Initially leaning towards potential rate hikes, market sentiments pivoted towards a more dovish stance, prompting a re-evaluation of USD positions. While USDJPY intervention played a role, it was primarily US data releases that influenced the downward trajectory. Notably, USD selling at week’s end was largely a trimming of positions rather than a significant shift to shorting, with only demand for BRL standing out in this regard.

USDJPY H1 Chart

Despite holiday-thinned trading, the USD weakened further, prompting cautious optimism among traders regarding the extent of these movements. However, our research team remains cautious, maintaining the view that while last week’s developments provided a temporary reprieve, the broader trend favours a stronger dollar over the long term. Limited divergence and a reduced FX carry buffer increase the vulnerability of emerging market currencies to hawkish US shocks.

Japan’s actions underscore the global focus on US policy, with many policymakers adjusting their strategies based on Fed decisions. Moreover, the People’s Bank of China’s recent adjustments to the USDCNY fix suggest a potential shift, contributing to stabilization in USD/NJA pairs. Macro interest in buying USDCNH topsides remains robust across various maturities.

USDIndex H1 Chart

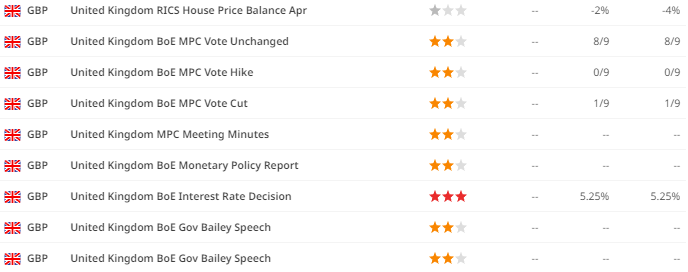

Looking ahead, the US data calendar is light, placing Fed speakers in the spotlight. Meanwhile, the Bank of England’s communication on Thursday will be closely scrutinized for clues about potential policy shifts. Changes in inflation projections, voting splits, and Governor Bailey’s tone during the press conference will provide insights into future rate decisions. In the emerging market space, central bank meetings in CEEMEA and Latam, particularly in Brazil and Peru, will be monitored for potential policy adjustments.

BoE Rate Decision

Insights Inspired by Goldman Sachs (FX Morning Thoughts): Credit to Their Analysis for Shaping Some Aspects of This Text.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff. The information does not constitute investment or financial advice or an offer to invest.

The post USD Strength Amidst EURUSD Bearish Signals appeared first on FinanceFeeds.