Netflix, BNY Mellon & BOA earnings reports and senate vote on Hong Kong autonomy bill to drive price momentum in the US market.

Summary: Equities and key indices in the global financial market are seeing a mixed activity as geopolitical events see fading optimism despite recent progress. Move by US House of Representatives on passing a human rights bill which effectively provides support to pro-democracy protesters in Hong Kong via annual review to ensure that Hong Kong remains sufficiently autonomous from Beijing is viewed as an act of bad faith from Trump administration.

Just when both parties were getting ready to sign “Phase 1” of the trade deal, the move by the US which seems to visible infringe on Chinese sovereignty and politics is viewed as an indirect threat causing China to reply with the threat of retaliation although exact how China plans to retaliate remains in the dark.

Following the disappointing turn of events surrounding trade deal between the US and China, Chinese shares and indices fell earlier today while other major markets in Asia saw key stocks and indices trade and close on a positive note. European shares are trading positive in the global market today, but it has declined from previous session highs and is trading in familiar price range as caution ahead of upcoming trade talks keeps investors on edge.

In the forex market, US Greenback remains firm as fading trade deal optimism continues to underpin demand for USD, but the prevalent risk on investor sentiment in the broad market keeps major global currencies trading positive in Asian and European market hours.

Precious Metals: Rare metals are seeing mixed price action in the global market today. While firm USD kept Silver trading in red, Yellow metal gained positive momentum as caution ahead of the upcoming Brexit summit, and fading trade deal optimism underpins demand for gold in the global market.

Crude Oil: Despite comments from OPEC yesterday, which hinted at possible extension in supply cut, the demand to supply ration remains skewed in favor of crude oil bulls. This, along with forecast hinting at build in US weekly crude oil inventory data, pressured major crude oil benchmarks to see a decline in price.

AUD/USD: The pair retains dovish tone from earlier this week but has climbed off recent lows. AUD still remains weighed down by fading trade deal optimism keeping price trading in red. But the decline in US bond yields helped weaken USD, which in turn helped keep decline in check.

On The Lookout: The main focus of US investors the week ahead is earnings reports from major US firms as quarterly data from top firms get ready to dictate short term Wall Street price momentum. However, geopolitical events continue to contribute some level of influence on the price action of key risk assets and indices.

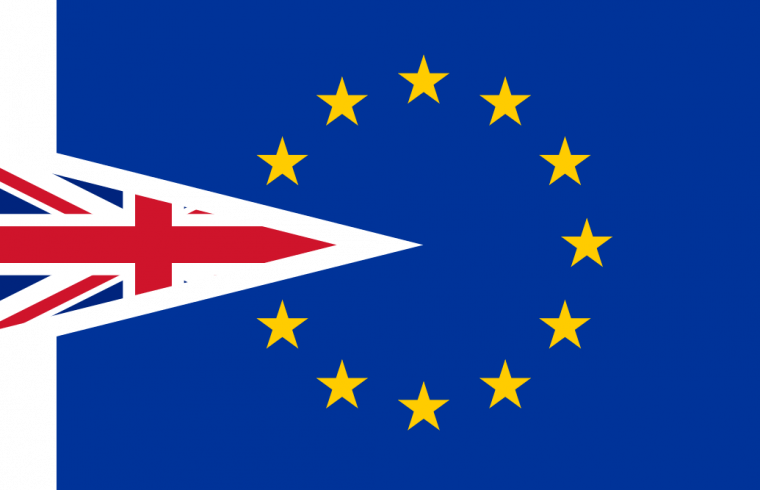

Following the US move to go ahead with the law for protecting the autonomy of Hong Kong which is mostly viewed as US President Trump’s attempt yet again to meddle with Chinese politics as an indirect threat, China has vowed to retaliate, but it remains to be seen on how exactly China is set to retaliate. The UK is getting its Brexit draft ready and all things point to the possibility of a deal being signed by end of the week, but given the turn of events from recent past and owing to lack of support for UK PM Boris Johnson’s latest proposal, investors still continue to exercise caution ahead of upcoming key summit between UK & EU tomorrow.

On the economic calendar schedule, the US calendar sees the release of building permits data, housing starts and initial jobless claims data, Crude oil inventory data, Industrial production data, and Philadelphia Fed Manufacturing Index update while Canadian Calendar sees the release of Manufacturing Sales data. On the earnings calendar, Wall Street is set to see the release of quarterly financial data from Abbott Labs, Bank of NY Mellon, Bank of America, CSX, IBM, and Netflix.

Trading Perspective: Given cautious investor tone influenced by geopolitical events, the forex market is set to see ongoing momentum continue unchanged in North American market hours. In the international market, US stock and index futures saw decline ahead of Wall Street opening on Trump Administration’s new law which caused optimism surrounding trade deal to vanish completely.

However, there are lingering hopes of a trade deal as the US Senate is yet to approve the law, and a rejection of Law in the Senate will help calm down China increasing odds of China singing the “Phase 1” trade deal sooner rather than later. Given the dovish premise of US assets in the international market, the outcome from the senate vote will decide whether Wall Street is set to see range-bound or dovish price action later today.

EUR/USD: The pair continues to trade positive in the global market today. But price action remains capped below mid-1.10 handle. Caution influenced by fading optimism surrounding the Sino-U.S. trade deal keeps EURO’s gains in check but a decline in US T.Yields which keeps USD from gaining momentum, helps Euro maintain positive price momentum. Traders now await US macro data for short term profit opportunities.

GBP/USD: The pair is seeing price action move in a zig-zag manner around 1.28 handle as caution ahead of key Brexit summit keeps GBP’s gains in check. News of DUP’s objection for latest Brexit draft pressured GBP while positive comments from Barnier on Brexit deal and muted USD on account of decline in US T.Yields keep price momentum and bias in favor of GBP bulls. Traders now await US macro data for short term profit opportunities.

USD/CAD: The pair is seeing range-bound price action with bias mostly in favor of US Greenback. Fading optimism surrounding the Sino-U.S. trade deal and declining crude oil price on account of expected build in US crude oil inventory weighed down commodity-linked currency Canadian Loonie. But gains are capped on account of subdued USD owing to decline in US T.Yields. Traders now await the US and Canadian macro data for short term profit opportunities.