Amidst the ebb and flow of the stock market, one trend resurfaces the return of SPACs, or Special Purpose Acquisition Companies, to the NASDAQ exchange, signalling a shift in investor sentiment and a rekindling of interest in tech stocks.

The SPAC frenzy that gripped the market in 2021 feels like a distant memory now. These blank-check companies, offering a shortcut to public listing with minimal scrutiny, flooded the NASDAQ, propelling little-known entities to billion-dollar valuations almost overnight. However, the aftermath saw many of these firms grapple with plummeting stock prices, injecting volatility into the NASDAQ index.

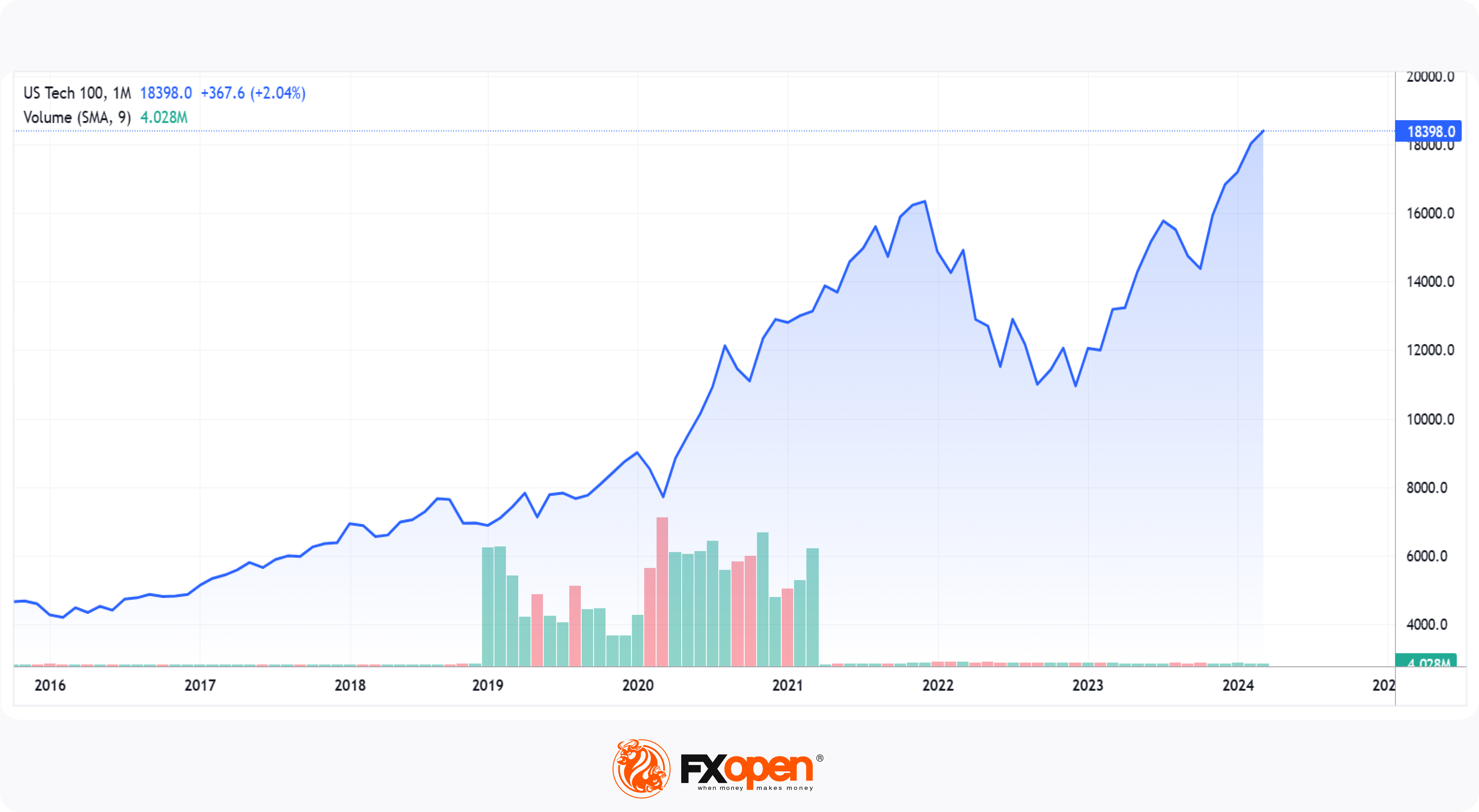

Today, the NASDAQ continues its upward trajectory, reaching 18,398 at 9:30 am UK time. This steady climb marks a rebound from the lows of late November when the index bottomed out at 14,127.

Adding fuel to NASDAQ’s rise is the public debut of Trump Media & Technology Group Corp., facilitated by Digital World Acquisition Corp., a SPAC founded on Monday. This merger thrusts Trump’s social media venture, Truth Social, into the limelight on the NASDAQ exchange, with an initial share price of $50 and a market capitalization of approximately $6.8 billion.

The acquisition symbolises a strategic manoeuvre, leveraging Digital World’s resources to bolster Trump Media’s presence in the competitive social media landscape. As Truth Social vies for space in the digital sphere, all eyes are on how this union will shape the fortunes of both companies.

Trump’s history of leveraging social media for political discourse adds an intriguing layer to this development. The combination of his ownership in a social media company and its listing via a SPAC raises questions about potential market volatility and long-term viability.

With the NASDAQ soaring and Digital World’s listing contributing to its ascent, the fate of Truth Social and its parent company becomes a compelling narrative in the ever-evolving stock market landscape. As investors weigh the risks and rewards, the saga of SPACs and tech stocks continues to unfold, offering both opportunities and challenges in equal measure.

FXOpen offers spreads from 0.0 pips and commissions from $1.50 per lot. Enjoy trading on MT4, MT5, TickTrader or TradingView trading platforms!

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Disclaimer: The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.