Headlines from weekend have caused investor sentiment across all major global markets to take on risk averse tone. Both Brexit and Sino-U.S. trade talks are seeing multi-party talks fall due to actions of single key person. Investors now await further headlines before placing major bets causing markets to bleed.

Headlines from weekend have caused investor sentiment across all major global markets to take on risk averse tone. Both Brexit and Sino-U.S. trade talks are seeing multi-party talks fall due to actions of single key person. Investors now await further headlines before placing major bets causing markets to bleed.

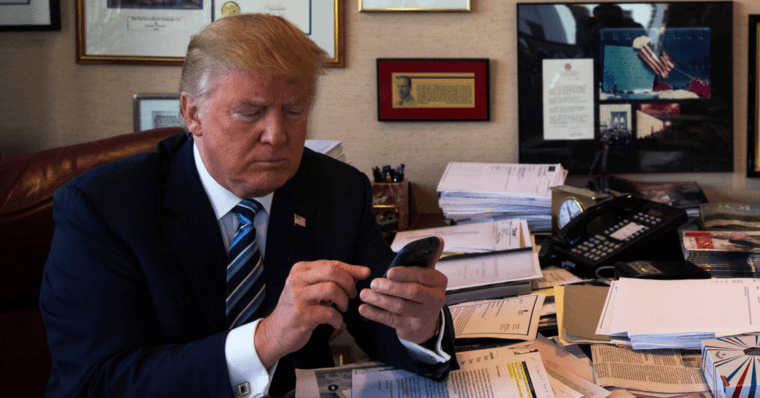

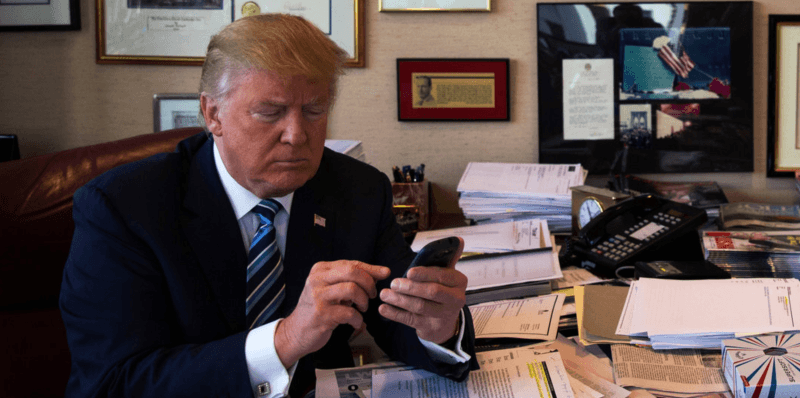

Equities in Asian and European markets are bleeding today as Trump Tantrums induced rally. Just as things were looking rosy and headlines was hinting that trade talks between China and U.S. entering last legs with hopes for trade deal between two nations, tweets from US President Donald Trump derails all progress made in bi-lateral talks over last couple of months. Trump tweeted on Sunday that talks were proceeding too slowly and that he is raising tariffs on $200 billion worth goods from 10% to 25% coming Friday which will then be followed by new round of tariffs targeting another $325 billion worth of Chinese goods shortly. This has caused investor sentiment to take on risk averse stance with major markets across globe seeing loss worth hundreds of millions. This trade war has been a thorn in making for global economy having caused loss with several billion dollars to US & China while also causing impact on other trade dependent major global economy leading to worldwide economic meltdown. China has responded that it is considering cancelling trade talks planned for the week in response to Trump’s tweets. However, Forex market is seeing relatively positive activity when compared to major equity benchmarks in both Asian and European markets.

Precious Metals: Both gold and silver are seeing solid bullish price action in the global market. Other major metals are also seeing positive price action as demand for safe haven assets spiked in the global market in response to Trump’s tweets which has burst open concerns relating to trade war between China and U.S. Risk Appetite dampened in market on trade war related concerns sustaining demand for precious metals.

Crude Oil: Crude oil price is on steady decline today as concerns surrounding Sino-U.S. trade war spiked in global market once again following US President Trump’s tweets. An escalation in trade tensions is likely to impact global economy slowing down business growth which is bad for crude consumption. This has caused crude oil price to slide to six week lows hitting an intra-day lows of $60.09 per barrel post which it has rebound back above $61 handle per barrel on support from OPEC enforced supply cut agreement.

