On September 30, 2019, the International Monetary Fund (IMF) released the results of the tenth annual Financial Access Survey (FAS). The FAS is a unique supply-side dataset that enables policymakers to measure and monitor financial inclusion and benchmark progress against peers. The dataset covers 189 jurisdictions with more than 150 indicators on financial access and use with historical data from 2004.

2019 marks the tenth anniversary of the Financial Access Survey

The FAS was launched in 2009 and has evolved over time to adapt to the changing landscape of financial services, including the rise of fintech and growing demand for more granular data. Key enhancements include introducing country-level data on mobile money in 2014, adopting gender statistics in the FAS questionnaire in 2018, and expanding FAS’s coverage of innovations in traditional banking services, including branchless banking and debit and credit cards in circulation.

Given near global coverage, two FAS indicators— number of commercial bank branches per 100,000 adults and number of automated teller machines (ATMs) per 100,000 adults—have been adopted to monitor Target 8.10 of the 2030 UN Sustainable Development Goals (SDGs). To improve data collection on other indicators and encourage peer learning on data collection, FAS regional workshops were started in 2018. Two regional workshops, in Thailand and Mauritius, have been conducted so far.

The 2019 FAS introduces new data series on mobile and internet banking and gender statistics for deposit-taking microfinance institutions, given the digital transformation in finance and growing importance of micro-savings for women’s financial inclusion. The current round of FAS has also improved reporting on some existing data series. The number of countries reporting mobile money data increased from 66 last year to 71, and those reporting data disaggregated by gender increased from 35 to 47. The 10th anniversary edition of FAS Trends and Developments illustrates what the latest FAS data covers: (i) mobile money; (ii) traditional banking; (iii) use of financial services by women; and (iv) credit to SMEs.

Mobile money boom continues

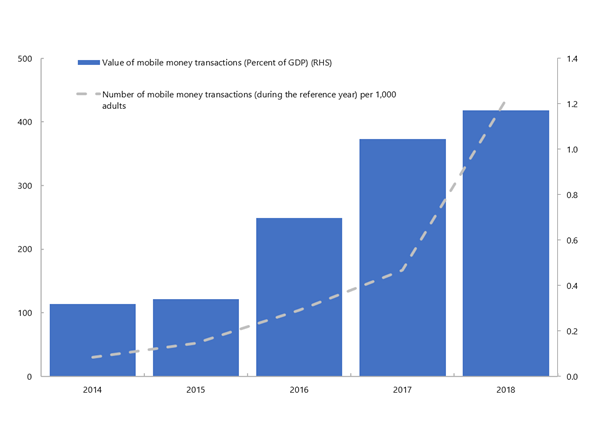

Mobile money has a profound impact on financial inclusion, particularly in countries without deep banking penetration. In Afghanistan, where less than 200 out of 1,000 adults have bank accounts, but more than 80 percent of the population has access to a cellular phone, mobile money access is slowly picking up. Data from the FAS—the sole source for country-level data on mobile money—suggests that in the past five years, the value of mobile money transactions has grown fourfold in Afghanistan to reach 1.2 percent of GDP in 2018.

Mobile money: Creating easier access to financial services in Afghanistan

Sources: Financial Access Survey, World Development Indicators database, and IMF staff calculations.

Regions with a large mobile money footprint, such as Sub-Saharan Africa, have started leveraging the base of mobile money users to make inroads into traditional banking. An example is the M-Shwari account launched jointly by the Commercial Bank of Africa and Safaricom in Kenya, which offers savings and credit facilities that can be accessed entire through M-PESA, the mobile money platform.

Traditional banking is changing: The rise of mobile and internet banking

FAS data suggests that the muted growth in the number of commercial bank branches globally may be a result of the decline in the number of commercial bank branches in advanced economies of North America and Europe. This is indicative of a move towards a different mode of accessing financial services¾mobile and internet banking. Growth in mobile and internet banking is, however, not limited to high income countries. For example, in Mongolia, the volume of mobile and internet banking transactions increased fourfold between 2015 and 2018.

Gender gap persists in use of financial services in low- and lower middle-income countries

FAS data suggests that disparities persist in the use of financial services between men and women, especially in low- and lower middle-income countries. Studies suggest that one of the underlying reasons for women’s financial exclusion can be discriminatory laws, highlighting the importance of regulatory reforms and women-oriented policies.

Bank financing of small and medium-sized enterprises (SME) remains subdued in many low and middle-income countries

FAS 2019 suggests that bank lending to SMEs has remained stagnant at around 6 percent of GDP over the past five years. However, there are large cross-country variations in the growth of SME lending. Improvements in SME financing in countries like Georgia, Mongolia and Fiji may in part be due to effective and targeted SME policies as well as interventions in partnership with international development agencies.