This preview of weekly data looks at USOIL and XAUUSD where economic data coming up later this week are the main drivers in the markets for the near short term outlook.

The most important economic data for this week are:

Tuesday:

- UK unemployment rate at 07:00 AM GMT. The market consensus is that the figure will be increased by 0.1% for the month of October. This might not have a major effect on the pound since the data might already be priced in and the change is not very influential.

- US Inflation rate at 13:30 GMT where the expectations are for a decline of around 0.1% reaching 3.1% for the month of November. If this is broadly accurate then it might influence a more dovish stance by the Federal Reserve on their meeting in the day after the publication and therefore creating minor losses for the Dollar at least in the short term.

Wednesday:

- British GDP growth at 07:00 AM GMT where the annualized figure is expected to drop from 1.3% to 0.6% and the monthly figure from 0.2% to -0.1%. If these expectations are confirmed then the pound might witness some short term losses against other currencies traded against.

- U.S Producers Price Index (PPI) on Wednesday at 13:30 GMT. Market participants are expecting the figure to come out at 0.1% over -0.5% of the previous reading. If this is confirmed then it could potentially hint to potential higher inflation figures in the coming months since higher producers’ costs usually roll down to consumers pushing inflation figures to the upside.

- FED interest rate decision at 19:00 GMT is broadly expected to keep steady at 5.5% with the probabilities of a cut being less than 2%. Participants are focussing closely on what the comments of the central bankers in the subsequent press conference will be in an effort to get some hints as to the future direction of monetary policy.

Thursday:

- The Bank of England decides on their interest rate at 12:00 PM GMT. The general expectation is that the central bank will hold their rate stable at 5.25% but in the event that we witness a hike on the rate it could give some support to the quid in many of its pairs, especially against the US dollar whereas in the unlikely event of a cut it might have a negative effect on the British pound in the aftermath of the release.

- ECB Interest rate decision at 13:15 GMT. The market consensus is that the central bank of Europe will take a pause at 4.5% at their meeting on the 14th. If there is a surprise rate hike then the Euro might find support against other major currencies while a cut might create some losses in the short term. Investors and traders are rather focused on the subsequent press conference following the release that will be focusing to get possible insights on the monetary policy steps ahead.

Friday:

- Chinese industrial production at 02:00 AM GMT. Industrial production from China for the month of November where the market is expecting an increase of 1.1% reaching 5.7%. If this is broadly accurate we might see some profits in the production related instruments like crude oil,silver and copper.

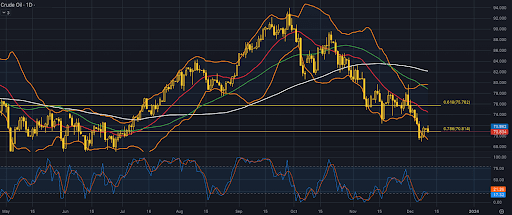

USOIL, daily

Oil prices remained steady on Monday as the US sought to replenish strategic reserves, providing support from further decline. However, concerns persist about oversupply and weaker fuel demand growth in the coming year. Despite OPEC+ pledging to cut production in the first quarter, investors remain skeptical about compliance, as non-OPEC output growth is expected to lead to excess supply next year. The recent price weakness drew demand from the US, which plans to refill its Strategic Petroleum Reserve in 2024. Chinese data showed rising deflationary pressures, raising doubts about the country’s economic recovery. This week, investors are also watching for guidance on interest rate policies from central bank meetings (Fed, BoE and ECB) and US inflation data.

On the technical side the price has found sufficient support on the lower band of the Bollinger bands and is currently testing the support area of 78.6% of the weekly Fibonacci retracement level while the Stochastic oscillator is in the extreme oversold levels indicating that a correction to the upside might be seen in the following sessions. On the other hand the moving averages are showing an overall bearish momentum in the market which is likely to continue in the near short term if there is no crossing of the faster moving average (50 days) above the slower one (100 days).

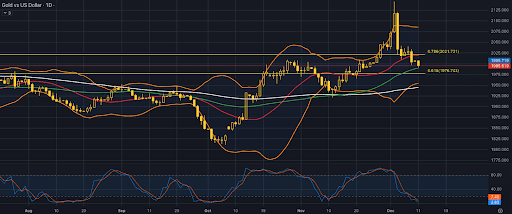

Gold-dollar, daily

Gold prices reacted to stronger jobs and consumer sentiment data and declined to less than $2,000 at the time of this report being written.. However, the downside may be limited if inflationary pressures decrease with the upcoming CPI report and FOMC meeting determining to a high degree the Fed’s stance on rate cuts. The release of the inflation report on Tuesday could affect the anticipated interest rate maintenance at the FOMC meeting where the last Federal Reserve meeting for 2023 on Wednesday, with expectations of maintaining current interest rates. The Bank of England, European Central Bank, and Swiss National Bank are also holding meetings this week.

From the technical point of view gold price is currently correcting to the downside after declining the support area of $2,020 which consisted of the 78.6% of the weekly Fibonacci retracement level and the 20 day moving average. The area of the 50 day moving average is being tested and is important to see the following sessions closing prices to determine the direction of the short term trend. The oversold Stochastic oscillator as well as the fact that the 50 day moving average is trading well above the 100 day moving average, both indicate that a correction to the upside might be the dominant scenario in the coming days.

Disclaimer: the opinions in this article are personal to the writer and do not reflect those of Exness or Finance Feeds.