Video games are no longer just a popular pastime. With the emergence of blockchain and Web3 technologies, they are transforming into a lucrative endeavor that can provide significant financial rewards to the most successful players. We’re talking about an entirely new segment within the video games industry, popularly known as “GameFi”.

GameFi refers to a breed of games that integrate with blockchain and use innovations such as non-fungible tokens or NFTs to ensure players can actually own in-game assets. With games like Axie Infinity, Splinterlands, and Upland, users can earn rewards each day that are paid out in cryptocurrency, and the NFTs themselves can have substantial value, and be bought and sold for crypto through decentralized marketplaces. In GameFi, NFTs typically represent game characters, weapons, and other useful items that help players to win greater rewards.

The Value In GameFi

The core idea behind GameFi is that players can earn crypto tokens for racking up achievements, beating other players or completing certain challenges within games. It has given birth to the concept of “play-to-earn”, where gamers can generate a substantial income simply by playing each day. This concept first hit the headlines during the COVID-19 pandemic, when media reports revealed that some players of the hit game Axie Infinity were earning over $1,000 per month.

The play-to-earn model generally requires players to make an initial investment in a game, using crypto to purchase or rent an NFT character that allows them to access its virtual world and start earning rewards. It’s entirely different from traditional games, where players only play for enjoyment.

While the rewards are fairly straightforward, more recent innovations in GameFi have seen some titles integrate decentralized finance, or DeFi, mechanisms. In the open-world exploration game Illuvium, for example, players not only earn rewards from playing the game but also generate a passive income via activities such as liquidity mining, yield farming, and staking, similar to how protocols like Curve and Aave work.

GameFi’s Decline

GameFi first made a splash back in 2020/2021 during the pandemic, when it emerged to give people an alternative income stream while being locked down at home. However, when the wider crypto industry suffered a downturn that began in late 2021, the value of most GameFi tokens plummeted.

The long-running crypto winter that ensued exposed the weaknesses of many GameFi tokens’ tokenomics, and demonstrated that not all of them are viable in the long term. For instance, games like Stepn, which pioneered the walk-to-earn concept, have been criticized for being dependent on the platform’s ability to keep signing up new users, which is not sustainable over the long term. In addition, some of the best-known play-to-earn games suffered from scandals, such as when hackers attacked Axie Infinity’s Ronin Network and made off with more than $600 million worth of crypto. That caused a big decrease in the price of its native AXS token.

X user @ginoa_io illustrated just how far the sector had fallen in a January 2023 tweet, with the total market capitalization of GameFi tokens declining from an all-time high of $36 billion in Nov. 2021, to just over $5 billion.

6 Stats about the #GameFi Industry from 2022

1. The total market cap of all #GameFi tokens reached its peak of $25B on April 1st.

This was $11B shy of the industry’s ATH of $36B in Nov 2021.

Reference: https://t.co/YBSrPWxR3o(Token only, excluding gaming NFT)

— Ginoa.io (@ginoa_io) January 29, 2023

A New Lease Of Life

However, the concept of GameFi has since been refined and is now enjoying a resurgence amid the rise of a new generation of play-to-earn games that boast superior tokenomics and better gameplay, increasing their long-term sustainability.

GameFi has also been getting attention from traditional video game developers, such as Epic Games, which secured a $2 billion investment from Sony earlier this year. Epic Games said the funds would be used to develop its upcoming metaverse, which would feature dozens of play-to-earn games. Its metaverse is being developed in collaboration with some big names, including the studio behind hit AAA game Fortnite, and the iconic children’s toy brand Lego.

Meanwhile, GameFi-focused developers have secured plenty of backing themselves. The Hong Kong-based venture capital firm Animoca Brands has invested more than $434 million in Web3 and GameFi projects such as The Sandbox, Arc8, and Phantom Galaxies, this year alone.

Top Performing GameFi Tokens

One of the best-performing GameFi tokens this year is Illuvium’s ILV, which has increased its value by a staggering 122% between October and November, at a time when Bitcoin was also experiencing a resurgence.

With the market bullish on Bitcoin and other famous crypto tokens such as Ethereum, it has had a knock-on effect on GameFi. Last month, Immutable-X’s IMX token grew by more than 32% compared to the prior month, thanks in part to a recent announcement that it’s partnering with the renowned video game developer Ubisoft.

