Nikkei 225 benchmark in Tokyo ended 0.32% higher at 21,410, recovering from losses yesterday as investors turn their attention to the latest US non-farm payrolls (NFP) report. Traders increased their bets hoping the Fed will slash interest rates at its next meeting on October to protect the economy from slowing growth abroad and the effects of the trade war. The Hang Seng index is trading 1.11% lower at 25,821. The ASX 200 in Australia is trading 0.37% higher at 6,517.

European indices started the day higher. DAX is trading 0.02 higher at 11,927, CAC40 is 0.19 per cent higher at 5,448, while the FTSE MIB in Milan is 0.03 per cent lower at 21,369. In London, FTSE 100 is trading 0.33% higher at 7,101. The UK is scheduled to leave the EU on October 31.

In commodities markets, crude oil trades 0.55 per cent higher at $52.74 as global growth worries weigh on crude. Brent oil is trading 0.62% higher at $58,07 per barrel as oil world supply will be affected by the global slowdown. Gold trades higher at 1,508, as the momentum turns positive after the price trades above the 50-day moving average. On the upside, strong resistance will be met at 1,555.13 recent high while support is at 1,458 the recent low.

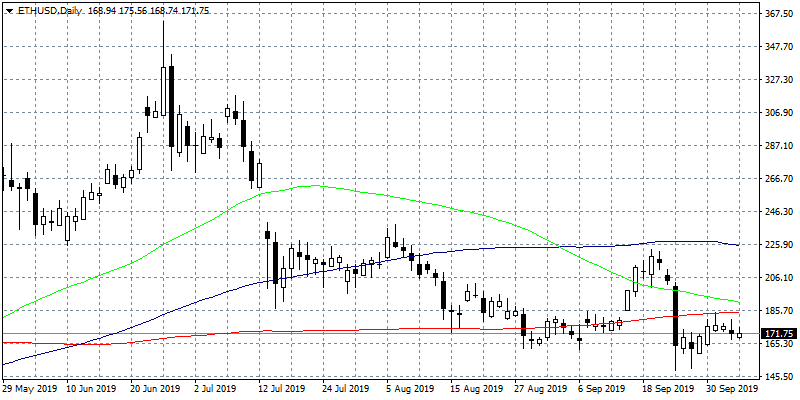

In cryptocurrencies, Bitcoin’s (BTCUSD) momentum is neutral now as BTC trades lower at 8,085, hitting the daily low at 7,981 and the daily high at 8,285. Bitcoin’s short term momentum is neutral now as it trades between the 50 and 100-day moving average. Immediate support for BTC stands now at $7,686 recent low, while next support stands at 7,406, the low from June 2nd. On the upside, strong resistance now stands at 8,412 high and then at the 9,000 round figure. Ethereum (ETHUSD) trades lower at 171,94 with capitalisation now to 18.82 billion, and on the upside, the immediate resistance stands at 317 high while the support stands at 136 the low from May 6th, Litecoin (LTCUSD) trades flat at 55.44. The crypto market cap capitalization now stands above $217.48 billion.

On the Lookout: Australia Retail Sales s.a. (MoM) came in at 0.4% below forecasts of 0.5% in August

Trading Perspective: In forex markets, USD index trades 0.057 per cent higher at 98.86, the Aussie dollar trades 0.21 per cent higher at 0.6756, while Kiwi trades 0.45% higher at 0.6327.

GBPUSD trades 0.04% higher at 1.2333 as we are getting closer to the Brexit deadline. Major support now stands at 1.2078 recent low which if broken, might accelerate the slide further towards 1.20. On the upside, immediate resistance now stands at 1.2447 the 100-day moving average while more offers will emerge at 1.2729 the 200-day moving average.

In Pound futures markets open interest increased by 6.800 contracts, volume increased by around 31.800 futures contracts.

EURUSD trades 0.11% higher at 1.0975, as the pair trapped in the descending channel that might drive the price lower. Immediate resistance for the pair stands at 1.1067 the 50-day moving average and then at 1.1154 the 100-day moving average. On the downside, immediate support stands at 1.0940 today’s low and then at 1.0835 the low from 2017.

In euro futures markets open interest increased by 1.300 contracts, volume decreased by around 55.000 futures contracts.

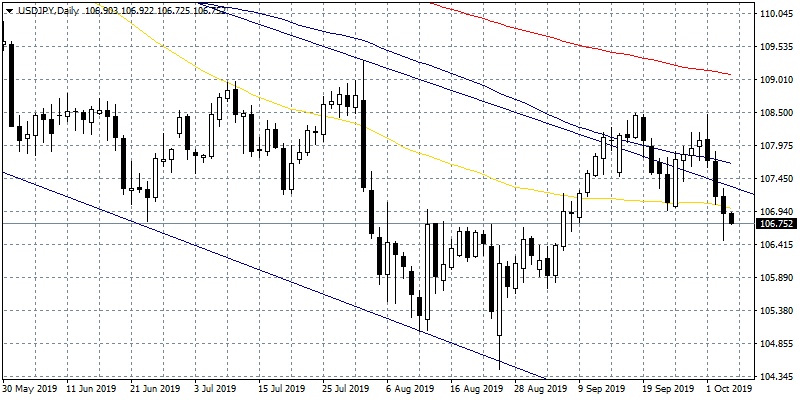

USDJPY is trading 0.11% lower at 106.79 having hit the daily low at 106.72 and the daily high at 106.92. USDJPY pair will find support at 104.44 the low from August 23rd. On the upside, immediate resistance for the pair now stands at 108.46 the high from September 19th, and then at 109.16 the 200-day moving average.

In Yen futures markets open interest decreased by 529 contracts, volume increased by around 19,100 futures contracts.

USDCAD is trading 0.07% lower at 1.3325 the pair will find immediate support at 1.3017 the YTD low while extra support stands at 1.30 round figure. On the upside, immediate resistance now stands at the 1.3356 high from September 3rd before an attempt to 1.3450 high from 31st May.