For over six decades, Japan’s blend of conservative business practices and engineering prowess has propelled it to global prominence.

From electronics to automobiles, Japanese corporations have captivated markets worldwide, their names reverberating across continents. Yet, despite this commercial triumph, Japan’s economic landscape hasn’t always mirrored its corporate success.

In the 1980s, Japanese stocks stood as the epitome of economic achievement. However, with the emergence of Silicon Valley tech giants in the internet age, Japan’s indices faded from the limelight. Traditional heavy manufacturing and property development firms lost ground to internet-based behemoths, reshaping investor focus.

Diverging from Western economic policies, Japanese central bankers pursued unconventional tactics, like maintaining a negative interest rate to stimulate spending. However, last week marked a turning point as Japan raised its interest rate to zero after 17 years of stagnation, yielding little effect.

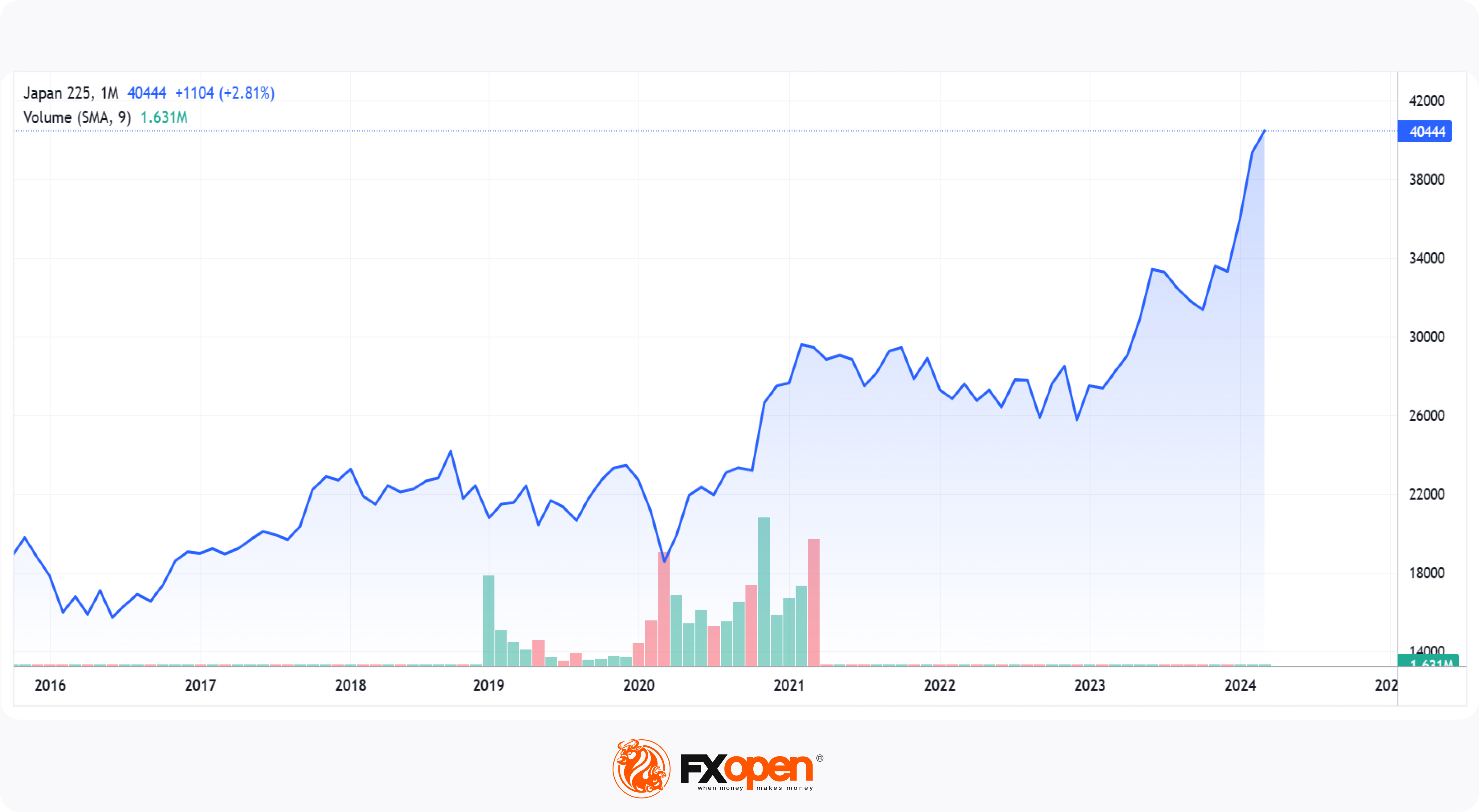

Interestingly, abandoning attempts to invigorate the economy triggered an unexpected outcome. The Nikkei 225 index, tracking Tokyo Stock Exchange’s premier stocks, surged, becoming the top mover on FXOpen, breaching the 40,000 mark for the first time since the 1980s.

Initially established in 1950, the Nikkei 225’s ascent above 40,000 in February brought it back into Western view, surpassing its 1989 peak. Today, the index continues its rapid ascent, albeit with occasional volatility, such as the 292-point drop during the recent Asian market session.

The question now looms: will Japan’s stocks maintain their upward trajectory above 40,000, defying the nation’s stagnant economy, or will they regress? The path ahead remains uncertain, teetering between continued ascent and potential decline.

FXOpen offers spreads from 0.0 pips and commissions from $1.50 per lot. Enjoy trading on MT4, MT5, TickTrader or TradingView trading platforms!

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Disclaimer: The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.