USD/JPY: As fresh wave of risk averse investor sentiment rides global market influenced by US President Donald Trump’s tweets, Japanese Yen gains momentum on resultant safe haven demand. This has caused the pair to hit new 5 week lows hitting an intra-day low at 110.28 post which the pair has rebound from lows but remains range bound well near mid 110 handle. Traders now await further headlines on Sino-U.S. trade talks for directional cues and confirmation from China on cancellation of this week’s upcoming trade talks could push the pair to new monthly lows.

On The Lookout: Amid a week ahead with relatively light macro calendar schedule, traders focus on geo-political event related headlines for directional cues. Headlines from weekend caused all positive sentiment surrounding both Brexit and Sino-U.S. trade talks to evaporate from market leaving risk averse trading activity in the global market. While traders await China’s response to Trump’s tweets and look to see if China will cancel or attend the upcoming talks with US, Brexit is also seeing all proceedings get washed away into drains. Headlines last week reported that cross party talk are progressing smoothly and a Brexit deal is likely, but post UK PM Theresa May’s decision to leak confidential details from discussions to public and media both parties are back at odds once again. With UK elections coming ahead and resolving situation before that being the only possible way to avoid hard Brexit, headlines hinted that UK PM Theresa May has began considering Second Brexit Referendum scenario. Moving forward, headlines from UK, US and China are likely to drive price action during the week ahead as decisions pertaining to trade talks are likely to greatly affect global economic activity. On the release front, US calendar lacks major impact updates while there are several central bank members speeches which are viewed as second tier releases and unlikely to have any major impact unless they comment on change in Fed’s stance in rate cut/hike decisions given current scenario between China and U.S.

On The Lookout: Amid a week ahead with relatively light macro calendar schedule, traders focus on geo-political event related headlines for directional cues. Headlines from weekend caused all positive sentiment surrounding both Brexit and Sino-U.S. trade talks to evaporate from market leaving risk averse trading activity in the global market. While traders await China’s response to Trump’s tweets and look to see if China will cancel or attend the upcoming talks with US, Brexit is also seeing all proceedings get washed away into drains. Headlines last week reported that cross party talk are progressing smoothly and a Brexit deal is likely, but post UK PM Theresa May’s decision to leak confidential details from discussions to public and media both parties are back at odds once again. With UK elections coming ahead and resolving situation before that being the only possible way to avoid hard Brexit, headlines hinted that UK PM Theresa May has began considering Second Brexit Referendum scenario. Moving forward, headlines from UK, US and China are likely to drive price action during the week ahead as decisions pertaining to trade talks are likely to greatly affect global economic activity. On the release front, US calendar lacks major impact updates while there are several central bank members speeches which are viewed as second tier releases and unlikely to have any major impact unless they comment on change in Fed’s stance in rate cut/hike decisions given current scenario between China and U.S.

Trading Perspective: US Wall Street is likely to see its major benchmark indices and equities bleed as trade war concerns weigh on investor sentiment creating a risk averse trading environment. But the impact of same in US market could be lower compared to global markets as US traders got fed up on lack of progress in trade talks and repeated tailored press updates giving them some space to expect fail in trade talks between two parties.

EUR/USD: Despite opening with a gap down move and tensions surrounding Sino-U.S. trade talks and Brexit taking a negative turn, the price action in EURUSD pair is seeing relatively limited declines. EURO has already reached the cusp of downside price move and needs a major shove to take it below critical support level at 1.1111 handle. Further, better than expected Euro area macro data updates also provided some strength to common currency bulls resulting in the pair trading with range bound momentum. Traders await further updates relating to geo-political events for directional cues and short term profit opportunities.

GBP/USD: The GBP/USD pair is seeing steady downside price action across Asian and European market hours. But the declines are limited as trading volume is relatively low compared to other major forex pairs and global currencies on account of holiday in UK market. UK market is closed on account of early may bank holiday, further risk averse investor sentiment in the global market is also adding pressure to GBP bulls in the market. This has resulted in the pair trading range bound with slight bearish bias across European market hours. Traders await further updates relating to geo-political events for directional cues and short term profit opportunities.

USD/CAD: While the pair closed last week with sharp downside move on account of positive crude oil price in the global market, the pair has since erased all losses and is trading with positive bias in the global market today. Headlines from weekend caused global market to open with a bearish bias as tensions between China and U.S. rose to new highs threatening to dissolve all progress made so far. Possibility of failing trade talks caused crude oil price to decline to multi-week highs adding pressure to commodity linked currency. This caused the pair to trade with solid positive bias scaling further gains post gap up opening at the start of the day. Traders await further updates relating to geo-political events and macro data updates for directional cues and short term profit opportunities.