While USD gained following less dovish than expected FOMC statement, investors fears of curve inversion in T.Yields inspired risk off sentiment in equity markets which was further supported by dovish comments from Fed members in post FOMC conference.

While USD gained following less dovish than expected FOMC statement, investors fears of curve inversion in T.Yields inspired risk off sentiment in equity markets which was further supported by dovish comments from Fed members in post FOMC conference.

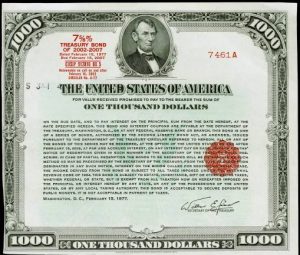

Summary: World equity markets slumped on Thursday after the U.S. Federal Reserve dashed investor hopes of a more dovish policy outlook even as signs grow that global economic growth is stuttering. Jitters over the Fed’s move to largely keep guidance for additional hikes over the next two years spread from Asia to Europe, where major indexes fell to their lowest in two years and investors headed for the relative safety of government debt bonds. The Fed raised key overnight lending rate rates by 0.25 percent point as expected to a range of 2.25 percent to 2.50 percent but what stock investors fears was forward guidance which hinted at two rate hikes in time of economic recession in both US and global markets. Investors believe Fed’s decision will call spread between the 10-year and two-year Treasury yield to drop sharply renewing fears of curve inversion from recent past which is clearly interpreted as sign of slowdown in economic growth.

EUR/USD: EUR/USD extends its gains, hitting the highest since early November, as US yields fall. Markets are having second thoughts about the Fed decision as it was relatively hawkish despite global economic slowdown and well in contrast to investor’s expectations of pause in rate hike. Meanwhile Euro also gains support from broad based dollar sellf off and favourable developments in regards to Italian budget crisis.

USD/JPY: The pair extends steep fall into fifth straight day and was down nearly 0.7% in early Thursday’s trading, following little benefit for the dollar on more hawkish than expected Fed on Wednesday. The greenback came under fresh pressure after brief post-Fed pause on growing risk-off mode on heightening global risks and decision from BoJ to keep ultra-low interest rates, but showed readiness to boost its massive stimulus program if the situation deteriorates.

AUD/USD: The AUD/USD pair quickly reversed Aussie jobs data-led uptick to an intraday high level of 0.7126 and dropped to fresh seven-week lows in early European market hours. Adding to this, a fresh wave of global risk-aversion trade, triggered by the post-Fed selloff in the US equity markets, further drove flows away from perceived riskier currencies, including the Australian Dollar, and collaborated to the ongoing slide. The ongoing price action suggests that the pair seems all set to revisit yearly lows amid absence of relevant market moving economic releases from the US.

On the Lookout: Now that most anticipated event of the week is over, investors continue to look for short term oppurtunities in news filled week ahead. Investors focus has shifted to Sino-U.S. trade negotiatons as tension between the two parties seems to be on see-saw motion ahead of planned meet during January in which both parties expect to make solid progress. Investors are also focus on crude oil price action which continues to decline sharply amid escalting production and inventory data (currently near record highs) which hints at continued glut scenario which is likely to outweigh impact of supply cut planned by OPEC from January 2019 amid decrease in demand for crude oil owing to slowdown in economic growth in key markets across globe. Investors are also focused on update from BOE’s MPC vote for hints on how they plan to deal with ongoing economic crisis as current scenario hints at no-deal outcome.

Trading Perspective: Thursday’s European and American session has multiple first and second tier data from UK, US and Canada which are expected to keep volatility high for reminder of today’s trading session.

EUR/USD: The pair is currently trading positive as pair is riding wave of USD sell-off on post FOMC meet reaction which saw comments from Fed members hint at slowdown in economy despite hawkish forward guidance. Investors are now on lookout for UK MPC meet in which the central bank is expected to key rates constant owing to clouded future outlook on brexit uncertainites. But better than expected UK readings provide positive influence to EURO bulls. Traders will also gain short term opportunities in NA session which sees the release of Philadelphia Fed’s Manufacturing Index and employment data. The pair has breached mid 1.14 handle hinting at price action in favor common currency across the day.

GBP/USD: The Cable is trading positive despite Fed surprise which showed limited negative impact as post FOMC market reaction was bearish interpretation for US Greenback On top of it, Sterling is supported by unexpectedly strong UK retail sales that rose 1.4% over the month in November with core UK retail sales stripping the consumer basket off motor fuel prices rising 1.2% m/m. The Bank of England is scheduled for noon in London with no rate changes expected and but members are expected to express caution owing to clouded future outlook on brexit uncertainties. While technical indicators paint a positive picture for GBP, the pair is likely to resume bearish price action following BOE MPC update as long term outlook remains bearish owing to PM Theresa May facing another No-Confidence vote in January caused by her intentional sabotage tactics.

GBP/USD: The Cable is trading positive despite Fed surprise which showed limited negative impact as post FOMC market reaction was bearish interpretation for US Greenback On top of it, Sterling is supported by unexpectedly strong UK retail sales that rose 1.4% over the month in November with core UK retail sales stripping the consumer basket off motor fuel prices rising 1.2% m/m. The Bank of England is scheduled for noon in London with no rate changes expected and but members are expected to express caution owing to clouded future outlook on brexit uncertainties. While technical indicators paint a positive picture for GBP, the pair is likely to resume bearish price action following BOE MPC update as long term outlook remains bearish owing to PM Theresa May facing another No-Confidence vote in January caused by her intentional sabotage tactics.

USD/CAD: The USD/CAD pair held within striking distance of over 18-month tops, albeit seemed struggling to build on the momentum further beyond the key 1.3500 psychological mark. USD retains positive price action owing to yesterday’s softer than expected Canadian inflation figures and a sudden fall in crude oil prices but Greenback failed to gain upper hand on bearish influence surrounding USD over post FOMC comments from US Fed members. Canadian market will see release of wholesale Sales data which will provide some bullish influence to Loonie in NA session but downside is likely to be capped despite broad based USD weakness owing to bearish rout in crude oil market.