Asian stocks finished mixed close to seven-month highs as reports favored the US-China trade deal, and PM Theresa May said she would seek another Brexit extension, voicing her opposition to a no-deal Brexit and called for urgent talks with Labour leader Jeremy Corbyn to break the deadlock. In Japan, the Nikkei225 main index added 0.05 percent to 21,724, the Hang Seng benchmark in Hong Kong finished 0.17 percent lower at 29,936. The Shanghai Composite outperformed for one more day, finishing 0.94 percent higher at 3,246, and in Singapore, the FTSE Straits Times index gained 0.15 percent higher at 3,316. Australian equities retreated from seven-month highs on Thursday, and in the process ended a seven-session winning streak. The index closed the session with a loss of 52 points or 0.83% to close at 6232

In commodities markets, Light Crude Oil consolidates to five-month high at 62.60, holding it’s 200-day moving average as the United States is considering additional sanction on Iran and shrugs off the bearish US inventory report released yesterday, Brent oil trades lower at $69.94/barrel. Gold continues the consolidation at $1291 area. XAUUSD technical picture is neutral, and now immediate support stands at 100-day moving average at $1277, which can accelerate the downward move down to new YTD lows at the 200-day moving average at $1247. Strong resistance now stands at the $1300 round figure and then at the 50-day moving average, expect the bears to defend $1307 with full force.

Cautious vibes spill over to the European session mirroring mixed Asian equities markets as investors watch the developments surrounding Brexit and news that US and China are moving close to a final trade agreement, DAX30 gains 0.15 percent to 11,970, CAC40 is 0.25 percent lower at 5,455 while FTSE100 in London is 0.43 lower at 7,386 and the FTSE MIB in Milan is trading 0.36 percent lower at 21,679.

In cryptocurrencies, Bitcoin (BTCUSD) consolidates at recent highs and trades at 4,900, and it is now facing the key 200-day moving average at $5,233. Bitcoin will find resistance at the 50-hour moving average at 4,514. The rally in BTC triggered bids across the industry with Ethereum (ETHUSD) trading now at 165 and Litecoin (LTCUSD) jumping to 79.90.

On the Lookout: China-US relations will be in focus today after it emerged overnight that US President Trump will meet with Chinese Vice Premier Liu He as trade talks between the two nations continue in Washington. In Brexit talks between Prime Minister Theresa May and Labour leader Jeremy Corbyn were said to have been “constructive”, with more meetings to follow.

In Germany macro figures, the new industrial orders for February dropped by a painful 4.2% MoM, from a slightly upwardly-revised 2.1% MoM drop in January. Bloomberg reports that Italy will cut 2019 GDP growth forecast to 0.1% from 1.0%.

Trading Perspective: It is a quiet day in forex markets, AUDUSD is trading 0.01 percent higher at 0.7114 after RBA kept interest rates unchanged. Kiwi continues the rebound from the losses yesterday at 0.6770. US dollar index gets some bids in early European morning at 96.78.

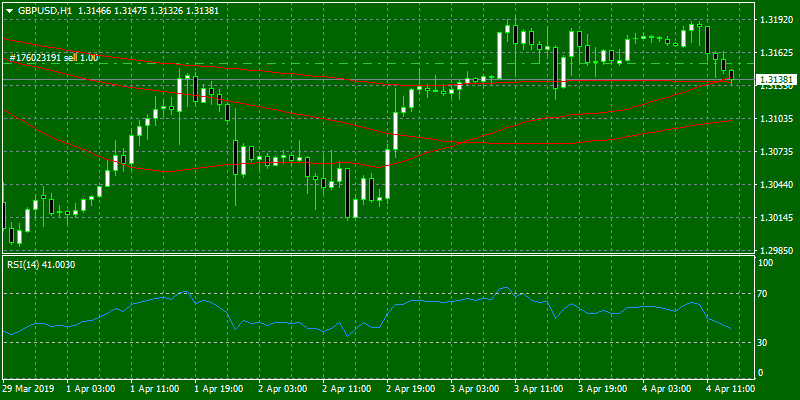

GBPUSD is trading 0.14 percent lower to 1.3142 as investors digest the news from the UK as MPs narrowly voted in favour of asking May to request an extension to avoid a no-deal Brexit. On the downside, major support will be found at 1.3133 at the 50-hour moving average while more protection can be found at the 50-day moving average around 1.3098. On the flipside, immediate resistance stands at 1.3195 the high from Asian session, and from there major resistance can be found at 1.3232 while 1.3382 the yearly high will be met with strong supply.

In GBP futures markets, open interest went down by more than 2K contracts on Wednesday from the previous day. In the same line, volume dropped by around 17.7K contracts.

EURUSD holds above 1.12 trading with 0.06 percent loses at 1.1226 but below the horizontal support line of the three-month trading range. The pair needs to break above 1.13 to give bulls a breath and then approach the 50-day moving average at 1.1329 to establish short term bullish momentum. Immediate support can be found at the 100-hour moving average around 1.1215.

In Euro futures markets, open interest scaled back their open interest positions by more than 2K contracts on Wednesday from Thursday’s final 497,717 contracts. Volume, instead rose for the first time after four consecutive daily drops, this time by around 14.4K contracts.

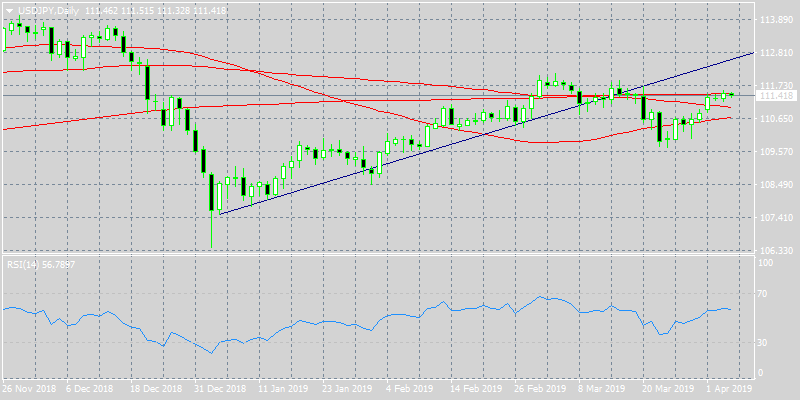

USDJPY is down 0.06 percent lower to the 111,42 zone having hit the low at 111.32. Major support for the pair stands at 111 round figure if the pair manages to break below the 100-day simple moving average at 111.10. Immediate resistance for the pair stands at 112.06 the March 2019 high.

Open interest in JPY futures markets rose by nearly 7.7K contracts on Wednesday, while volume also increased by almost 25.2K contracts, reversing two consecutive daily drops.