Today, Norges Bank Investment Management has published extended information on the return and risk of the Government Pension Fund Global.

The main purpose of this publication is to give an overview of the fund’s return and risk with a focus on equities and fixed income.

The publication presents our main investment strategies and includes return, risk estimates and costs data for them individually. We have added a section on the consequences of changing asset correlations, as well as one on equity sector risk characteristics across time horizons. As the fund approaches a strategic equity weight of 70 percent, variables such as country and sector composition within equities will have an increasing impact on the long-term risk characteristics.

We distinguish between actual risk and relative risk in this publication. We also present risk adjustments using different metrics. These exercises are not meant to give conclusive answers, but to provide additional insights into our results.

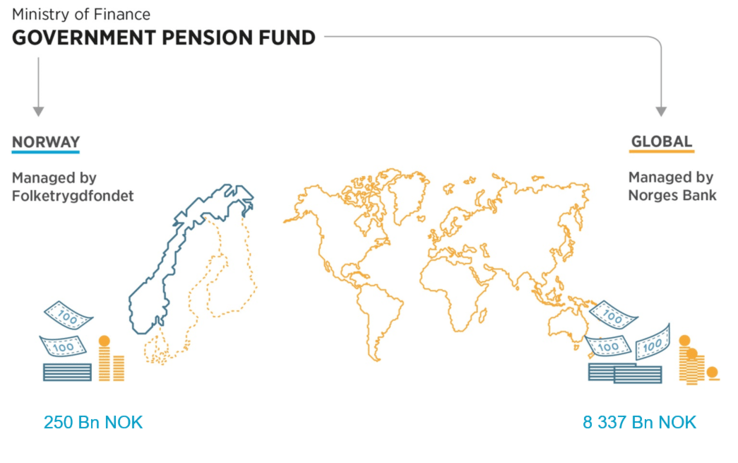

Norges Bank Investment Management manages the fund on behalf of the Ministry of Finance, which owns the fund on behalf of the Norwegian people. Government Pension Fund Global is a sovereign wealth fund of Government of Norway. The ministry determines the fund’s investment strategy, following advice from among others Norges Bank Investment Management and discussions in Parliament. or its equity investments, the fund invests in the diversified sectors. For its fixed income investments, it invests in Government and corporate bonds including the debt issued by companies as well as covered bonds, and debt issued by banks that are secured by a portfolio of mortgage loans. For real estate, the fund focuses on European markets, with a mandate to invest outside as well. The management mandate defines the investment universe and the fund’s strategic reference index. Hence , It invests in the public equity, fixed income, private equity, infrastructure, and real estate markets across the globe.

The Ministry of Finance has on a regular basis transferred capital to the fund from the Norwegian state’s petroleum revenues. The fund’s capital is invested abroad, to avoid overheating the Norwegian economy and to shield it from the effects of oil price fluctuations. The fund invests in international equity and fixed-income markets and real estate. The fund is invested in most markets, countries and currencies to achieve broad exposure to global economic growth.

The investments are to produce a high long-term return. We aim to achieve this this with an acceptable level of risk, as a responsible investor and through an efficient organisation.