Summary: The British Pound soared to 6-week highs after data showed the UK economy picked up more than expected in July. Hopes that the UK will not leave the EU without a deal propelled Sterling to 1.2384 before settling at 1.2345, best performing currency. The risk-on theme extended after the Peoples Bank of China lowered its reserve requirement ratio by 50bp. Risk currencies extended gains led by the Australian Dollar, up 0.3% to 0.6865 (0.6849). The Kiwi rose 0.3% to 0.6427. A Reuters report that Germany may boost fiscal stimulus lifted the Euro although expectations of further ECB easing pared gains. EUR/USD finished 0.2% up at 1.1047. The US Dollar rallied against the Yen (107.25) and Swiss Franc (0.9924) as haven flows reversed. USD/DXY (Dollar Index) settled at 98.334, modestly above yesterday’s 98.02.

Treasuries slumped lifting bond yields on stimulus prospects ahead of Thursday’s ECB policy meeting. The yield on the US 10-year bond climbed 8 basis points to 1.64%, its highest level in more than two weeks. Germany’s 10-year Bund yielded -0.59% against -0.645.

Wall Street stocks ended mixed. The DOW was up 0.18% while the S&P 500 dipped 0.02%.

Japan’s Current Account fell to JPY 1.65 trillion against a forecast JPY 1.70 trillion while Final Q2 GDP was unchanged at 0.3%. Japanese Economic Watchers Sentiment rose to 42.8 from 41.2.

The Eurozone Sentix Investor Confidence Index lifted to -11.1 against expectations of -13.0.

UK July GDP beat forecasts at 0.3% (0.1%), July Manufacturing Production was up to 0.3% from the previous -0.2%, UK Construction Output rose to 0.5% (vs f/c 0.2%) while Britain’s Goods Trade Deficit beat estimates to -9.1 billion against -9.6 billion.

- EUR/USD – the shared currency rallied to 1.1068 overnight highs on the Reuters report that Germany may boost public investment above and beyond limits to boost growth. The Euro dipped back to 1.1047 on expectations of further ECB easing on Thursday.

- GBP/USD – Sterling soared to 1.23842, fresh 6-week highs as data from the UK showed that the economy picked up more than expected in July. Hopes remained that the UK will not leave the EU without a deal. Parliament was set to vote on a bill to prevent a no-deal Brexit. GBP/USD closed at 1.2345, up 0.57% from yesterday.

- AUD/USD – The Aussie continued its grind higher to 0.6865 (0.6850) on the extended risk-on profile supported by trade war optimism. AUD/USD hit an overnight and near 6-weak high at 0.68757 before settling lower.

- USD/JPY – The Dollar grinded higher against the have Yen to 107.274, closing at 107.23, up 03%. US 10-year bond yield climbed 8 basis points to 1.64% while Japan’s10-year JGB yield was unchanged.

On the Lookout: The rise in US bond yields was matched by its global peers although not to the same extent. This should put a bid on the US Dollar until further economic data are released. The big event for Europe is Thursday’s ECB meeting while the US sees Headline and Core CPI (Thursday) and Retail Sales (Headline and Core) on Friday.

Today sees Australia’s NAB Business Confidence Index followed by China’s annual CPI and PPI. Japan reports its Preliminary Machine Tool Orders. Euro area sees French and Italian Industrial Production for August. UK employment data follow with Average Earnings Index (Wages), Claimant Count Change (Unemployment claims), and August Unemployment rate. Canadian Housing Starts and Building Permits follow next. The US finishes off the day’s reports with its NFIB Small Business Index and JOLTS Job Openings.

