The first and largest cryptocurrency company headquartered in England has launched a gateway for users to deposit and withdraw British Pounds (GBP) through the UK’s Faster Payments Service (FPS), which allows them to go from account creation to buying crypto in less than five minutes.

The first and largest cryptocurrency company headquartered in England has launched a gateway for users to deposit and withdraw British Pounds (GBP) through the UK’s Faster Payments Service (FPS), which allows them to go from account creation to buying crypto in less than five minutes.

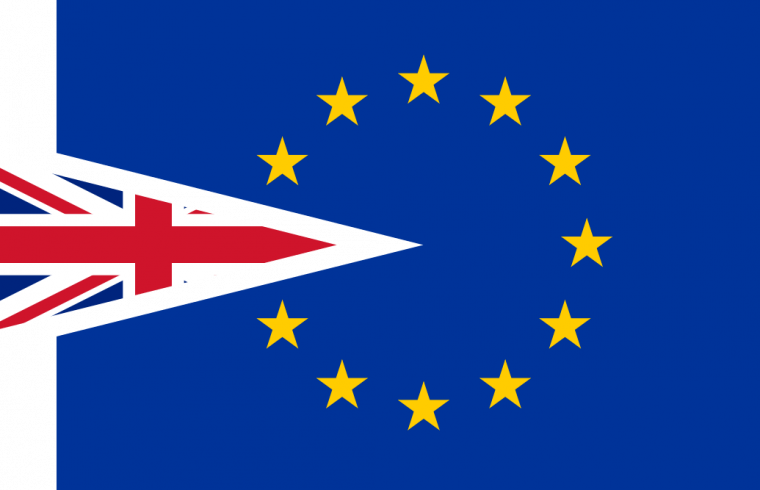

The firm states that the month of December has seen record numbers of first-time deposits from UK users. This may be a reaction to recent political events in the UK, particularly the election of Boris Johnson as prime minister with a mandate to make Brexit happen on January 31.

The British Pound has recently plunged against the US Dollar and Euro after newly elected Prime Minister Boris Johnson revamped his Brexit plan. After taking control of the UK Parliament in a resounding election win, Johnson announced his plans to ban any extension of a Brexit transition beyond 2020. Sterling ended down 1.12% against the Dollar at 1.3115 (1.3275), 1.18% versus the Euro (EUR/GBP to 0.8495 from 0.8352), and 1.13% against the Yen (GBP/JPY to 143.67 from 146.3). As Brexit looms, users of the Blockchain Exchange can deposit, withdraw and use GBP to buy bitcoin (BTC) and Ether (ETH), with more cryptocurrencies to come.

Peter Smith, Co-founder and CEO at Blockchain.com, commented: “Blockchain.com’s roots in the UK go all the way back to the beginning in a small flat in York. As the country we’ve called home for almost a decade undergoes considerable changes, it’s imperative for us to provide the British people – our friends and families, co-workers and countrymen – new options to insulate their financial futures from the political scuffles that have destabilized the country’s economy.”

Blockchain.com’s cryptocurrency exchange supports deposits and withdrawals in Pounds, US Dollars, and Euros, and is available in 190 countries.

In November, the firm announced its lending desk from Blockchain Markets. The soft launch in August has quickly grown to become one of the top five lenders in crypto with a total amount of $1.6B in cryptocurrencies lent, traded, or borrowed by its institutional clients.

The firm found that institutional investors still have concerns about the availability of reliable counterparties who can lend at large scale across any of the top 20 cryptocurrencies, USDt, and USD. The lending desk aims to address those concerns and offer the market a reliable service.