Characterized by its reliance on algorithms and computer-driven trading, his vision of quantitative trading shifted the landscape of investment management and led the “quant revolution.”

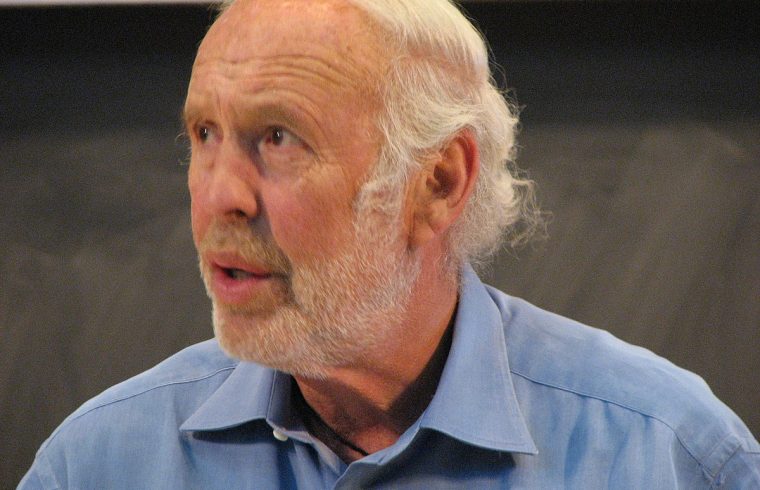

The trading and investment community is in mourning following the passing of Jim Simons, the brilliant mathematician and founder of Renaissance Technologies, on May 10.

Jim Simons, whose groundbreaking work in applying complex mathematical models to the financial markets revolutionized the industry, was 86. Before entering finance, Simons had a distinguished academic career, contributing significantly to the field of mathematics, particularly in geometry and topology.

Jim Simons founded Renaissance Technologies in 1982

In 1982, he founded Renaissance Technologies and launched what would become one of the most successful hedge funds in history, the Medallion Fund. Under his leadership, Renaissance Technologies pioneered the use of quantitative data models leveraging patterns and statistical probabilities to predict market movements.

At the core of Simons’ strategy is the intensive use of data. His team collected extensive historical data on price movements, trading volumes, and other market variables. They then designed algorithms to analyze this data, searching for patterns and correlations that could predict future market movements. This method, known as algorithmic trading, automates the decision-making process in trading activities, allowing for high-speed and high-volume trading that can capitalize on small price fluctuations.

Jim Simons famously applied a variety of mathematical models that, while shrouded in secrecy, are known to involve advanced statistics, probability theory, and pattern recognition. Statistical Arbitrage involves complex algorithms designed to find and exploit price inefficiencies between related financial instruments, predicting when and how these prices will converge. The strategy relies heavily on probability and statistical tools to identify short-lived arbitrage opportunities that can be capitalized on.

Pattern Recognition also plays a critical role. Here, Renaissance’s models scan vast datasets to detect meaningful patterns and trends. These could include price movements, trading volumes, or changes in market indicators.

Characterized by its reliance on algorithms and computer-driven trading, his vision of quantitative trading shifted the landscape of investment management and led the “quant revolution.” The Medallion Fund consistently outperformed market benchmarks and other investment strategies by a significant margin, delivering average annual returns of over 66% before fees.

Beyond his professional achievements, Simons was also known for his philanthropy, particularly in scientific research and education. Through the Simons Foundation, he contributed hundreds of millions to various causes, supporting the next generation of scientists and mathematicians.

The loss of Jim Simons is felt deeply across the trading and financial sectors. His legacy, marked by a fusion of scientific rigor and investment acumen, continues to influence the industry.