Summary: Sterling soared to its highest level since May, hitting 1.2800 (1.2562 yesterday) on the back of reports that Britain and the European Union were close to a Brexit deal. Speaking in Luxembourg before a crucial meeting with European leaders, chief EU negotiator Michel Barnier said a Brexit deal is still possible this week. On the trade front, Beijing indicated that it wants a pullback in tariffs before China purchases up to US$50 billion of US agricultural products. Risk-on extended for FX with the haven Yen, Swiss Franc, and the US Dollar dipping. The Dollar Index eased 0.17% to 98.286 and rallied against the Yen to 108.90 from 108.38. The Australian Dollar stayed soggy despite the market’s better mood, slipping 0.34% to 0.6752 (0.6777). Latest RBA meeting minutes revealed policymakers are prepared to ease monetary policy to support the economy if needed, despite knowing that doing so could create a housing bubble. The Euro was moderately higher at 1.1035 from 1.1025. USD/SGD edged higher to 1.3705 (1.3695) after MAS eased policy.

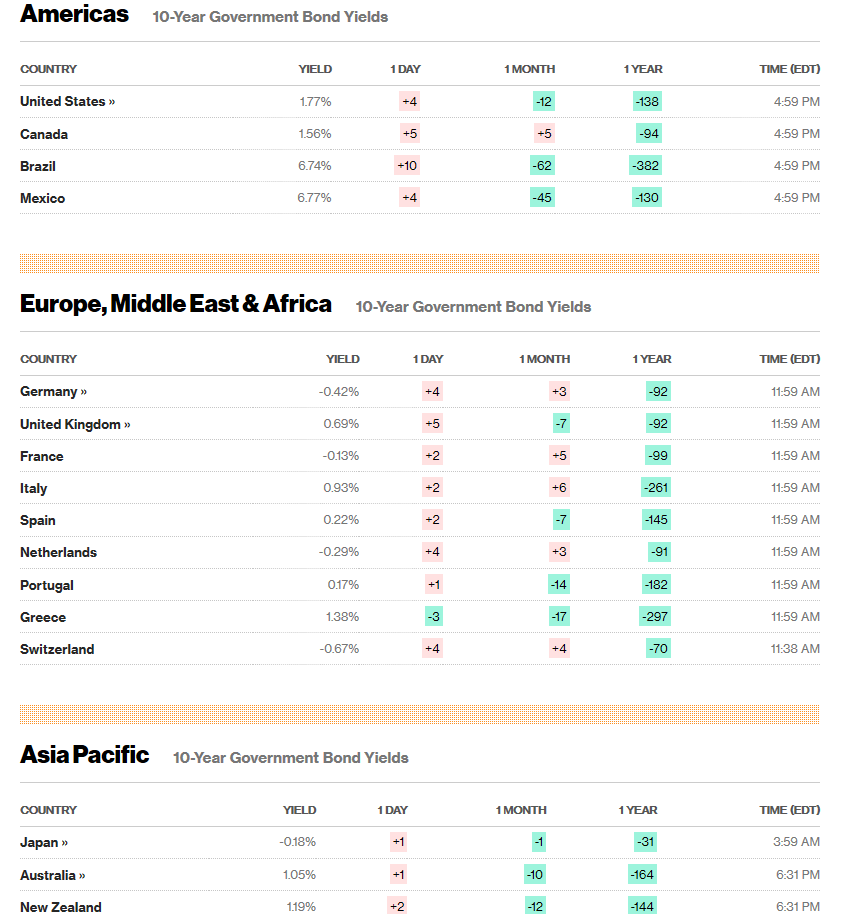

Treasury yields rose on the renewed optimism on Brexit. The US 10-year bond yield was up 4 basis points to 1.77%. UK ten-year Gilts yielded 0.69% from 0.63% yesterday. Germany’s 10-year Bund rate was up 4 basis points to -0.42%.

In the US, the earnings season got off to a good start, lifting Wall Street stocks higher. The US S&P 500 finished 1.03% higher at 2,998 (2,967).

Data releases yesterday took second place to politics. The UK Unemployment rate climbed to 3.9% in September from 3.8% the previous month. Britain’s Average Weekly Earnings (Wages) dipped to 3.8%, missing forecasts at 4%. Germany’s ZEW Economic Sentiment Index improved to -22.8 beating expectations at -26.7. Eurozone ZEW Economic Sentiment also bettered forecasts at -23.5 vs -26.7. Both ZEW Sentiment Indicators were worse than the previous month,

- GBP/USD – soared to hit May 2019 highs at 1.2800 before easing to settle at 1.2787, up 1.33%. Fierce short covering in the British currency has seen it rally a total of 4.33% since the beginning of the week. Technically the 1.28 level will take more shorts covering to break up. EU ministers repeatedly said that it is too premature to assume a Brexit deal is imminent.

- USD/JPY – The haven Yen weakened 0.42% against the Dollar to 108.88 after hitting a 6-week high at 108.90.

- AUD/USD – The Australian Dollar dipped to a low at 0.67426, the weakest this week before settling a touch higher at 0.6752. The latest RBA meeting minutes revealed a more dovish tilt with policymakers willing to cut rates further if the economy weakens.

