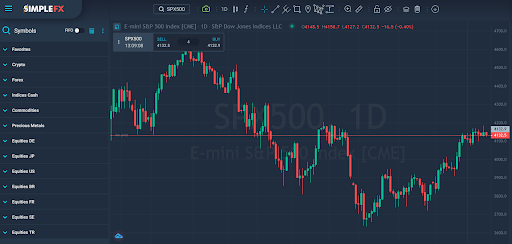

Equities have gone up enormously since the low. SP500 has gained 13.88% since June 17. In August, the indices drifted sideways. On Wall Street, veteran investors expect a move in either direction.

Equities have gone up enormously since the low. SP500 has gained 13.88% since June 17. In August, the indices drifted sideways. On Wall Street, veteran investors expect a move in either direction.

Whatever happens in the near future, smart investors will make a big profit either way. With trading apps, such as SimpleFX, you can invest your crypto (or local currency) in the price action of stocks, commodities, and cryptocurrencies. The asset you choose doesn’t have to increase its value. You can also short an overpriced stock or pumped cryptocurrency and cash out a profit when the bubble pops.

The stock markets should still be considered to be in a bear market. Dow Jones Industrial Average and S&P 500 are roughly 20% below the record close on January 3. The tech-heavy Nasdaq 100 index lost even more as innovative companies are more prone to big price swings. However, many SimpleFX users have acquired Alphabet stock at a discounted price. Google’s owner shares dropped to around $105 four times since May 23.

Of course, going in at any of these moments seemed very risky, as nobody knew if the markets weren’t going to crash even more profound, but buying Google on July 26 paid off. Several brave SimpleFX traders went for the move, and some of them used the highest effective leverage. The price of google stocks rose by 12.76% in just two weeks, giving huge profits.

Let’s take a closer look at the SPX500’s recent outlook. The index gained over 7% in the past four weeks. From a technical analysis perspective, Wall Street analysts see some strong price action signals ahead. If SPX500 succeeds in gaining 8% over the last four weeks, the formation will prove to hit an essential mark of two standard deviations.

That move might trigger a strong rebound, but nobody knows if it will be a bearish rally (a retraction) or a change of trend. No technical analysis signs can beat the fundamental basics of global economic performance. No bullish formation can save stocks or cryptocurrencies if the world tumbles into recession.

Currently, the most critical data for equity markets is inflation from the most significant economies. Central banks worldwide are watching the Federal Reserve’s decision. Raising interest rates slows the economy but is indispensable to preventing inflation.

A potential recession may trigger a domino effect, which could fuel the geopolitical tensions between the US and China. Global trade keeps the world together, and if the exchange slows or stops, there may be no turning back.

The global markets are at a turning point. Smart traders will benefit no matter what happens. Keep your eye on the news, watch the inflation data from the biggest economies, follow the companies’ financial reports, and trade accordingly.

With the SimpleFX trading and investing app, you can multiply your funds in just minutes. During these exceptional times, SimpleFX is launching a limited-time offer. They give a special August Cashback to every trader who deposits until August 26.

The rewards will be paid out in bitcoins! This is an excellent opportunity to increase your trading margin for free. Go to SimpleFX and opt-in to the promo.