“With this new feature, we are expanding our product portfolio at once to offer our customers one of the most attractive investment and saving products in Germany.”

N26 has announced the introduction of a Stocks and ETFs trading product to the German market after having recently announced plans to increase the interest rate to 4% on Instant Savings for N26 Metal customers.

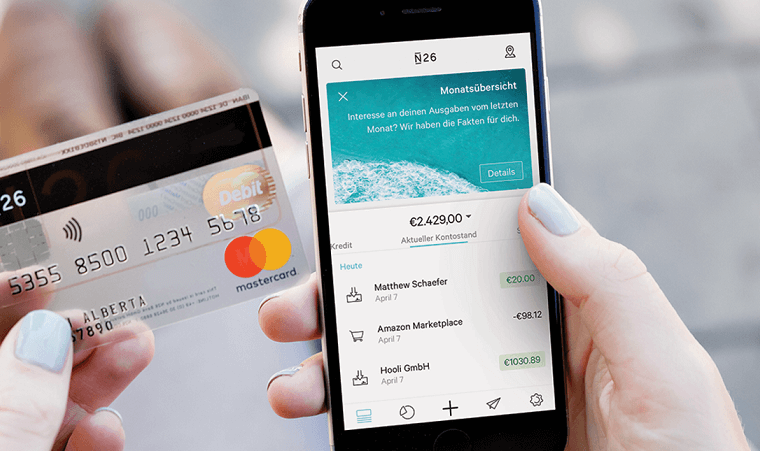

The moves constitute part of N26’s strategy to enhance its portfolio of savings and investment products as the company aims to integrate the management of investment portfolios, personal bank accounts, savings accounts, joint accounts, and crypto portfolios within the N26 app, as outlined in their press release.

“The most attractive investment and saving products in Germany”

Valentin Stalf, Founder and CEO at N26, said: “With this new feature, we are expanding our product portfolio at once to offer our customers one of the most attractive investment and saving products in Germany.”

According to the announcement, N26’s new offering seeks to address the low engagement in equity markets in Germany, where, based on data from the German Stock Institute (Deutsches Aktieninstitut) 2023, only about 17.6% of Germans over 14 invest in stocks, stock funds, or ETFs. N26’s initiative aims to make investing more accessible and straightforward for newcomers to the stock market.

The company’s press release details that the Stocks and ETFs trading product will enable customers to trade shares of popular European and US assets and invest in global ETFs. N26 plans to extend its trading options to include over a thousand stocks and ETFs in the future. A fixed trading fee of 0.90 EUR per transaction is highlighted as one of the market’s most competitive prices, eliminating commissions or custody fees.

N26 also communicated that its N26 You and N26 Metal membership holders would benefit from free trades as part of their subscription, with N26 You customers receiving up to 5 free transactions per month and N26 Metal customers up to 15. The company is also planning to introduce free recurring Investment Plans to allow all customers to engage in fee-free investing.

The increase in the Instant Savings interest rate for N26 Metal customers to 4% reflects the company’s commitment to offering attractive savings products, as per the announcement.

The phased rollout of the N26 Stocks and ETFs feature to eligible German customers over the coming weeks was also announced, indicating the company’s strategy to gradually introduce this service.

It was three weeks ago that N26 announced that customers in Austria, Belgium, Estonia, Finland, Greece, Ireland, Latvia, Lithuania, Luxembourg, the Netherlands, Portugal, Slovakia, and Slovenia would have the opportunity to earn up to 4% interest per annum on their savings – no deposit limits and no additional fees.

In addition to these benefits, N26 ensures that all funds, including those within the Instant Savings accounts, are safeguarded up to EUR 100,000 per customer through the German Deposit Protection Scheme.