Swissquote has introduced a staking service for Ethereum (ETH) — a practice of earning rewards for serving as a transaction validator in the Ethereum blockchain.

The process enables users to earn dividends or interest on their Ether holdings just for depositing and holding the second largest cryptocurrency on the platform.

The Swiss online bank posted on its website the terms for staking Ethereum, noting that it will provide an estimated 5.28% annual percentage yield (APY) on tokens staked in the network. Rewards are currently locked, the company details, but yields will be distributed to retroactively once the Ethereum protocol has been updated.

Notably, staking positions can be exited at any time as there is no minimum withdrawal period. Yield rates, however, are subject to change and are largely dependent on fluctuations in the total amount of tokens locked up through staking on each given network.

Additionally, users of ETH staking will not be able to unstake via a token tradable on the open market without having to wait for the Shanghai upgrade.

The staking process involves the users delegating their token holdings to those running the blockchain software in exchange for sharing some profit. The decision was taken in the context of huge interest from retail investors who were open to the idea of earning interest on their crypto assets.

This move also provides another crypto on-ramp for those looking to enter the crypto space, and comes shortly after the Ethereum network’s long-promised shift from an energy-intensive proof-of-work consensus mechanism to proof of stake.

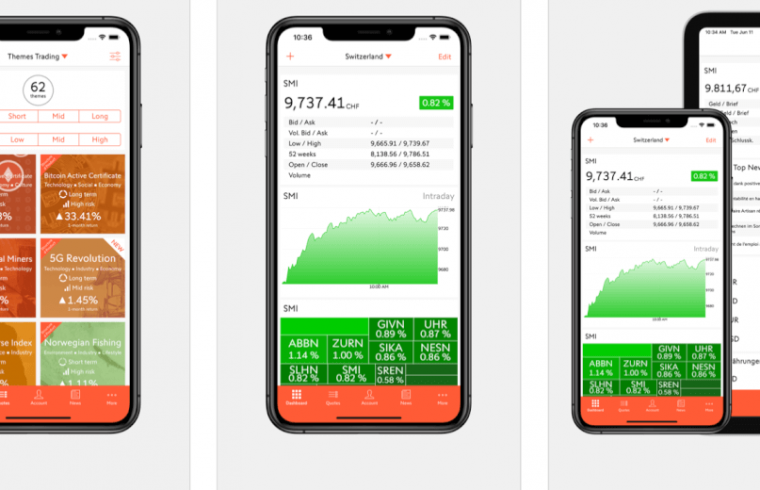

Swissquote is looking to delve further into the digital-asset arena with the launch of its own cryptocurrency trading platform. Earlier this month, the company announced that its own crypto exchange, dubbed ‘SQX’, is run and operational. To further sweeten the offering, Switzerland’s largest online bank plans to add stablecoins and staking services, which are currently in high demand, to the list of cryptocurrency offerings.

The new service combines Swissquote’s expertise as a provider of online trading services with digital asset security, in a bid to provide a safekeeping service for investment houses looking to gain exposure to the rapidly emerging asset class.

The brokerage firm already allows its clients to trade CFDs on 24 cryptocurrencies: Bitcoin, ethereum, litecoin, XRP, bitcoin cash, chainlink, ethereum classic, EOS, stellar, tezos, augur, ox, cardano, uniswap, aave, cosmos, algorand, filecoin, maker, compound, year.finance, dogecoin, polkadot and solana.

Swissquote’s crypto offering is going up against local players like Dukascopy which has its own cryptocurrency, allows clients to deposit and withdraw funds in digital coins, as well as enabling free internal crypto-transfers between users of mobile banking.