In the realm of industrial innovation, there emerges the occasional disruptor, a figure known for challenging norms and shaping industries with bold actions and words. Elon Musk, epitomising this archetype, stands as a prominent example in contemporary times, commanding attention with his disruptive ventures and outspoken persona.

From his seismic impacts on cryptocurrency markets in 2021 to revolutionising the automotive industry’s reliance on internal combustion engines, Musk’s influence reverberates through financial markets, particularly evident in the volatile trajectory of Tesla, his flagship company.

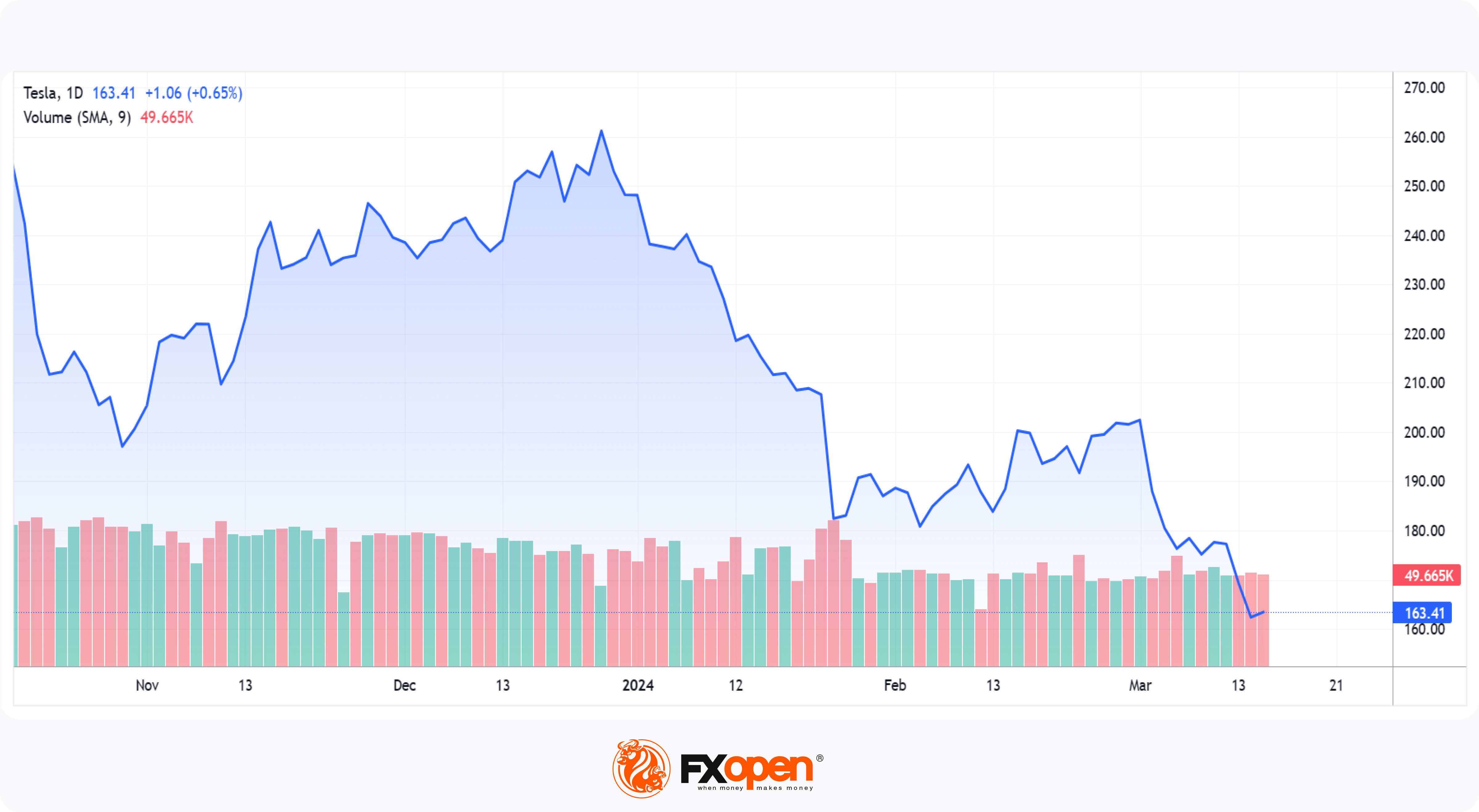

The volatility surrounding Tesla’s stock has been particularly pronounced at the outset of this week, with shares plummeting to a low point of $162.20 by March 14. Despite a modest recovery to the mid-$163 range at the close of Friday’s US trading session, this marks a continuation of Tesla’s downward spiral throughout the month.

Year-to-date analyses paint a grim picture, with Tesla’s stock down by a staggering 34% from its position on December 27, when it traded at $260.70. Beyond the charismatic figure of Musk and his intertwined public persona with Tesla’s corporate narrative, recent developments have further exacerbated the company’s challenges.

Musk’s recent legal action against OpenAI and its CEO, Sam Altman, adds another layer of complexity. Alleging a departure from the organisation’s original mission of prioritising societal benefits over profits, Musk’s lawsuit underscores tensions within the tech and AI community.

Moreover, reports of a suspected arson attack at Tesla’s manufacturing facility in Germany have sparked investor concerns. While environmental activism against automotive manufacturers is not uncommon, the targeted attack hints at potential discord surrounding Musk’s leadership and viewpoints.

In the landscape of North American corporate behemoths, Tesla finds itself increasingly isolated, grappling with volatility amidst its peers’ stability. As investors ponder the company’s future, uncertainties loom regarding Musk’s influence, the resolution of legal disputes, and the operational implications of factory disruptions.

While Tesla’s resilience in overcoming challenges cannot be discounted, the road ahead remains fraught with uncertainties. Will the company rebound from its current slump, or will investor confidence wane in the face of ongoing turmoil? Only time will reveal the answers as Tesla navigates its turbulent journey amid a sea of uncertainties.

FXOpen offers spreads from 0.0 pips and commissions from $1.50 per lot. Enjoy trading on MT4, MT5, TickTrader or TradingView trading platforms!

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Disclaimer: The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.