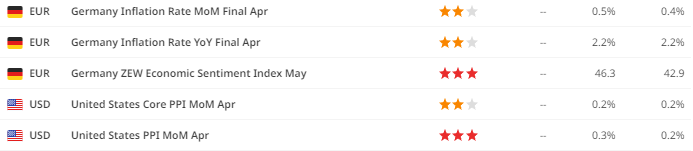

Today holds significant importance for both Germany and the USA as they prepare to unveil pivotal economic data.

Germany is poised to release the Consumer Price Index (CPI), while the USA will disclose the Producer Price Index (PPI). These unveilings serve as crucial indicators of each nation’s inflationary trajectory. The CPI, focused on consumer prices, directly influences individuals, while the PPI, reflecting producer costs, holds sway over businesses. Despite their distinct focuses, both indices offer valuable insights into the evolving landscape of inflation.

Economic Calander

For those who might have missed it, I provided a comprehensive overview of the week’s upcoming events in yesterday’s article. You can catch up on all the details by following this link: https://acy.com.au/en/market-news/market-analysis/natural-gas-outlook-for-major-players-during-the-usa-election-l-s-112806/. Staying well-informed is paramount as you embark on the new week. Now, what can we expect from the German CPI and the USA PPI?

In recent weeks, the trajectory of the US dollar has been on a downward slope. After reaching a peak on April 16th at 106.52, the dollar index has undergone a slight correction, dipping just over 1.0% and stabilizing around the 105.00 mark. This decline has contributed to reduced volatility in G10 FX markets, thereby favouring FX carry trades.

USDIndex

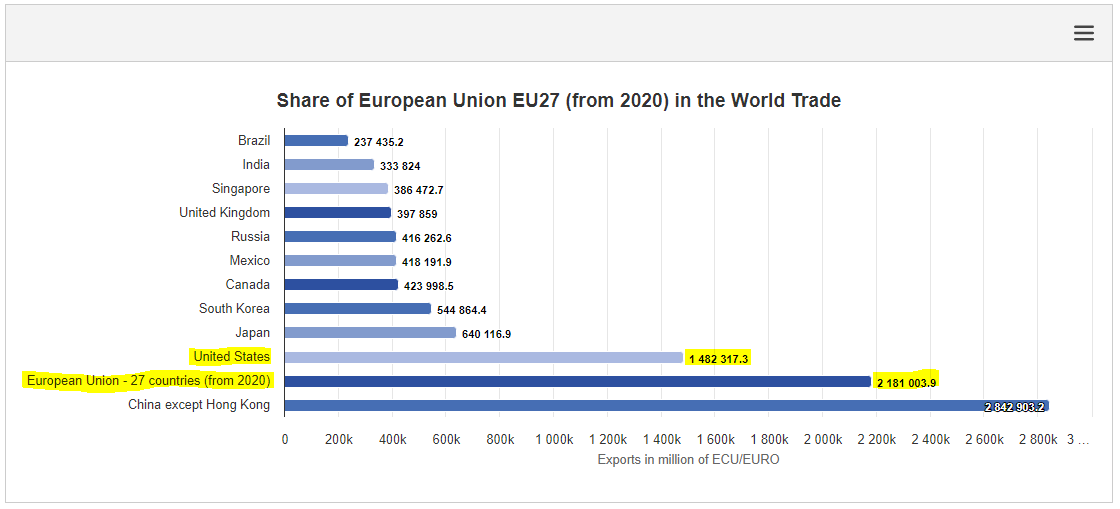

One significant factor behind the dollar’s loss of momentum is the evident economic growth outside the United States since the year commenced. Europe has witnessed a noteworthy economic resurgence, with the euro-zone expanding by 0.3%Q/Q in Q1, marking its fastest quarterly growth since Q2 2022. Similarly, the UK economy surpassed expectations by exiting a technical recession in Q1, expanding by 0.6%Q/Q. Projections indicate this growth trajectory may persist into the middle of the year, albeit with some moderation expected in the UK during Q2. China’s economy has also displayed signs of improvement, expanding by 1.6%Q/Q in Q1.

Conversely, recent indicators hint at a potential slowdown in the US economy. Growth tapered to an annualized rate of 1.6% in Q1, following robust but unsustainable growth of 4.1% in the latter half of the preceding year. Moreover, recent economic data for the early stages of Q2 has been lacklustre, with the Citi US Economic Surprise Index slipping into negative territory.

Europe Growth x USA

The probability of a more pronounced decline in the US dollar in the forthcoming months increases if tangible evidence aligns with the softer survey data indicating weaker US growth. Market reactions following the release of April’s nonfarm payrolls report and last week’s initial claims underscore concerns about sustaining previous employment growth levels. A significant deceleration in employment growth would bolster forecasts for the Federal Reserve to implement multiple rate cuts in the latter part of the year.

Looking ahead, the primary challenge to the notion that US rates and the USD are at their peak lies in the release of April’s US inflation reports. Consistent upside surprises in inflation are imperative to rekindle upward momentum in US rates and the USD in the short term. Conversely, in-line or softer inflation prints could prompt further retracement of the gains made by the USD since the year began.

In summary, while there exists a disparity in monetary policy between the Fed and European central banks, with the latter contemplating earlier rate cuts, caution is advised regarding the further appreciation of the US dollar. Confirmation that US yields and the USD have peaked remains eagerly anticipated.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.