The market – or rather the market observers – assume that the Gold price has recently risen to an all-time high thanks to hopes of lower interest rates. Geopolitical tensions are also repeatedly mentioned as an additional driver.

We only partly agree with these arguments. A key driver for us is the recent increase in the likelihood that Kamala Harris could actually become US president. Her economic policy (Kamalanomics) would further drive US debt and she even spoke of price controls – which has never had a long-term positive impact on the economy in history. The market is currently pricing in this growing risk.

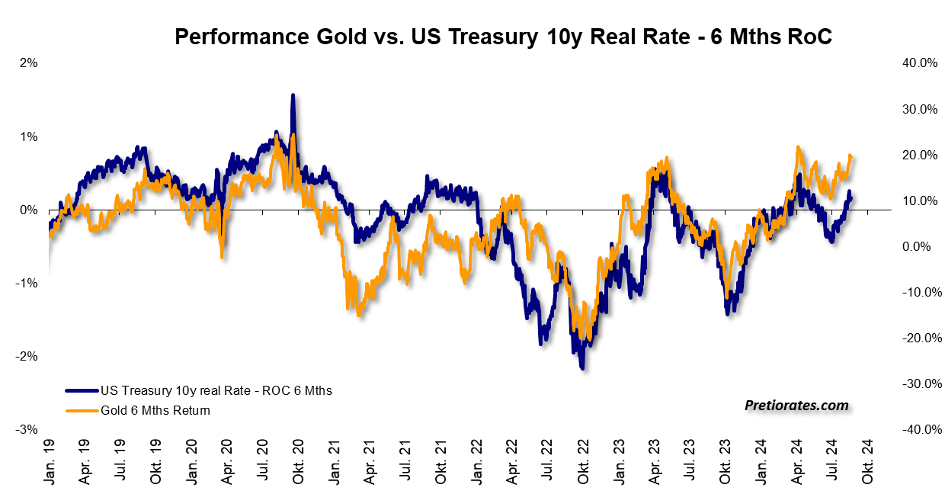

Of course, her policy would have a major impact on the development of US interest rates. The real market yield (US interest rates minus inflation) has always been one of the most important factors for the price development of Gold. However, since spring 2022, this previously very high correlation has apparently come to an end. It can be speculated that the war in Ukraine has something to do with this, i.e. that the Gold price has since incorporated a risk premium.

In fact, however, the Gold price continues to correlate with the real market yield, as the percentage change over the last six months shows very clearly…

– Advertisement –

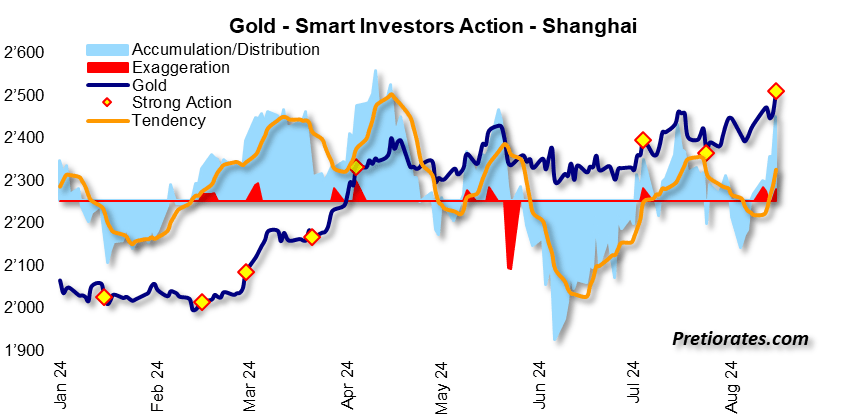

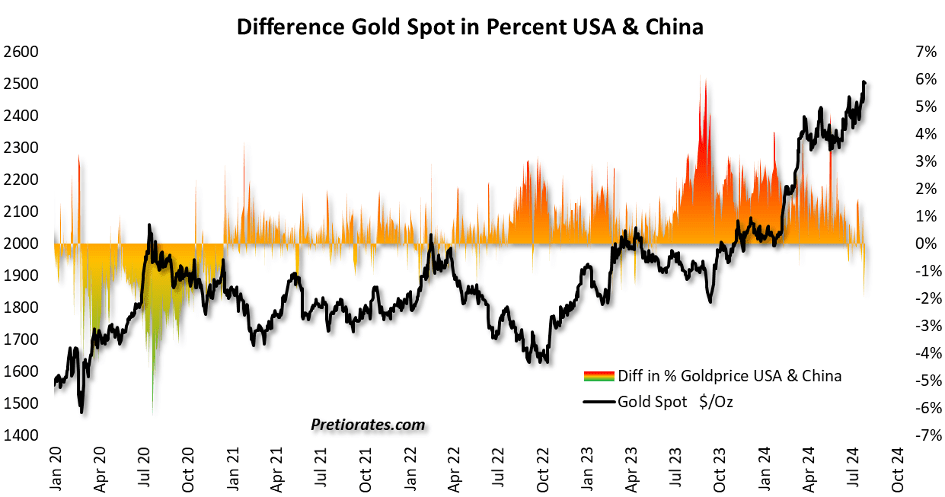

We are pleased that the Gold price has finally reached the USD 2500 per ounce mark. However, we do not expect a firework. The Gold price is increasingly being controlled by the Chinese Market and the chart of the Smart Investors Action for the Shanghai Gold Exchange is now showing warning signals such as ‘exaggeration’ and ‘strong action’, which often bring about contrary trends…

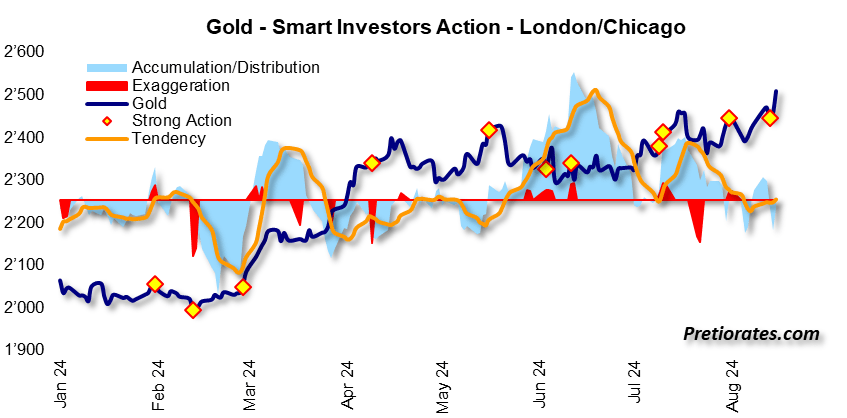

The same indicator for the western Gold exchanges also shows no accumulation on the part of smart investors…

For the first time in many months, Chinese investors are no longer willing to pay a premium compared to western exchanges. Chinese interest has apparently evaporated during these days…

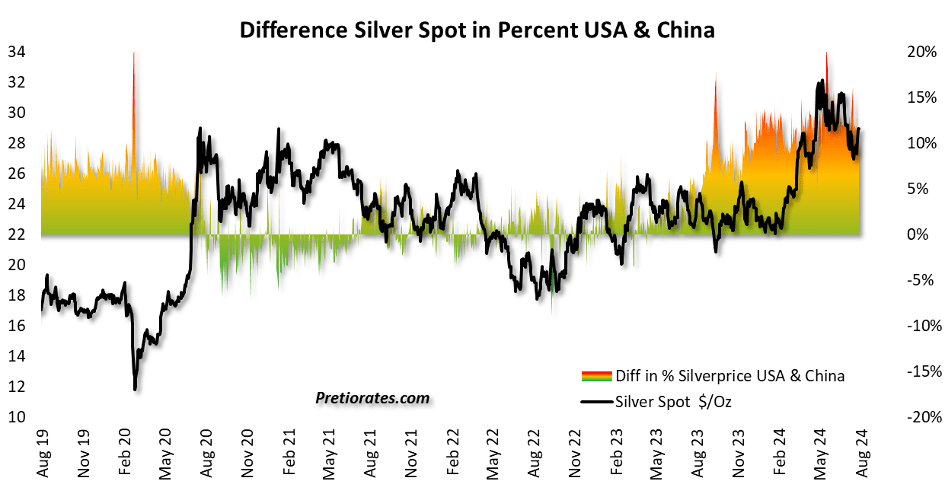

However, a premium of over 10% is still being paid for physical Silver, which speaks for a relative strength of Silver compared to Gold…

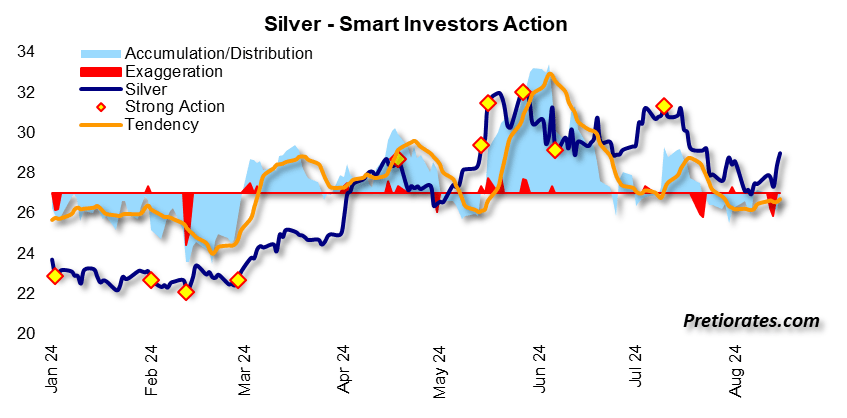

But the Smart Investors Action also shows no accumulation. At least, during trading days with stronger corrections, a negative exaggeration, an exaggeration downwards, was seen during the last few weeks…

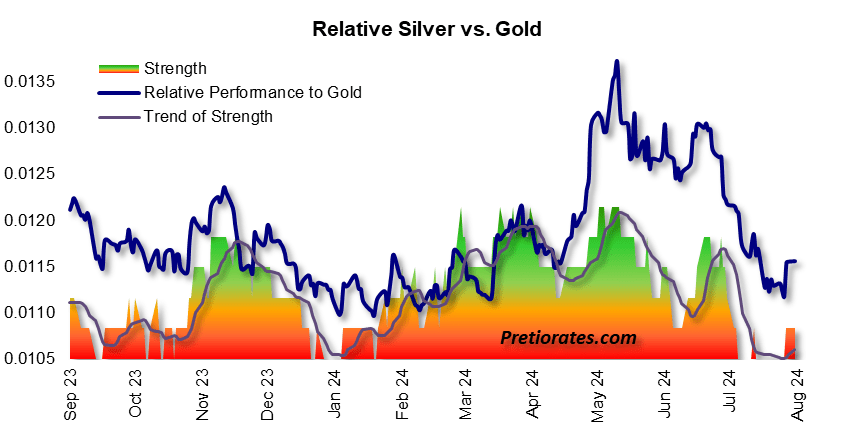

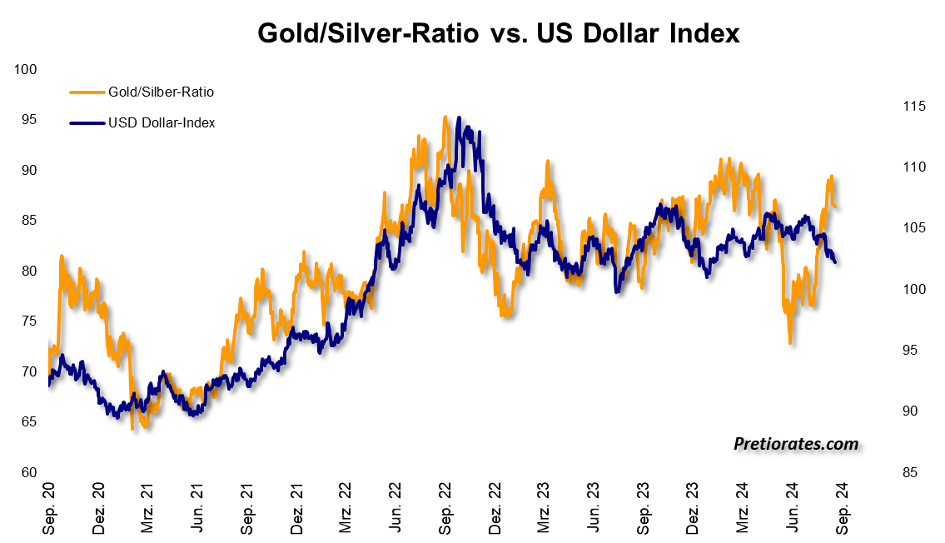

The Gold/Silver-Ratio has clearly suffered since the high in May, but the strength indicator is showing the first signs of life again, which confirms the relative strength of Silver against Gold here as well…

As we mentioned in an earlier edition about two weeks ago, the Gold/Silver-Ratio against the US dollar is too high – and has since corrected somewhat – with potential for more…

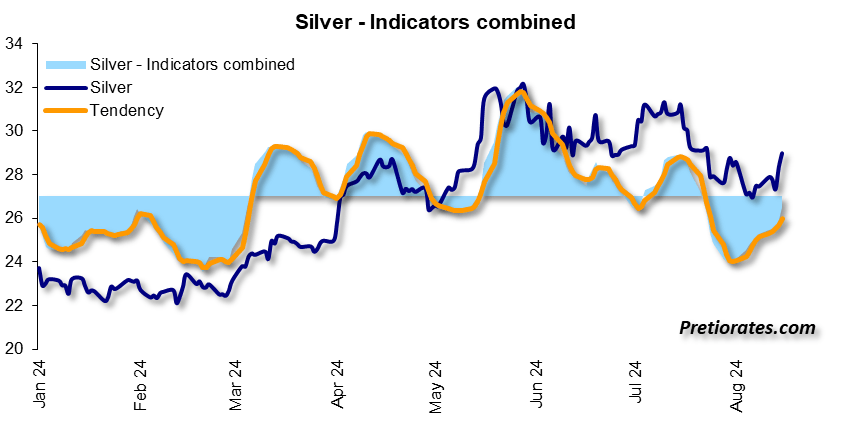

The combined indicators also suggest that the Silver price still has strength…

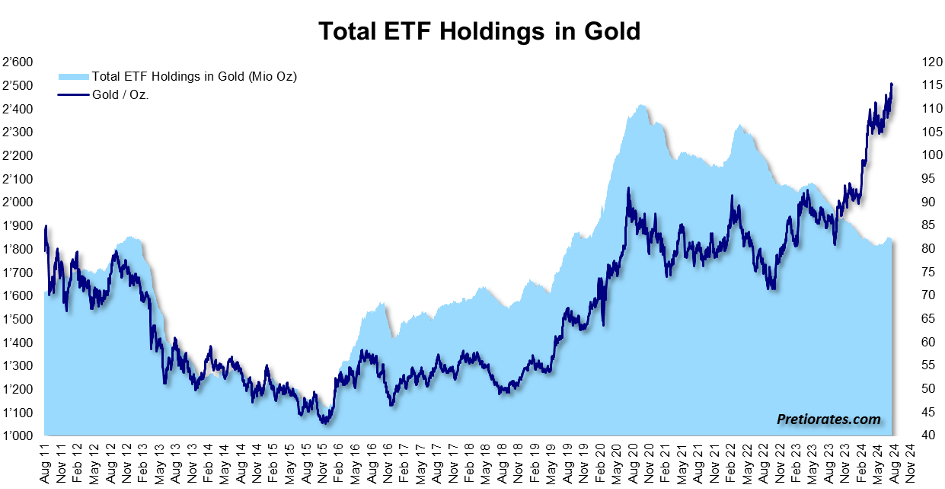

A look at the ETF market tells us that the interest of private investors in particular has increased only slightly…

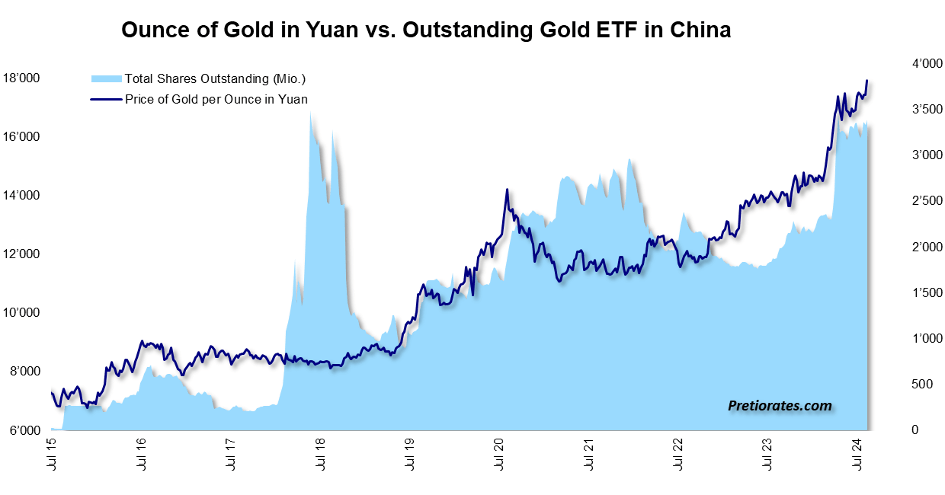

Chinese investors have also not increased their Gold ETF holdings further…

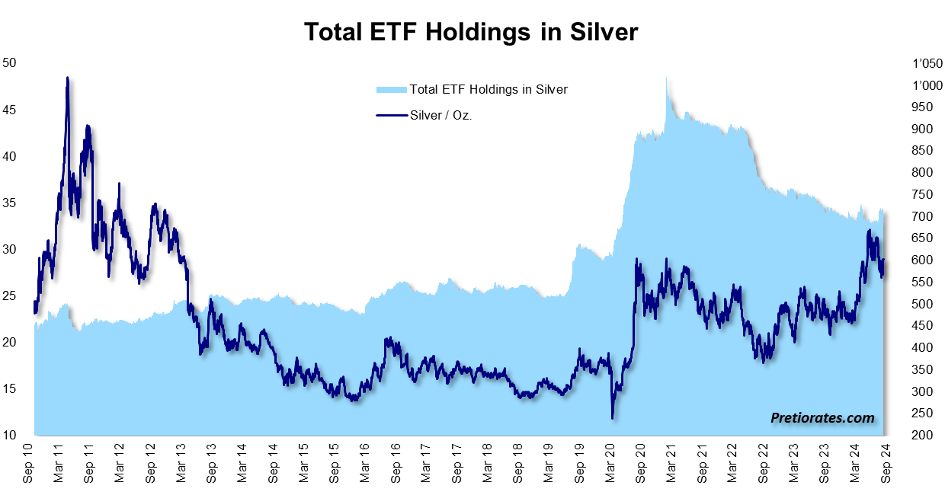

A similar picture for Silver ETFs. At least the selling pressure that has been going on for almost three years seems to have come to an end…

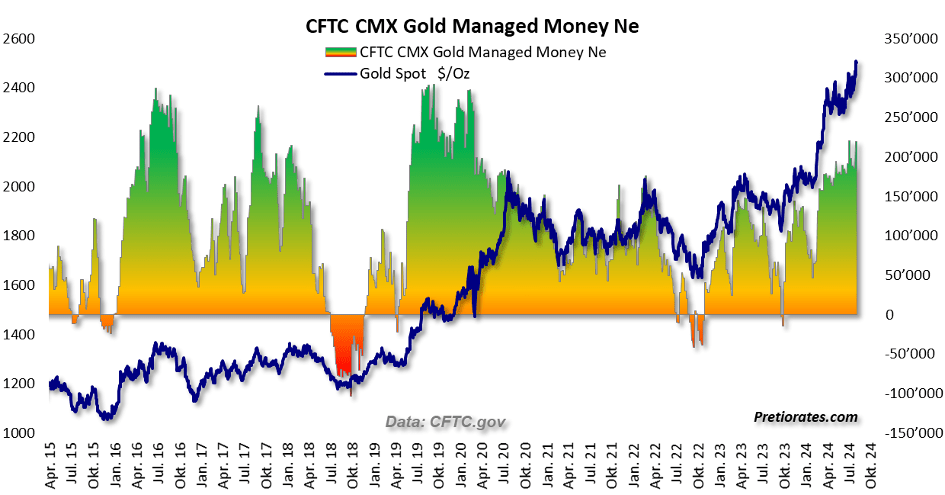

The futures market also tells us that investors continue to hold large Gold positions. This limits additional buying interest in the coming weeks…

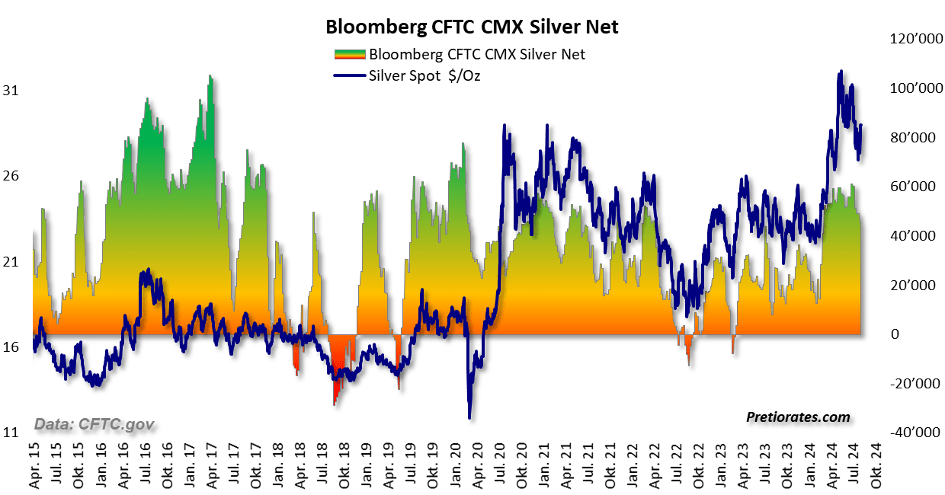

A similar picture in the Silver futures market…

While the bulls are likely to continue to have the advantage in the long term, the short term does not look so exciting. A surprise at the Jackson Hole (meeting of central banks) or at the DNC meeting could have a major impact on the price of Gold and Silver. The same applies to a geopolitical escalation. If these do not occur, we can expect a rather calm development of the Gold price, with the Silver price having somewhat more potential.