Looking at the FX market, recent dynamics have underscored the resilience of the US dollar amidst global economic shifts.

Following the highly anticipated Federal Open Market Committee (FOMC) press conference chaired by Jerome Powell, initial expectations of dollar depreciation were swiftly overturned. Instead, the DXY index surged beyond pre-FOMC levels during Asian trading hours, indicative of a complex interplay of factors influencing investor sentiment.

USD INDEX

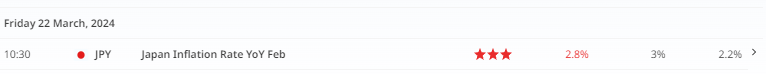

The Bank of Japan’s (BoJ) recent policy decisions injected further complexity into the dollar’s trajectory. Despite the BoJ’s bold move to hike rates, the response from currency markets was muted, suggesting a cautious approach among investors. While the significance of the BoJ decision is undeniable, it’s clear that a more extended period of observation, coupled with comprehensive economic indicators, will be necessary before market speculation regarding further rate hikes gains traction.

Moreover, last Friday’s release of nationwide inflation data, which fell slightly short of expectations, has prompted a revaluation of the timeline for potential BoJ rate hikes. This underscores the importance of patience and prudence in navigating the intricacies of monetary policy decisions.

The Bank of England’s Monetary Policy Committee (MPC) has also played a pivotal role in shaping market dynamics. The recent revelation that two MPC members have shifted their stance from advocating for rate hikes to a more dovish position has led to renewed selling pressure on the British pound (GBP). Additionally, Governor Bailey’s recent remarks in an interview with the Financial Times, where he hinted at the possibility of future rate cuts, have further fuelled speculation, contributing to the already volatile market environment.

Furthermore, the strength exhibited by the US dollar in Friday’s trading can be attributed to the breakout of USD/CNY above the critical 7.2000 level. This development carries significant implications, particularly considering the People’s Bank of China’s (PBoC) historical interventions to prevent such movements. The PBoC’s decision to allow this breakout, influenced by the reaction of the Japanese yen to the BoJ rate hike, has been further supported by comments suggesting the possibility of additional cuts in the Reserve Requirement Ratio (RRR), leading to a notable decline in the Hang Seng China Enterprise index.

USDCNY

In addition to these developments, the recent rate cut by the Swiss National Bank (SNB) and the softened guidance on future rate hikes by the Reserve Bank of Australia (RBA) have added to the narrative of global monetary easing. These actions reflect a broader trend among central banks towards accommodative monetary policies in response to evolving economic conditions.

Looking ahead, market participants are bracing for a period of heightened uncertainty as central banks navigate the delicate balance between supporting economic growth and managing inflationary pressures. The current outlook suggests that the US dollar is likely to remain within a relatively narrow trading range in the near term, with forward market pricing indicating expectations of synchronized easing among key central banks.

In the case of the Swiss franc (CHF), the SNB’s recent rate cut was widely anticipated, given the prevailing economic conditions characterized by declining inflationary pressures. Looking ahead, the SNB’s inflation projections suggest the possibility of additional rate cuts in the future, further weighing on the value of the CHF against currencies such as the Japanese yen (JPY). With SNB President Jordan signalling the potential utilization of unconventional policy tools, including intervention in the foreign exchange market, the stage is set for further developments in the realm of global currency dynamicsTop of Form.

Disclaimer: The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.