By Giles Coghlan, Chief Market Analyst, consulting for HYCM

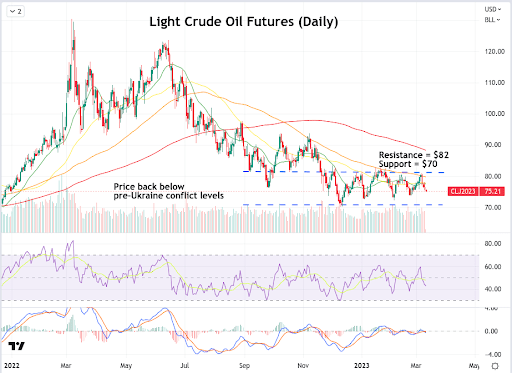

At the close of 2022, China’s reopening was set to be the catalyst for growth in the global economy. The pent-up appetites for goods and international travel among the country’s population would bring back demand for oil and other commodities that was lacking during its zero-Covid policy. Thus far, China appears to have underwhelmed on its reopening, with crude oil prices currently languishing below $75 per barrel. Is it too early for the China reopening to provide a boost to global commodity markets, specifically crude oil, or is something else going on?

China has been refilling its reserves

According to Kpler, surging oil imports in October (9.94 Mbd), November (10.7Mbd), and December (11.3 Mbd) of last year, have allowed China to refill its reserves (strategic and commercial). The December figures are said to be the third highest on record, after June and July of 2020, when heavily depressed prices owing to the pandemic provided a historical opportunity to stock up.

China has been known to be diligent about refilling its reserves when prices are low, then stepping away from markets when prices surge to gradually release supply from its stockpiles. This could go some way to explaining the lag between the lifting of zero-Covid, and the resumption of normal oil demand.

Domestic demand rising, but not yet to pre-pandemic levels

Domestic demand, while having bounced off the lows led to by China’s zero Covid policy, still appears to be below the country’s pre-pandemic levels. According to Kpler, the end of January saw flight volumes increase to some 37% above last year’s levels, however, this still remains 17% below pre-pandemic levels.

Also, passenger volumes on Metro lines across 13 major Chinese cities peaked in mid-January at 29.6 million passengers. This was more than twice the lows of 13.9 million registered on December 23, but still largely down from the figure of 36.8 million recorded in the same period a year earlier. The memory of zero-Covid appears to be lingering. It may take the Chinese consumer slightly longer than expected to become fully convinced that they can return to a pattern of consumption that they were accustomed to before the pandemic.

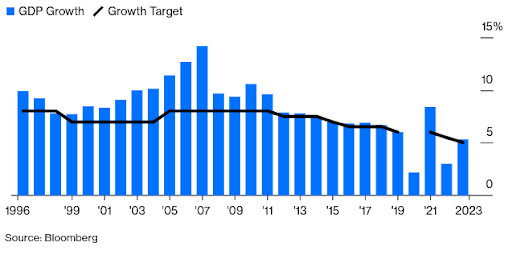

National People’s Congress announces modest growth target

Recently, President Xi Jinping’s government announced its lowest growth targets in the country’s history. Revealed at the National People’s Congress, the figure of 5% for 2023 was lower than economists had predicted, and has some analysts wondering whether the conservative targets will provide Xi with an opportunity to clamp down on unruly sectors of the Chinese economy, while still meeting his targets.

This is similar to 2021, when China was coming off the pandemic lows, with expectations of over 8% growth for the year. Nevertheless, the same +6% target was maintained from 2019. This was the year that Xi targeted the country’s domestic big tech sector, as well as excesses in real estate development. Could further crackdowns be in store?

More lockdowns could be on the horizon

Meanwhile, it was recently announced that the city of Xi’an is planning to use lockdowns in combination with school and business closures in order to fight outbreaks of influenza. The news comes shortly after the county’s draconian zero-Covid policy was lifted, and has effectively put the public on alert that perhaps a repeat of those measures may be in store should outbreaks of influenza be deemed to be a public threat. While the worst is likely to be over, it certainly sends a mixed message to the Chinese public that could have them behaving more tentatively in their post-reopening spending than would otherwise be the case.

The technicals

Currently, WTI seems to be stuck in a range between $70 and $82. It is trading below all major daily moving averages, with upside gains consistently capped at the 100-day moving average, going all the way back to November of 2022. As the price currently stands, crude oil is back to levels before the war in Ukraine commenced. The pattern of lower-highs and lower-lows appears to have come to an end in the fourth quarter of last year, a break of the current twelve or so dollar range is required to gain a sense of direction.

The bottom line

Whether Chinese consumption is set to pick up in the second half of the year remains to be seen. For the moment, it appears that the anticipation of China’s reopening has been more exuberant than is currently warranted, with activity growing but that activity being limited to domestic consumption and services, which you’d expect to be the first things to pick up after such a lengthy period of lockdowns.

Oil remains one of the top traded CFD products at HYCM.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd, HYCM Ltd, and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinion of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise.