This week promises a rollercoaster in the financial markets with key insights on inflation and monetary policy across the G10, particularly the EUR and USA. Stay tuned for pivotal data releases that might reshape market dynamics. Gear up for a week of crucial economic indicators!

Monday

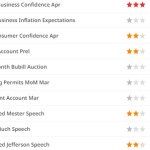

Transitioning from a sluggish week, we’re gearing up for a new one filled with significant developments. Keep a close eye on the EUR and USA areas within the G10 group, as they’re poised to be the most impacted. Let’s take a breather from current events and delve into what lies ahead this week. Monday kicks off with relatively low volatility across the market. The agenda is light, featuring only New Zealand’s inflation expectations and a speech on US monetary policy from an FOMC member. While these FOMC member hints may seem subtle, they offer valuable insights into future monetary policy, so don’t overlook them.

Tuesday

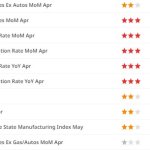

Tuesday brings a touch more intrigue, particularly in the EUR area, with Germany releasing its MoM CPI. If the inflation remains unchanged from the previous release, we can anticipate stability in the EUR market. However, any uptick could stir volatility. Considering the steady consumer spending and sticky CPI across the EUR region, there’s a slight chance inflation could surpass expectations, shaping market dynamics for the week. Later in the day, the eagerly awaited Producer Price Index (PPI) will be unveiled, offering a glimpse into producer-side inflation. A higher-than-anticipated PPI could drive bullish sentiment for the USD, especially if it exceeds the previous 0.2% by reaching 0.3%.

Wednesday

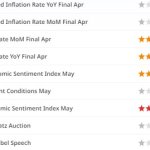

Following the PPI release, attention shifts to the US Consumer Price Index (CPI) on Wednesday. The inverse relationship between PPI and CPI suggests that if producer-side inflation rises, consumer-side inflation may follow suit. Anticipated CPI figures reflect a 0.1% decrease from the previous month, from 0.4% to 0.3%. A lower-than-expected CPI could propel the EURUSD upwards. Concurrently, Retail Sales data will shed light on consumer spending trends. Continued high spending may signal potential inflationary pressures in the future, influencing the Fed’s interest rate decisions.

Thursday

Thursday brings further insights into US monetary policy with additional FOMC speeches. While seemingly mundane, these speeches often offer valuable clues about future policy directions. In Asia, Japan’s GDP figures are anticipated to show a significant decline, potentially pushing the JPY into weaker territory.

Friday

As the week draws to a close, all eyes turn to the Euro Area’s CPI YoY and MoM releases on Friday. Expected to dip slightly from previous figures, this could weaken the EUR. The week’s playbook for EURUSD hinges on US data; lower-than-expected releases could deflate the USD Index (DXY), buoying EURUSD, particularly if Euro Area data surpasses expectations.

Wishing everyone a fruitful week ahead and a successful run in the markets! Remember, all data release times mentioned are in Australian time, so be sure to adjust accordingly using the Finlogix Economic Calendar ( https://www.finlogix.com/calendar ).

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.