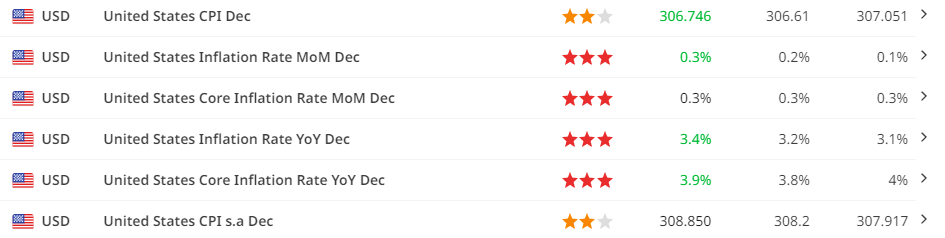

The final CPI report of 2023 presented a predictable scenario in my personal experience. December witnessed a 0.3% rise in the headline CPI, slightly exceeding market expectations, primarily fuelled by a modest uptick in energy prices.

Core CPI mirrored this increase, aligning with consensus forecasts, as core goods prices held steady on a year-over-year basis, maintaining a trajectory consistent with the pre-COVID trend. Conversely, core services inflation persisted, with shelter prices gradually easing and travel-related costs rebounding.

US CPI

Source: Finlogix

Despite December’s headline CPI surge to 3.4% year-over-year, an overall downtrend in inflation is evident. The core CPI, at 3.9%, falls below 4% for the first time in two and a half years. A three-month annualized rate of 3.3% hints at potential further deceleration. From my observations, I anticipate continued inflation deceleration in 2024, attributed to improved supply dynamics and weakened consumer demand. However, progress may be gradual, prompting policymakers’ concerns about a swift return to sustained 2% inflation.

While December saw a modest uptick in headline inflation, the overall downward trend persisted. The 0.3% increase in CPI, slightly above the expected 0.2%, extended to prices excluding food and energy. Notably, lower gasoline prices’ relief in October and November didn’t repeat, with gasoline and energy services contributing to a firmer headline reading. Food inflation remained relatively stable, offering tangible relief to consumers, though core goods prices showed a slight increase, particularly in used autos.

Despite the unchanged core goods prices in December, a reversal in the recent auto price increase is anticipated due to the resolution of UAW strikes and private sector measures. Household furnishing and recreation goods prices remained in deflationary territory. Core services inflation continued to slow but lagged core goods. Shelter inflation, a significant component, exhibited a slight increase, while airfares and motor vehicle insurance experienced varying changes.

Reflecting on 2023, a significant inflation slowdown was evident, with headline inflation over three percentage points lower than the previous year. This, combined with a resilient job market, contributed to positive real wage growth, and sustained consumer spending. Looking ahead, I anticipate a continued easing of inflation along its trend, driven by stabilized energy prices, declining food-related commodity prices, and further adjustments in goods prices. A balanced labour market is expected to contribute to easing inflationary pressures, though the improvement may be more gradual than in the previous year. My projection is a headline CPI of around 2.3% year-over-year, with core CPI easing to just under 3% by this time next year.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Disclaimer: The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.