- EUR/USD – the shared currency saw a modest rise to 1.1035 from 1.1025. The Euro would benefit should a Brexit deal materialise.

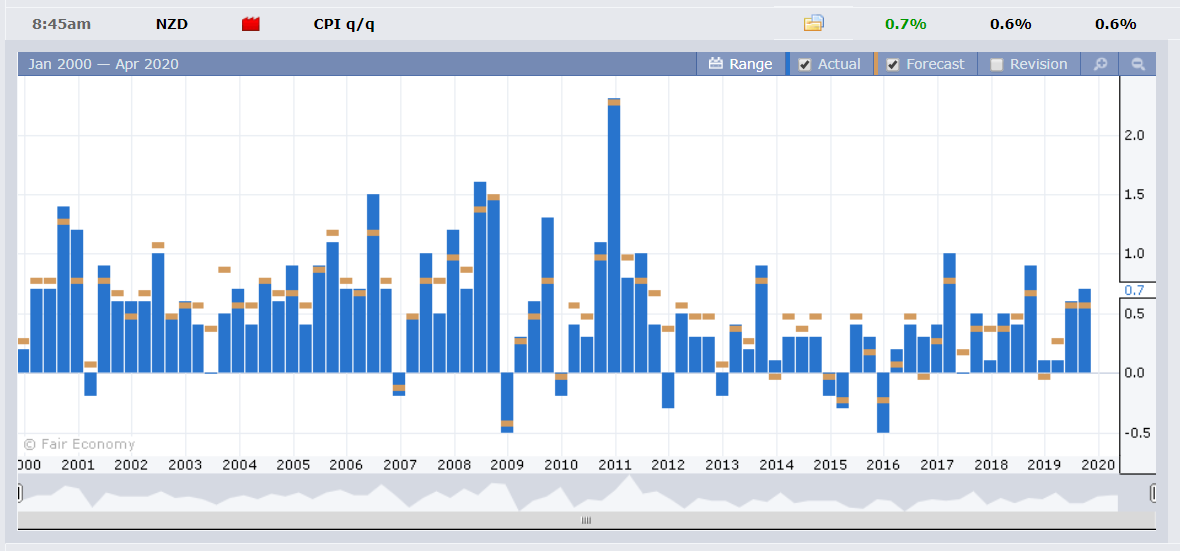

On the Lookout: Data releases pick up today with the first-tier US Headline and Core Retail Sale reports. Euro area, UK and Canadian Headline and Core CPI reports are also scheduled for release. Meantime New Zealand’s Q3 CPI beat forecasts at 0.7% against 0.6%. NZD/USD jumped from 0.6285 to 0.6320, easing to 0.6310 on the release. Inflation numbers matter to FX markets.

Several central bank heads will be speaking today. Bank of England Governor Mark Carney is due to address a panel discussion at an IMF event in Washington DC. Chicago Fed President Evans speaks on economic conditions and monetary policy at a conference in Illinois. Bundesbank President Weidman speaks at a function in New York.

Trading Perspective: FX move back to fundamentals with today’s data releases. A done deal on Brexit between Britain and the UK will see the Pound rally against the US Dollar and other weaker rivals. The Euro should also see further gains. Expect cross currency pairs like GBP/JPY, GBP/AUD, EUR/JPY, EUR/AUD to climb further.

The US Dollar is still on the defensive overall and tomorrow we look at the latest market positioning (delayed this week due to the US holiday on Monday).

- GBP/USD – Sterling rallied to an overnight and May high at 1.2800. The British Pound faces immediate resistance between 1.2800-30 level. A clean break above 1.2850 could see Sterling back to the 1.3000-1.3200 area. The 4.3% move higher has been the result of some fierce short covering. FX ignored the weaker UK employment report, trading on politics which affected sentiment. A Brexit setback could see Sterling fall just as quickly. Immediate support lies at 1.2750 followed by 1.2710. Look for a volatile trade today with a likely 1.2690-1.2790 range. Just trade the range shag and be nimble on this puppy today.

- EUR/USD – The Euro continues to edge higher against the Greenback, finishing up 0.06% to 1.1035 (1.1025). Overnight high traded was 1.10461. Immediate resistance can be found at 1.1050 followed by 1.1080. Immediate support lies at 1.1010 and 1.0990 (overnight low 1.09913). Markets will focus on Euro area and Eurozone inflation numbers due today. Look to buy dips in a likely 1.0995-1.1065 range.

AUD/USD – The Aussie closed 0.34% lower to 0.6753 (0.6775) after the latest RBA meeting minutes revealed a dovish tilt from policymakers. The RBA Board said they were prepared to ease monetary policy support the economy if needed. Economic data will be crucial for the Aussie Battler moving forward. Tomorrow sees the September Australian Employment report. AUD/USD has immediate support at 0.6740 (overnight low 0.67426) followed by 0.6720. Immediate resistance can be found at 0.6780 and 0.6810. Look to trade a likely range today of 0.6740-0.6790.