Recent developments in the currency markets depict contrasting trajectories for the US dollar (USD) and the British pound (GBP). While the USD continues its upward trend, bolstered by a series of positive performances, the GBP finds its footing amidst a backdrop of mixed economic indicators.

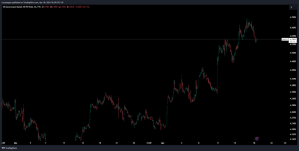

GBPUSD H1 Chart

For the USD, the momentum remains robust, highlighted by the dollar index reaching a new year-to-date peak. This surge, marking its sixth consecutive rise, showcases a notable strengthening of approximately 2.5% since early April. Year-to-date, the USD has exhibited a commendable gain of nearly 6%, particularly evident in its dominance over emerging market currencies such as the Indonesian rupiah, Mexican peso, Brazilian real, and Polish zloty.

The driving force behind the USD’s ascent stems from the surge in US yields, triggering a significant sell-off in risk assets, including a notable downturn in MSCI’s global equity index. The focal point of this shift in market sentiment lies in the Federal Reserve’s monetary policy stance. Recent statements from Fed Chair Powell have indicated a departure from previous expectations, suggesting a delay in anticipated rate cuts. This hawkish stance has reshaped market expectations, reducing the likelihood of a rate cut as early as June and potentially pushing it back to September.

US10Y Bonds

On the other side of the Atlantic, the GBP finds support from promising economic data. The release of the UK Consumer Price Index (CPI) report for March revealed figures that exceeded expectations, with both headline and core inflation surpassing projections. Combined with robust wage data from the latest UK labour market report, these indicators still a sense of caution within the Bank of England (BoE) regarding potential rate cuts. Despite hints from BoE Governor Bailey about the possibility of rate adjustments, recent data suggest a more cautious approach, potentially delaying any rate cuts until the August Monetary Policy Committee (MPC) meeting.

However, uncertainties persist, particularly surrounding labour market conditions in the UK. A further deterioration in employment metrics could intensify pressure on the BoE to act swiftly, possibly prompting an earlier rate cut. Consequently, the GBP may experience short-term weakness against the USD, although it could see modest gains against the euro.

In summary, the current landscape reflects diverging paths for the USD and GBP, driven by nuanced shifts in monetary policy expectations and economic fundamentals. As investors navigate these complexities, they must remain vigilant to capitalize on opportunities amid evolving market dynamics.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.