FXSpotStream’s trading venue, the aggregator service of LiquidityMatch LLC, reported its operational metrics for February 2024, which moved lower on a monthly basis.

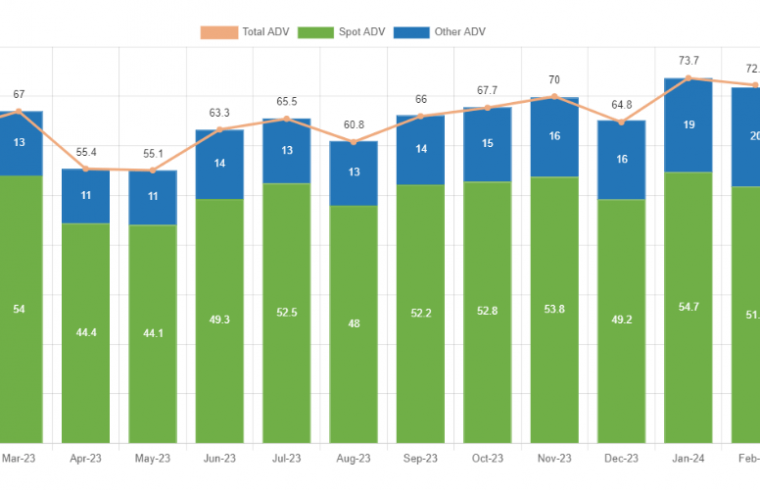

February’s average daily volume (ADV) was reported at $72.3 billion, down 2 percent from the previous month. January’s ADV was reported at $73.6 billion, a new all-time high, besting the previous record set back in March 2022 at $73.4 billion.

On a yearly timetable, the ADV metric was higher by 15 percent when compared with $62.9 billion in February 2023.

Meanwhile, December’s total turnover came in at $1.16 trillion, which was lower than $1.62 trillion in January 2024. Year-over-year, the figure was higher from $1.25 trillion in the previous year.

XSpotStream provides a multibank FX aggregation service for spot FX trading. The platform operates as a bank-owned consortium that provides the infrastructure to facilitate the route of trades from clients to liquidity providers.

Earlier in January, US investment bank Wells Fargo was the latest firm to join FXSpotStream’s growing consortium of liquidity providers. The platform onboarded Wells Fargoas as its 16th liquidity provider following changes to their LP pricing model. Building on this progress, the list now includes Barclays, BofA, BNP Paribas, Citi, Commerzbank, Credit Suisse, Goldman Sachs, HSBC, JP Morgan, Morgan Stanley, MUFG, Standard Chartered, State Street and UBS.

FXSpotStream’s offering is a client-to-bank platform, with each liquidity taker required to create individual credit relationships with participating banks. This differs from other multi-dealer platforms, such as FX ECNs like Hotspot and EBS Markets that operate with centralized order book systems for their participants.

The company caters primarily to institutional clients, including banks, asset managers, hedge funds, and proprietary trading firms. Its client base spans across the Americas, Europe, and Asia, and it continues to expand its reach by adding new liquidity providers and enhancing its technology infrastructure.