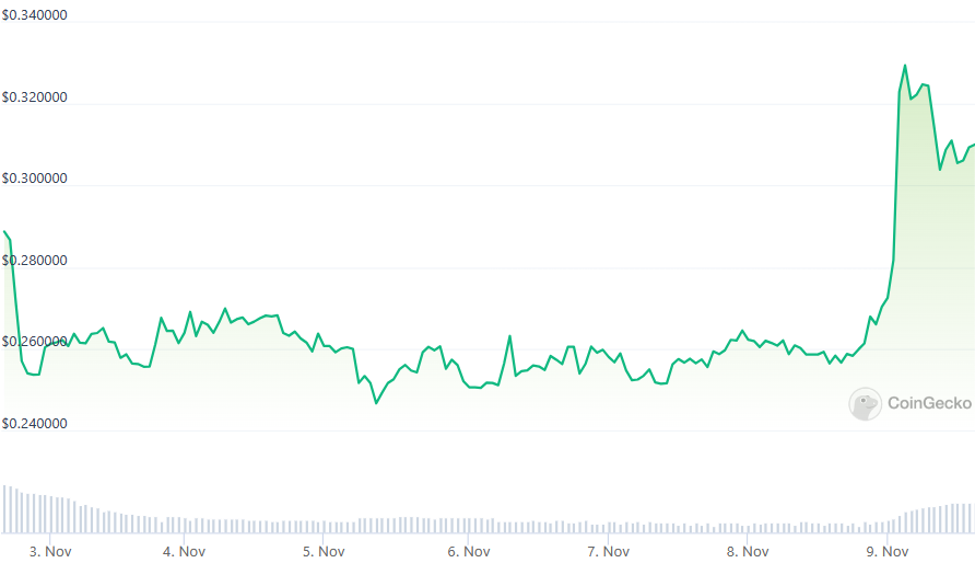

Meanwhile, the sci-fi-themed metaverse game Star Atlas saw a big uptick in the value of its DAO token POLIS, which rose by more than 20% in a single day in November. In Star Atlas, POLIS is a governance token that players must acquire in order to be able to take part in community votes on issues that affect the future direction of the game.

The Sandbox, one of the best-known metaverses, has also benefited from GameFi’s recent growth, as has Gala Games’ native token GALA.

Up-And-Coming GameFi Tokens

As we head into 2024, a number of promising new GameFi tokens have high expectations ahead of their launch. One of the most anticipated is Upland’s SPARK token, which will play a key role in its metaverse economy. Upland is a virtual world that’s mapped to the real world and it boasts having the world’s “largest open digital economy”. Players are encouraged to buy land and build up virtual properties, play games, create businesses and more. When it launches, players will be required to own SPARK tokens to accelerate the construction of their virtual buildings.

The interesting thing about SPARK is that Upland has focused on building its actual game first. It boasts three million players worldwide, and more than 30,000 are active on a daily basis. Its reputation has also been enhanced through partnerships with organizations like FIFA. During the 2022 World Cup in Qatar, Upland was FIFA’s official metaverse partner and built a full digital replica of the real-world World Cup village in Doha.

Upland has promised to bring additional utility to SPARK following its 2024 launch, which only increases its potential.

Other GameFi tokens launching next year include Web3 incubator GamePad’s GPAD, which will serve as the foundation of IDO launchpad, its rewards mechanism, NFT genesis platform, and more. GamePad is a launchpad that’s focused on supporting the development of AAA games, meaning it will only accept the highest quality GameFi projects.

Also promising is CTA, the native token of a new card trading and battle game called Cross The Ages. The game has already seen more than 300,000 downloads even prior to CTA’s launch, and it’s currently the second-most popular NFT game on the Immutable-X blockchain.

A Breakout Year For GameFi?

Expectations in the crypto industry are high as we enter the new year, with top cryptocurrencies finishing 2023 on a high due to optimism around the prospects for a Bitcoin ETF. Next year will also see the next Bitcoin “halvening”, which will see Bitcoin mining rewards slashed by half, increasing the scarcity of the token. Traditionally, these halvening events have always sparked bullish upward momentum.

That said, like all cryptocurrencies, GameFi tokens are still a risky bet and there’s no guarantee they will generate appreciable returns on investment, even if the wider crypto market embarks on a bull run. The prospects for any GameFi token are dependent on the success of the game itself, so developers must create a thrilling and addictive gameplay experience that keeps players coming back for more. A recent report by Game7 notes that “AAA-quality Web3 games” are still a rare breed, accounting for just 6% of all play-to-earn titles, with the rest being described as “indie-level” and “mid-sized” projects that may not have staying power.

Nonetheless, as the play-to-earn gaming market heats up and developers focus on creating more compelling gameplay, there are reasons to think 2024 could be the year that GameFi finally establishes itself as a viable model for the video game industry to follow.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.