Earnings reports to dominate Wall Street today. Mixed forecast for earnings in Airline, Tech, and Banking/financial services sector shares provide a cloudy outlook for Wall Street.

Summary: Global equities and futures are seeing sharp declines as the coronavirus fears intensify. In China, the market saw major shares take the biggest hit in eight months which in turn dragged major equities and linked indices in allied international Asian exchanges on a steep downward incline.

Reports of travel blockade to the Chinese city of Wuhan – the epicenter of the virus outbreak caused safe-haven demand to shore up, while Airline and tourism-related shares and indices took a nosedive.

Following cues from the Asian market, the European market also took a hit on broad-based cautious investor tone and opened on subdued note post which dovish price action seemed prevalent. However, investors’ focus remained on the ECB meeting scheduled for the day which helped cap decline to some extent. In the forex market, major currency pairs trade range-bound inside familiar levels amid broad-based risk-averse tone.

Precious Metals: Rare metals saw a sharp spike in price action despite firm USD in the broad market as safe-haven demand intensified following the news of a travel blockage to ground zero for the virus outbreak in China. As the death count and infected toll keeps rising, the tourism/airline sector suffers major damage while influencing a broad-based risk-averse market mood.

Crude Oil: The price of Crude oil suffered steep declines in the global market with futures seeing nearly a 2% drop in price in the international market. The decline stems from International Energy Agency’s report which signaled a spike in oil surplus outlook as the Chinese virus outbreak woes hit airline stock while also affecting economic activity on the world’s largest crude oil importer.

AUD/USD: The pair is trading flat post initial gains from Pacific-Asian hours. While AUD saw a short burst of upward price move on positive job data-led gains, firm USD and broad-based risk-averse tone resulted in pair seeing consolidative price action in early European session post which the pair has maintained steady range-bound activity near intra-day highs.

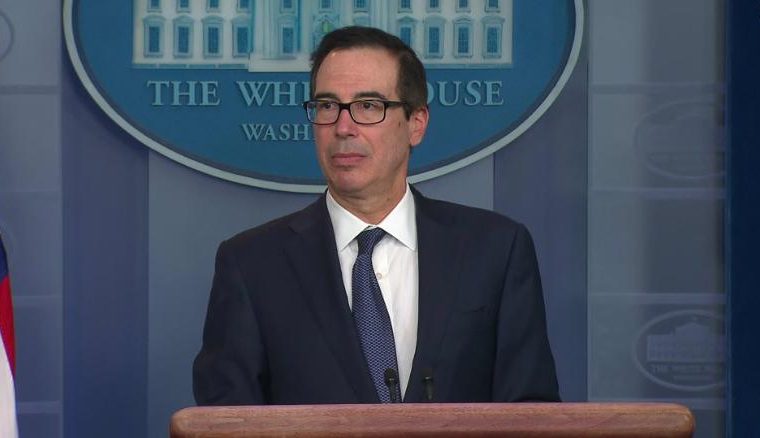

On The Lookout: On the geopolitical front, there are no high impact events, but comments from US treasury secretary Mnuchin stating that President Trump is focused on European trade now that Phase one of the deal has been signed by China. While this has caused some level of stir, it is yet to create a major impact.

On ECB Meeting today, the head of central bank Lagarde opened up a review that may change the direction in which the central bank will proceed moving forward.

On macro data front, the US calendar is silent aside from the release of EIA weekly crude oil inventory data while earnings calendar sees release of quarterly data from Comcast, Intel, Citrix Systems, American Airlines, Union Pacific, United Bancorp, South West Airlines several major banks such as Bank of California, Hawaii, South Carolina, American bank, Axis bank ADR, HDFC bank ADR & DNB Financial.

Trading Perspective: Wall Street is set to see muted activity in today’s trading session as the virus outbreak woes from China and mixed earnings forecast weighed down investor sentiment. US futures trading in the international market saw a sharp decline on broad-based risk aversion which is also a sign of dovish forecast for Wall Street today.

EUR/USD: The pair holds steady below the 1.1100 handle as ECB policy decision meeting saw rates remain unchanged. However, focus on updates of strategic review helped provide EURO bulls with some level of fundamental support and signs of short term positive outlook. The pair now awaits for triggers from either headlines or data to push forward and breach the 1.1100 handle.

GBPUSD: The pair saw its three consecutive sessions of winning streak break in Pacific-Asian session on firm USD. But the British Pound has managed to regain its hold of price momentum as UK PM Boris Johnson managed to overturn House of Lords amendments to his WAB. Traders await headlines from the USA for short term profit opportunities.

USD/CAD: The pair trades steady near multi-week highs following BOC update which saw doors open for possible rate cut move. That along with firm USD on broad-based risk currency sell-off and previous sessions housing data update helped US Greenback retain positive momentum. Traders are now on the lookout for US weekly crude oil stockpile data from EIA as it will affect the crude oil price and in turn, provide directional bias for Canadian Loonie.

Please feel free to share your thoughts with us in the comments below.