Yesterday saw the release of crucial inflation data in the United States. Despite the values aligning with expectations, it triggered a notable surge in volatility across financial markets.

Monthly CPI figures stood at 0.4%, aligning with forecasts and maintaining stability compared to previous month (0.3%) and last year (0.4%).

Today’s announcement regarding UK GDP for the month also met expectations, with a reported increase of 0.2%, recovering from the previous month’s dip of 0.1%.

Notably, despite initial downward pressure on GBP/USD following these announcements, subsequent recoveries underscored the enduring demand stability.

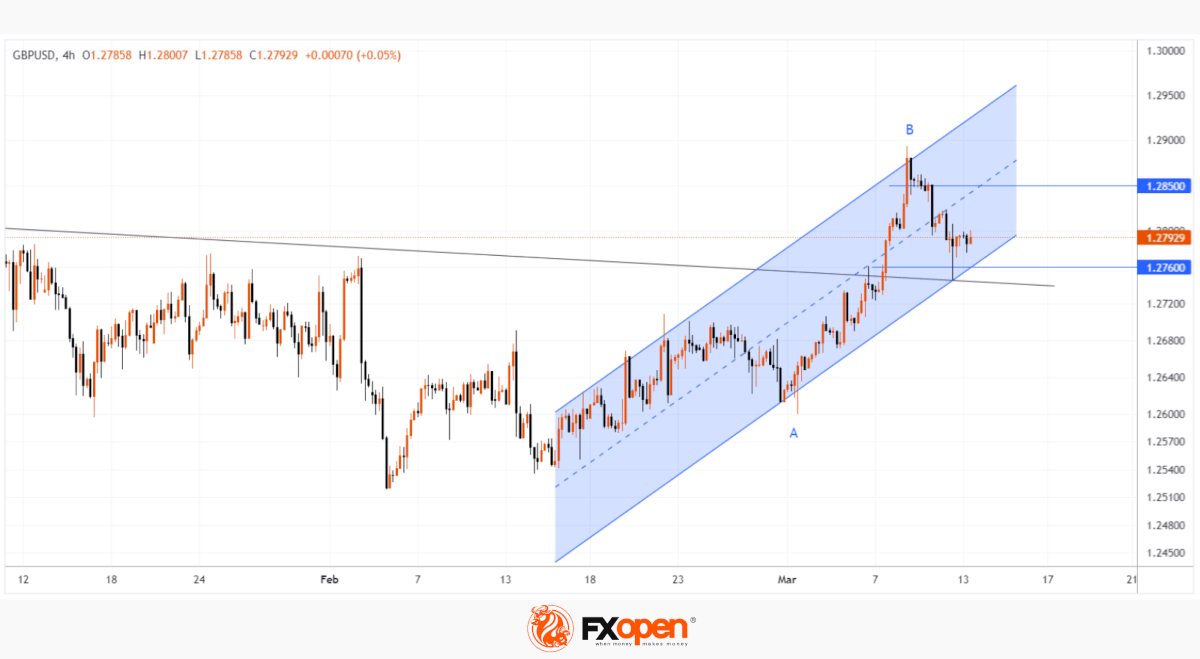

According to technical analysis, the GBP/USD chart reveals significant support around the 1.276 mark, evidenced by:

→ The lower boundary of the ascending channel (depicted in blue).

→ The 50% Fibonacci retracement level from impulse A→B.

→ The black long-term trend line, previously a resistance, now acting as support post-breakout on March 7.

Can the bullish momentum resume within the blue channel?

Even in pursuit of this scenario, the GBP/USD chart indicates potential challenges:

→ Potential encounters with bearish pressure, as observed in sharp price declines from top B.

→ Resistance may manifest around the 1.285 level, previously serving as local support on March 10-11, where the median line of the blue ascending channel currently resides.

FXOpen offers spreads from 0.0 pips and commissions from $1.50 per lot. Enjoy trading on MT4, MT5, TickTrader or TradingView trading platforms!

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Disclaimer: The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.