Today’s market landscape witnesses a notable shift as the US Dollar Index takes a steep dive to its lowest level of the month right at the market open.

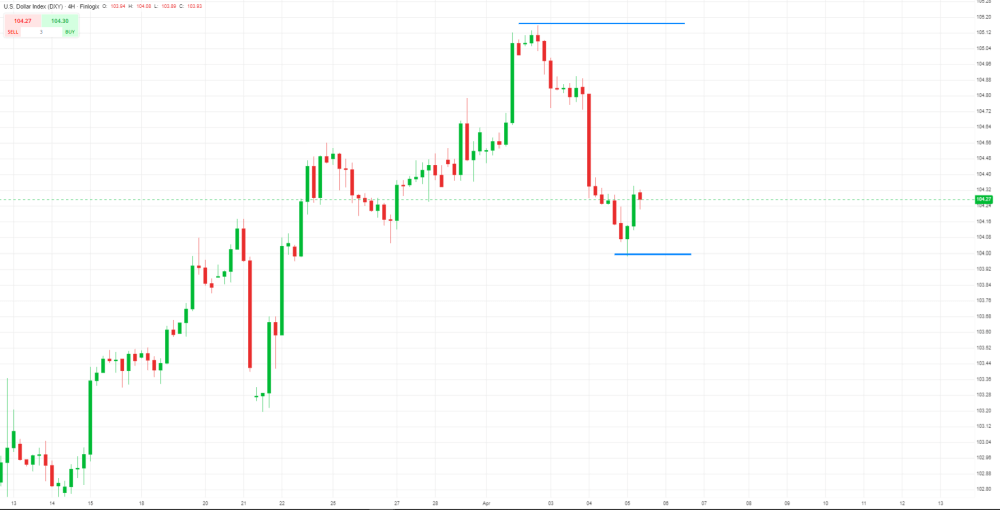

This plunge, from a four-month pinnacle of 105.16 to 104, reverberates across financial circles, prompting investors to confront a pivotal dilemma: stick with the faltering USD or seek refuge in the promising trajectory of gold (GOLG), which appears primed for an upward surge?

USD Index 4HR Chart

Fuelling this transition is the widespread anticipation of potential interest rate cuts by the Federal Reserve later this year. This speculation acts as a catalyst in the markets, notably enhancing gold’s appeal as a hedge against inflation and market volatility.

While some analysts float the notion of a staggering $500 correction in gold prices, such projections appear speculative and impractical. Looking ahead, envisioning gold’s ascent to new peaks, conceivably reaching the $2,500 milestone, seems within the realm of possibility. Though intermittent retracements may occur, the overarching trend suggests a sustained rally, particularly if central banks follow through with anticipated rate adjustments.

Recent gold flow data further corroborates this optimistic outlook, with notable surges in purchasing observed just a fortnight ago. Market sentiment seems attuned to the likelihood of a Fed rate cut, albeit perhaps not multiple times, with a reduction at least once this year deemed highly probable.

Nevertheless, dissenting voices challenge this narrative. Despite lingering inflationary pressures and unsettling unemployment figures, some argue against the notion of an impending collapse of the US economy. They posit that the Fed is unlikely to enact drastic rate cuts, fearing the potential exacerbation of inflationary tendencies and disruption to financial equilibrium.

Instead, these sceptics advocate for a more measured approach, suggesting a modest 25 basis point cut, strategically timed to assuage public sentiment without jeopardizing economic stability. Such a move could also serve political interests, especially in the context of an election year.

In this nuanced economic milieu, gold’s role as a haven asset remains paramount. While uncertainties persist, investors keenly monitor central bank manoeuvres and economic indicators for insights into the future trajectories of both the US dollar and gold prices.

In summary, premature forecasts of the demise of either the US dollar or gold seem unwarranted. The intricate interplay between monetary policy, economic fundamentals, and market sentiment will continue to shape the financial landscape in the foreseeable future.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.