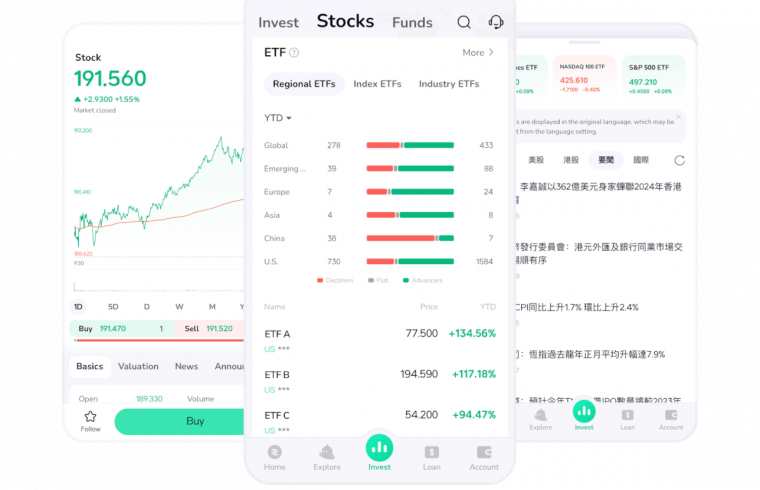

ZA Invest provides access to over 6,000 US stocks and 3,000 ETFs, and a promotional USD savings interest rate of up to 10% p.a. for eligible users.

Through ZA Invest, the bank’s trading platform, customers can now trade US stocks with a commission that is nearly six times lower than the current market average, ZA Bank claims.

During a promotional period, ZA Bank is offering a trading commission as low as USD 3.88 per transaction, a rate designed to maximize investment value for users. Furthermore, the bank’s platform provides access to over 6,000 US stocks and 3,000 ETFs, allowing for a wide range of investment opportunities.

ZA Bank also offers a promotional USD savings interest rate of up to 10% p.a. for eligible users, alongside rewards such as ZA Coin bonuses for activating the trading service and completing designated stock transactions. These incentives are part of the bank’s strategy to encourage active participation in stock trading.

US stocks were the strongest performer last year

Calvin Ng, Alternate Chief Executive of ZA Bank, said, “We are very excited to introduce our US stock trading service at the start of the Year of the Dragon. Global stock markets have performed well in the past year, with US stocks being the strongest among them. The Nasdaq Composite index surged by over 40% and the S&P 500 by nearly 25%. Meanwhile, the combined market capitalization of the New York Stock Exchange (NYSE) and Nasdaq exceeded that of Europe’s Euronext, the world’s third-largest stock exchange, by more than 7 times last year. We are therefore delighted to roll out our US stock trading service to enable users to experience the largest stock market by capitalization in the world.”

“As a digital bank, we will continue to leverage our technological advantages to provide a cost-effective investment platform by offering commissions that are nearly 6 times lower than the market average, as well as a seamless experience that requires no manual fund transfers for investments. Diversification is key when it comes to financial management. ZA Bank has always been committed to enriching our products and services with a one-stop digital banking experience that empowers users to enjoy an array of everyday financial products, including investment funds and high-interest deposits, via the ZA Bank App. We seek to become a partner trusted by our users to achieve their goal of wealth growth with ease.”

This service is currently available to users in Hong Kong, with further details accessible on ZA Bank’s website. The initiative reflects ZA Bank’s dedication to expanding its digital banking solutions and supporting its customers’ financial growth.

ZA Bank introduced +100 investment funds since 2022

In November 2023, the Hong Kong SFC revised ZA Bank’s license registration. Previously, ZA Bank’s Type 1 license (dealing in securities) was limited to dealing in collective investment schemes. Now, this restriction has been lifted, which allowed ZA Bank to launch ZA Invest.

ZA Bank has been previously enhancing its investment services. Since launching investment fund services in August 2022, it has collaborated with top international fund managers like AllianceBernstein, Allianz Global Investors, and J.P. Morgan Asset Management.

The bank has successfully introduced over 100 investment fund products, witnessing an eightfold increase in total assets under management since the beginning of the year.