US-based multinational financial services provider, VISA and UK based fintech, and banking services Revolut recently revealed in a joint announcement stating that the UK based firm is set to initiate a large hiring drive as a part of its efforts to expand globally as a part of their deal.

US-based multinational financial services provider, VISA and UK based fintech, and banking services Revolut recently revealed in a joint announcement stating that the UK based firm is set to initiate a large hiring drive as a part of its efforts to expand globally as a part of their deal.

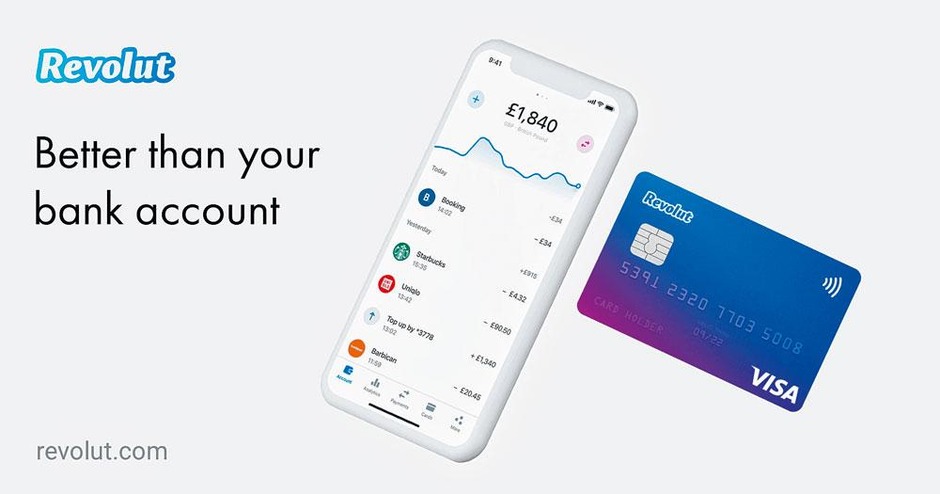

The UK based emerging banking service provider plans to leverage Visa’s brand image on a global scale and its presence in the global market to bring its product offerings to five new regions targeting 24 new markets, enabling the firm to offer its product services to a total of 56 markets globally. As a part of their deal, the UK based fintech service provider will primarily issue Visa-branded cards to its clients on their global expansion efforts.

Revolut is popular in today’s markets for its selected range of digital financial services which are made up of mobile applications for currency exchange, budgeting, and person to person (P2P) payments which are currently linked to Visa Card. Given the success of their partnership so far in the European market as a part of their existing agreement, Visa is set to empower Revolut’s expansion in Pacific and southeast Asian markets.

To be specific, the challenger bank is targeting to expand in Australia, Brazil, Canada, Japan, New Zealand, Russia, Singapore and the United States, followed by Argentina, Chile, Colombia, Hong Kong, India, Indonesia, Korea, Malaysia, Mexico, Philippines, Saudi Arabia, South Africa, Taiwan, Thailand, Ukraine and Vietnam. Both firms have built a strong partnership over the course of the last four years and have been highly successful in their endeavors till date. The challenger bank first began issuing VISA cards to its customers in the European market in 2017 and has since been leveraging the US-based financial service provider’s global network and capabilities to hasten their efforts on expanding business on a global scale.

In this new hiring drive to expand on a global scale, the banking service provider is expected to hire nearly 3500 employees. As a major player and one of the market leaders in the alternative banking sector, the digital banking service provider and VISA aim to provide their customers with flexible, customised, seamless banking services, low-cost currency exchange, and P2P payment options to allow customers to better manage their money digitally.

This deal between two parties was formed on Visa’s long term commitment to fin techs and is aimed at bolstering the US-based financial service provider’s strategic business priorities. Speaking about their expansion efforts and plans on leveraging VISA’s global network, Nikolay Storonsky – the founder and Chief Executive Officer of Revolut commented, “We are excited to build upon our existing collaboration with Visa, the world’s leader in digital payments, which will bring to life our shared vision for seamless, innovative payment experiences.

The new global agreement with Visa is timely for Revolut as we move into a number of new markets to offer even more consumers the control, flexibility and innovative features that our European customers have been benefiting from for years”. Speaking on the same note, Jack Forestell, chief product officer at Visa commented, “Revolut has made great strides in delivering innovative and unique experiences to consumers in Europe. We are thrilled to extend our relationship as Revolut looks to achieve their global growth ambitions and collectively drive increased volume on the Visa network. With Visa being accepted at nearly 54 million merchant locations across more than 200 countries, we have the scale, experience, and expertise to help fintechs like Revolut go global”.

Source: