Asian indices finished higher today as the China-U.S. trade dispute continues, with few signs a deal will be reached in the near-term. The Nikkei225 finished 0.37 percent higher to 21,260 the Hang Seng benchmark in Hong Kong finished 0.22 percent higher at 27,351. The Shanghai Composite finished 0.17 percent lower to 2,888 below the 100-day MA, while in Singapore the FTSE Straits Times index finished flat to 3,167. Australian equities rebounded on Tuesday, breaking a three-session slump. The market was boosted by gains in the Materials, Energy, Financial, IT and Telco sectors which outweighed weakness from utilities and property stocks. The ASX 200 (XJO) closed up 32 points or 0.5% to 6,484.

European session started lower today following news that EU is preparing to launch EDP against Italy in June, the DAX30 is 0.43 percent lower to 12,018 and CAC40 is 0.36 percent lower at 5,316 while the FTSE MIB in Milan is trading 0.98 percent lower at 20,163. The London Stock Exchange is adding 0.09 percent to 7,284 as traders return to desks today after the EU elections.

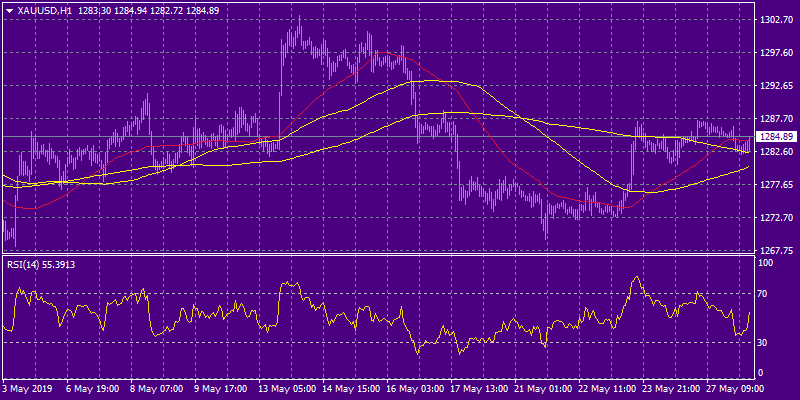

In commodities markets, crude oil consolidates to 58.80 after American Petroleum Institute data showed that U.S. crude stockpiles rose unexpectedly the previous week. Brent oil trades higher at $69,80 per barrel as major oil producers have yet to agree on adjustments on output. Gold started softly at the European session around 1283 zone. The precious metal is trading between 50 and 200-hour moving average turning the technical picture to neutral. Gold will find support at 1272 the low from the previous week while more bids will emerge at the 200-day moving average at 1255, on the upside resistance stands at 1296 the 100-day moving average.

In cryptocurrencies market, bitcoin (BTCUSD) continues the rally above 8,700, the daily low for BTC was at 8,644 and the daily high at 8,845. Immediate support for BTC stands now at $8,000 round figure, on the upside strong resistance stands at 8,845 the recent high. Ethereum (ETHUSD) also trades higher to 269, on the upside the immediate resistance stands at 273 the high during Asian session while the support stands at 263 and the 50 hour SMA, Litecoin (LTCUSD) also trades higher at 113.80. The crypto market cap holds above $175.0B.

On the Lookout: Iron ore price jumped by 4.2% to a five-year high of US$108 a tonne on supply concerns and a fall in stockpiles in China.

In Australia the weekly ANZ-Roy Morgan consumer confidence rating rose by 1.2% to 118.6 points, boosted by expectations the Reserve Bank will cut the cash rate next Tuesday to 1.25%.

In the America economic calendar, we await the US S&P/Case Shiller home price index is due to be released, along with consumer confidence and the Dallas Federal Reserve manufacturing index.

Trading Perspective: In fx markets, the US dollar trades flat to 97.65, The Aussie dollar trades higher at 0.6920 supported by better Australian consumer confidence data and the rally in iron ore prices. Kiwi also trades higher at 0.6550 level.

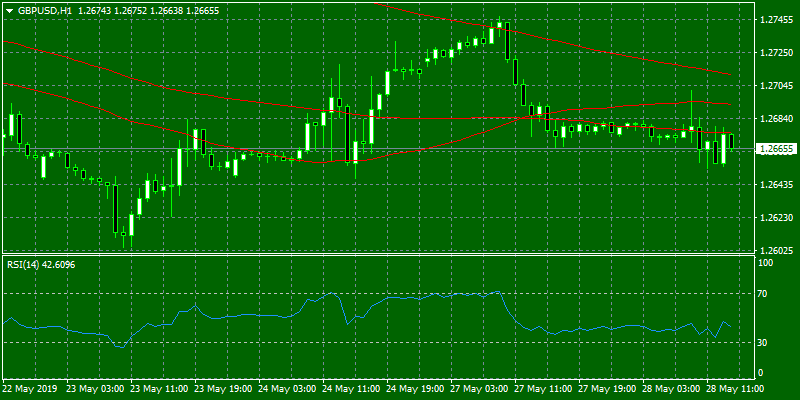

GBPUSD trades 0.17 percent lower to 1.2659 as the bearish momentum for Cable is still intact amid growing concerns over Brexit. The pair hit the daily low at 1.2653 and the daily high at 1.2701. On the upside immediate resistance now stands at 1.27 the high from Asian session while more sellers will emerge at the 200-hour moving average at 1.2713. Sterling shows persistent weakness amid UK political uncertainty and also on the back of risk aversion.

EURUSD also started 0.04 percent lower today to 1.1186 on trade tensions, patient Fed, German macro weakness, and EU elections. The pair managed to rebound fast from the lows during the previous week and breached all major hourly moving averages giving bulls the upper hand for the short term. On the upside, the immediate resistance stands at 1.12 the high from Asian session, while more offers will emerge at 1.1245 the 50-day moving average.

USDJPY is the loser of the day as the pair gives up 0.231 percent to 109.30 amid USD weakness across the board. Today the pair hit the low at 109.24 and the high at 109.62. The pair will find support at 109.20 Friday low, on the upside immediate resistance for the pair now stands at 110 and then at 110.54 the 100-day moving.

USDCAD trades at 1.3453 in the middle of the recent trading range. The pair will find immediate support at the 50-day moving average around 1.3392 while extra support stands at 1.3300 round figure. On the upside, immediate resistance stands at the 1.35 zone.