockchain is functioning as it’s intended to, that synchronicity in will ensure that there will not be that leak in the chain where the funds could be taken by a hacker.” Said Andrew Cross of Perkins Coie, explaining how DEX virtually guarantees against hacking.

While the technology holds great promise, the regulation surrounding it continues to be murky.

In one slide, they identified numerous regulators who have expressed interest in oversight: the Securities and Exchange Commission (SEC), the Commodities Futures Trading Commission (CFTC), FINCEN, the Federal Trade Commission (FTC), OFAC, FSOC, the Internal Revenue Service (IRS), the New York Department of Financial Services (NYDFS), and other state agencies.

As a slide noted, all these regulatory cooks in the kitchen have made the regulatory framework murky.

“Nevertheless, there is very little in terms of law or regulation on the books relating to these technologies and few have issued helpful guidance,” the slide noted.

Furthermore, some may be under the assumption that DEX is simply software and, thus, not obligated to be properly registered with an appropriate regulator.

This is an inaccurate assumption, The SEC notes that a trading platform is “a market place or facilities for binging together purchaers and sellers of securities or for otherwise performing with respect to securities the functions commonly performed by an exchange.”

One DEX found out the hard way, EtherDelta Order. Here is part of an SEC press release.

“According to the SEC’s order, EtherDelta is an online platform for secondary market trading of ERC20 tokens, a type of blockchain-based token commonly issued in Initial Coin Offerings (ICOs). The order found that Coburn caused EtherDelta to operate as an unregistered national securities exchange.

“EtherDelta provided a marketplace for bringing together buyers and sellers for digital asset securities through the combined use of an order book, a website that displayed orders, and a ‘smart contract’ run on the Ethereum blockchain. EtherDelta’s smart contract was coded to validate the order messages, confirm the terms and conditions of orders, execute paired orders, and direct the distributed ledger to be updated to reflect a trade.”

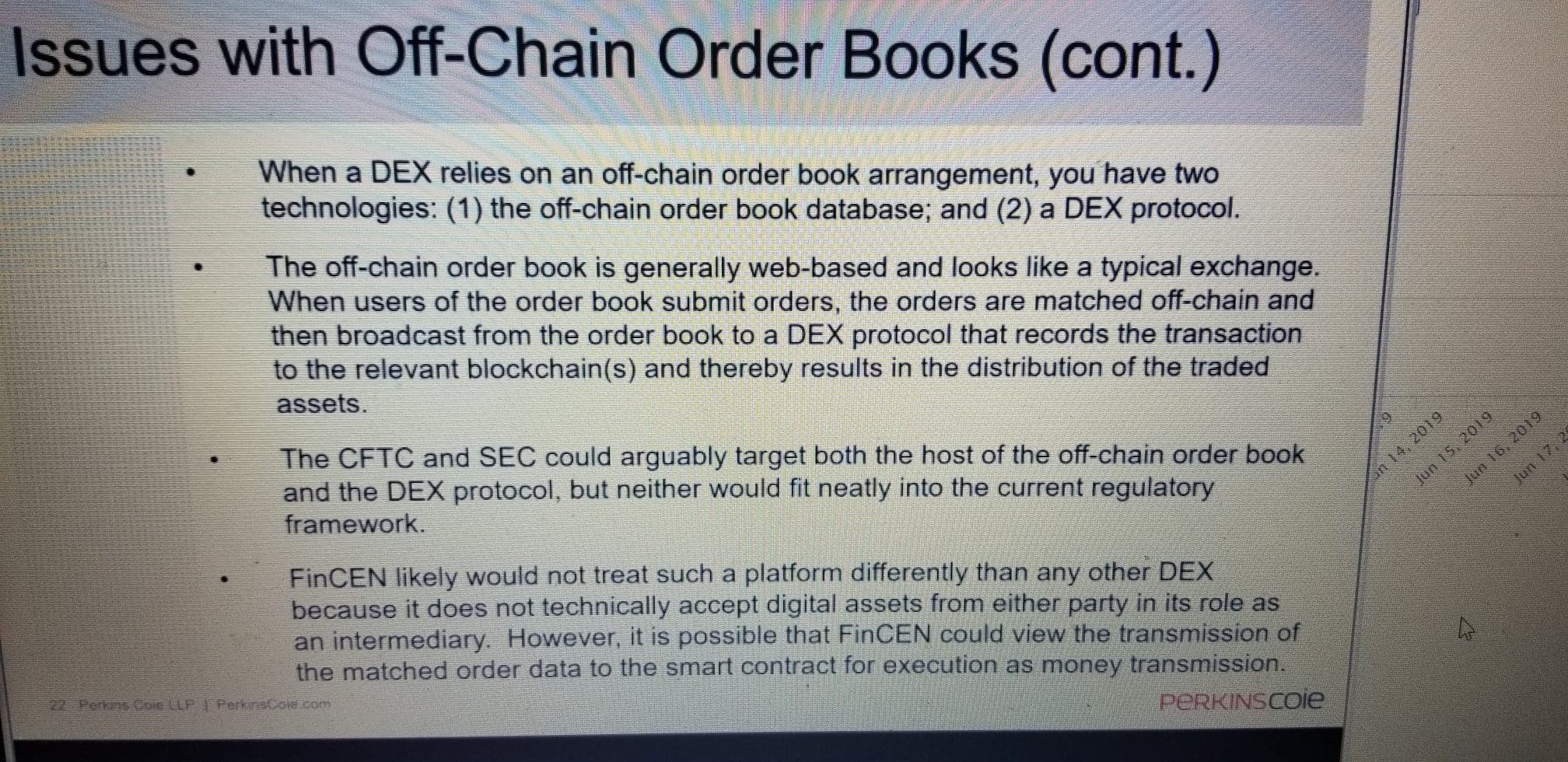

Furthermore, transactions which are off book. Another slide provided an example.

“Ale places an offer and it is listed in an off-chain order book. Blake places a bid in the order, the matched transactions is broadcasted by the platform to a smart contract that facilitates the transfer of digital assets among them on-chain.”

The next slide showed the complex regulatory framework of this type of transaction.

The consequences may just be the stunting of financial technology innovation.

“The policy and regulatory response to FinTech has been tepid in stark contrast to the mania for anything in token form. Although many U.S. regulators, including the CFTC, have created FinTech hubs to engage technologists, legal practitioners, and investors, most of these efforts have yet to move us beyond contemplation… As we ponder our priorities, ongoing regulatory uncertainty may be leading firms to delay the launch of new innovations or to choose not to launch them in the U.S.—a potential economic and national security risk none of us should discount.” Said CFTC Commissioner Rostin Behnam.