European financial regulatory body ESMA announced it wants to ban Binary Options in the European Union and limit leverage up to 30:1 on Forex trading.

European financial regulatory body ESMA announced it wants to ban Binary Options in the European Union and limit leverage up to 30:1 on Forex trading.

ESMA plans to conduct a public consultation in early 2018 before issuing its final ruling, but as it considers that “risks to investor protection are not sufficiently controlled or reduced“ by the national financial watchdogs, the final recommendations may be very close to what was now made public. These recommendations, however, have no legal authority over national regulators who can adopt them or not, despite the political pressure.

ESMA intends to prohibit the marketing, distribution or sale to retail clients of binary options; and restrict the marketing, distribution or sale to retail clients of CFDs, including rolling spot forex. The restrictions on CFDs currently under review are:

ESMA intends to prohibit the marketing, distribution or sale to retail clients of binary options; and restrict the marketing, distribution or sale to retail clients of CFDs, including rolling spot forex. The restrictions on CFDs currently under review are:

leverage limits on the opening of a position between 30:1 and 5:1, whose limit will vary according to the volatility of the underlying asset;

a margin close-out rule;

negative balance protection to provide a guaranteed limit on client losses;

a restriction on benefits incentivising trading; and

a standardised risk warning.

The UK, that is preparing for Brexit, is home to some of the largest retail FX brokers. The UK Financial Conduct Authority (FCA) is waiting for ESMA’s recommendations but has hinted it wants to regulate Binary Options instead of banning them. Its statement: “The FCA supports ESMA in its consideration of potential EU-wide product intervention. Our domestic policy work on permanent product intervention measures applicable to firms offering CFDs and binary options to retail clients is ongoing. Any permanent FCA policy measures would take in to account any prospective ESMA measures.”

The UK, that is preparing for Brexit, is home to some of the largest retail FX brokers. The UK Financial Conduct Authority (FCA) is waiting for ESMA’s recommendations but has hinted it wants to regulate Binary Options instead of banning them. Its statement: “The FCA supports ESMA in its consideration of potential EU-wide product intervention. Our domestic policy work on permanent product intervention measures applicable to firms offering CFDs and binary options to retail clients is ongoing. Any permanent FCA policy measures would take in to account any prospective ESMA measures.”

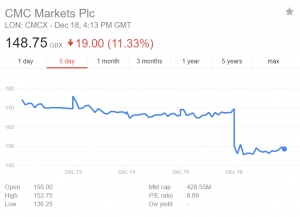

Despite the UK FCA’s independence from ESMA, its different plans, and the expected Brexit, shares of the leading FCA regulated UK online brokers are plunging today in reaction to the announcement. Shares of Plus500 (-9.78%), CMC Markets (-11.33%), and IG Group (-9.62%) are down as investors price in the probable trading volumes to expect as of 2019, potentially half of what they are today.

Despite the UK FCA’s independence from ESMA, its different plans, and the expected Brexit, shares of the leading FCA regulated UK online brokers are plunging today in reaction to the announcement. Shares of Plus500 (-9.78%), CMC Markets (-11.33%), and IG Group (-9.62%) are down as investors price in the probable trading volumes to expect as of 2019, potentially half of what they are today.

The UK FCA, however, may respond with a leverage cap of 50:1 and a bonus ban, as the regulator found that 82% of clients of CFD brokers have lost money on these products. At the day of the announcement, December 6, shares of IG, Plus500 and CMC tumbled between 25-33%.

The UK FCA, however, may respond with a leverage cap of 50:1 and a bonus ban, as the regulator found that 82% of clients of CFD brokers have lost money on these products. At the day of the announcement, December 6, shares of IG, Plus500 and CMC tumbled between 25-33%.