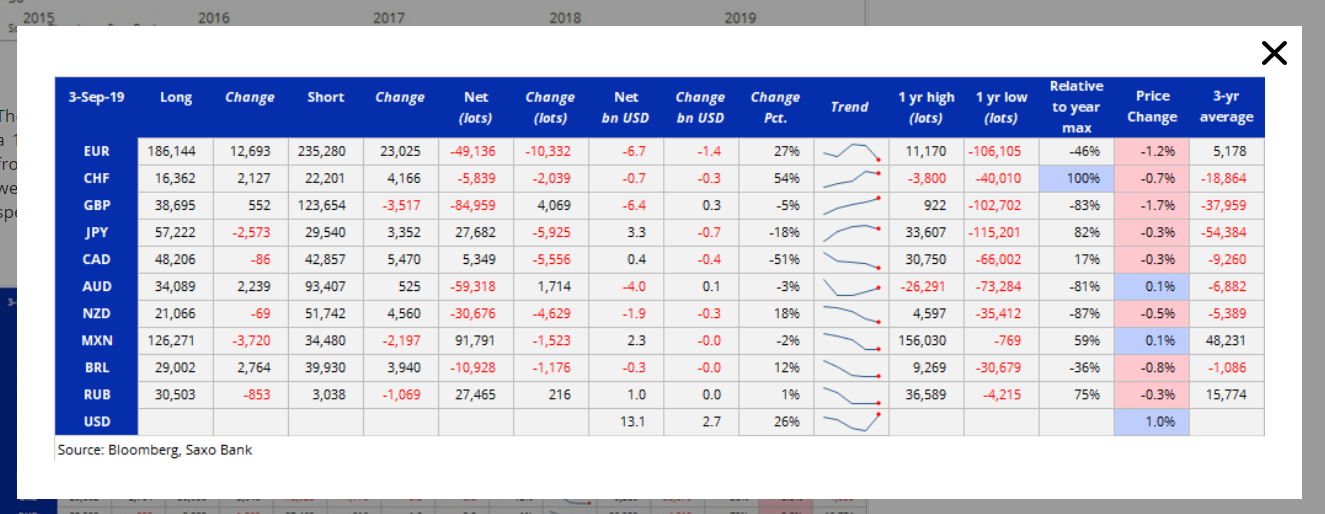

Trading Perspective: The slight yield advantage favours the US Dollar and should put a bid tone to the Greenback for now. On the other hand, the latest COT/CFTC report (week ended 3 September) saw total speculative US Dollar long bets increase 26% to USD 13.1 billion, a 5-week high according to a Saxo Bank report. Most of those US gains were on the back of an increase in net EURO short bets. Net total Euro short bets increased by EUR 10,332 lots to -EUR 49,136. The total increase was also aided by a reduction in net JPY long bets. Sterling shorts were further reduced while total short Aussie bets were little changed.

- EUR/USD – The Euro rallied to 1.1068 before easing to settle at 1.1047 in New York. Expectations of further central bank easing will continue to constrain the Euro although much of this is already built into the current rate. The increase in net speculative Euro shorts in the latest week will keep the Euro supported above 1.1000. Unless Mario Draghi goes out with a bang in his last meeting as ECB president (before handing it over to incoming Christine Lagarde), expect the Euro to stay supported. Immediate resistance can be found at 1.1070/80 with 1.1110 the next line up. Immediate support can be found at 1.1030 and 1.1010. Look for a likely range today of 1.1015-1.1075. Preference is to buy dips.

- AUD/USD – The Aussie Battler continues to grind higher. After closing at 0.6865, the Aussie has immediate resistance at 0.6880 (overnight high was 0.68757). The next resistance level can be found at 0.6900. Immediate support lies at 0.6840 and 0.6810. The latest COT/CFTC report for the week ended 9 Sept. saw net speculative Aussie shorts total -AUD 59,318 from the previous week’s -AUD 61,032. Look to trade a likely range today of 0.6840-0.6890. Preference is to buy dips in the low 68/s.

- GBP/USD – Sterling lifted to 1.23842 highs before settling at 1.2345. UK economic data reports showed remarkable resilience in the UK economy for July which was translated into the British currency. Hopes remain high that the UK will not leave the EU without a deal. Meantime the market remains short of Sterling despite a trimming of those shorts. The latest COT/CFTC report saw net speculative GBP shorts trimmed to -GBP 84,959 from -GBP 89,028 bets. Immediate resistance for the Pound lies at 1.2385 followed by 1.2400. Immediate support can be found at 1.2330 followed by 1.2290. Look to trade a likely range today of 1.2290-1.2390.

- USD/JPY – The Dollar grinded higher against the Yen to 107.274 before settling at 107.23. The 8-basis point climb in US 10-year yields supported the Greenback as haven flows dried up. The latest COT report saw a trimming of JPY longs to +JPY 27,682 contracts from +JPY 33,607. USD/JPY has immediate resistance at 107.30 followed by 107.80. Immediate support can be found at 107.00 followed by 106.70. Look to trade a likely range of 106.80-107.30. Just trade the range shag on this one.

Happy trading all.