Amidst the beginning of the week, market activities surged with a spotlight on the robust performance of the US manufacturing sector. The latest ISM report exceeded expectations, signalling strength across key indicators such as new orders, production, and employment. This positive momentum drove US yields higher, reflecting growing investor confidence.

In the currency realm, the US dollar showcased notable strength, particularly against European currencies within the G10 basket. Emerging markets witnessed fluctuations, with the Brazilian real bearing the brunt of the dollar’s resurgence. In Asia, while movements remained relatively subdued, the Thai baht faced pressure, hitting new highs against the dollar.

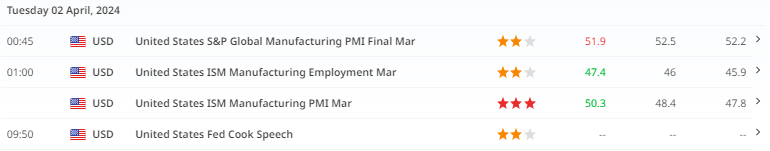

USA Data

Following disappointing HICP figures from Italy and France, anticipation mounted for Eurozone data releases. Projections hinted at a decline in year-on-year figures for March, setting the stage for potential market shifts. Uncertainty loomed over the Euro’s performance amidst differing interest rate outlooks between the Eurozone and the US Federal Reserve.

Looking ahead, the European Central Bank’s planned policy rate cuts in June add further complexity to the Euro’s trajectory. Despite resilience in Euro-area activity and economic indicators, the Euro has struggled against the steadfast US dollar, hovering near yearly lows.

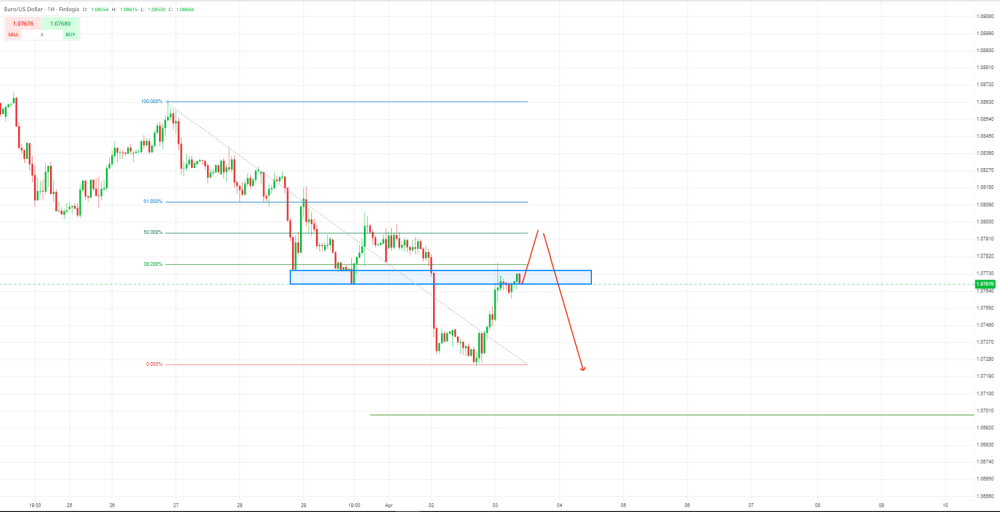

EURUSD 1HR Chart

In emerging markets, Turkey’s local elections stirred anticipation, with eyes on the AKP’s performance. Despite initial concerns, acknowledgment of election results and commitment to economic stability by Erdogan provided some reassurance. Analysts foresee a potential resurgence in capital inflows, supported by the government’s commitment to stabilizing inflation through consistent economic policies.

Each development shapes the landscape of opportunity and risk. As investors navigate uncertainties, the weeks ahead promise to be filled with twists and turns, where each piece of data and policy decision plays a pivotal role.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.