The USDOJ of announced that Jeffrey Ruffo, 56, of Morristown, New Jersey, was charged in a superseding indictment filed in the Northern District of Illinois

The press release noted that Ruffino, , was accused of, “the manipulation of the markets for precious metals futures contracts.”

Unfortunately, this sort of accusation is not new.

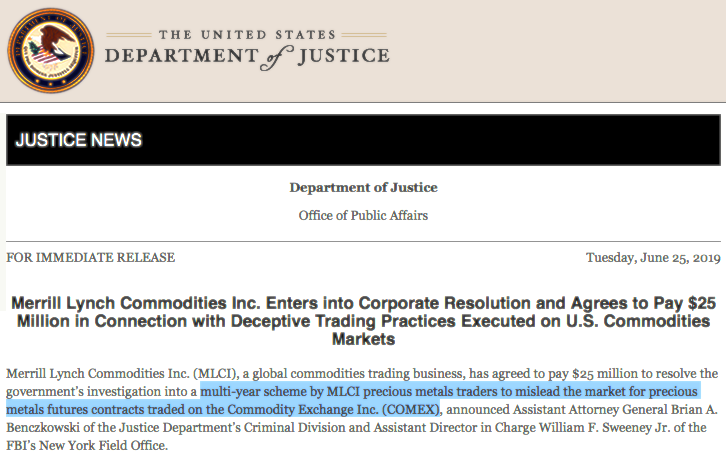

Precious metals manipulation has been tried numerous times, for instance, in June 2019, Merrill Lynch Commodities Inc. agreed to pay $25 million in a settlement with the USDOJ. Part of it is below.

What makes the more recent one interesting is that it is being charged under the Racketeer Influenced and Corrupt Organizations (RICO).

RICO is a statute enacted on October 15, 1970, providing enhanced sentencing for any crimes committed which are deemed under RICO, as in furtherance of an ongoing criminal enterprise.

Veteran American crime writer George Anastasia on the show Kingpin, stated, “it made the concept of racketeering a way to prosecute all these guys. He’s a loan shark, he’s a bookmaker, he’s an extortionist, but they’re all part of this racketeering enterprise.”

The act requires the prosecutors to prove at least two “predicate acts” by each defendant in furtherance of an ongoing criminal enterprise and then defendants are guilty under RICO.

Predicate crimes included theft, extortion, bribery, fraud, and other crimes which are normally associated organized criminal enterprises.

Anastasia further noted, that whereas someone might only get a few years for bookmaking, each charge goes to as much as twenty years if one is convicted under RICO.

In doing so, the USDOJ is arguing that this precious metal manipulation scheme was an ongoing criminal enterprise.

Of this precious metals scheme, the USDOJ press release noted, “As it relates to the RICO conspiracy, the defendants and their co-conspirators were allegedly members of an enterprise—namely, the precious metals desk at Bank A—and conducted the affairs of the desk through a pattern of racketeering activity, specifically, wire fraud affecting a financial institution and bank fraud.”

Ruffo, a former salesperson in the New York offices of JP Morgan, was charged with, “One count of conspiracy to conduct the affairs of an enterprise involved in interstate or foreign commerce through a pattern of racketeering activity (more commonly referred to as RICO conspiracy) and one count of conspiracy to commit wire fraud affecting a financial institution, bank fraud, commodities fraud, price manipulation and spoofing.

“The superseding indictment follows the original indictment filed on Aug. 22, 2019, which charges Gregg Smith, 55, of Scarsdale, New York; Michael Nowak, 45, of Montclair, New Jersey; and Christopher Jordan, 47, of Mountainside, New Jersey, with one count of RICO conspiracy; one count of conspiracy to commit wire fraud affecting a financial institution, bank fraud, commodities fraud, price manipulation and spoofing; one count of bank fraud and one count of wire fraud affecting a financial institution. Those original charges – as well as the original charges of one count of attempted price manipulation, one count of commodities fraud and one count of spoofing against Smith and Nowak – are incorporated into the superseding indictment.”

Indeed, this is a case which has been unfolding since at least September 2019.

This is a superseding indictment, meaning it takes place of a previous indictment.

This scheme was first indicted in August but that indictment against Nowak, and Jordan was first unsealed in September.

That received a fair bit of attention, including a Reuters story.

In that story, the bank involved in this scheme was identified as JP Morgan Chase, though The Industry Spread has not independently verified that.

Here’s more from Reuters, “The Department of Justice charged two current and one former JPMorgan Chase & Co (JPM.N) executives on Monday with alleged racketeering and manipulating prices of metals such as gold, silver, platinum and palladium between 2008 and 2016.”

Reuters continued, “In a statement and in the indictment, prosecutors described how the trio executed ‘thousands’ of unlawful trading sequences that included ‘layering’ deceptive orders at different prices in rapid succession. Prosecutors also described attempts to influence market prices toward specific price points to trigger or avoid triggering options.

“An option is a financial instrument that gives buyers the right to buy or sell an underlying asset at an agreed price and at a fixed time. Its value is tied to the value of the underlying asset.

“While previous spoofing prosecutions have led to guilty pleas, in a similar case a former metals trader at the Swiss bank, UBS Group (UBSG.S), was acquitted by a jury last year, highlighting the difficulties in making a case that canceling orders is a criminal act given that many market orders go unfilled.”

The Industry Spread will follow the story.