Proprietary trading firms Lark Funding and Alpha Capital have both announced changes to their operations that mainly affect their business with US clients.

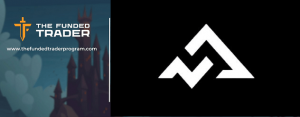

Lark Funding, based in Canada, announced that it would no longer onboard new US clients. Existing US clients, however, can continue trading as usual for now. At the end of the month, these clients will be migrated to DXTrade, though the specifics of this process are still being finalized. Lark Funding CEO Matt L said he hopes for allowing new US registrations in the future, pending regulatory developments and confirmed that this change does not impact clients outside of the US.

Meanwhile, Alpha Capital has confirmed its switch to the cTrader platform and has suspended sign-ups for US traders. The firm stated that it is seeking clarification on this matter to ensure certainty. However, operations in other jurisdictions remain unaffected by this change.

CTrader NOW LIVE

The new platform has officially been launched.

Upon purchasing a new account you can choose between MetaTrader and CTrader.

cTrader features include:

•Unlimited watchlists which can be detached and moved around your workspace

•Detailed symbol… pic.twitter.com/CsJG6AvSJT— Alpha Capital Group (@AlphaCapitalUK) February 21, 2024

In a similar move, The Funded Trader, another retail prop platform, has also shifted its technology provider to Spotware Systems, the developer of the cTrader platform.

👑 Big News, Traders! Welcome cTrader to The Funded Trader Family! 👑

We’ve just launched cTrader, and it’s nothing short of a trading game-changer! With this new development we’re coming to you with a complete breakdown and walk through of the C-Trader platform, how to connect… pic.twitter.com/kHTtw4FTIe

— The Funded Trader (@thefundedtrader) February 20, 2024

cTrader’s focus in 2024 would be on developing new tools for Introducing Brokers (IBs) and partners, particularly those related to algorithmic (algo) trading, the company’s head of growth told FinanceFeed in an exclusive interview at the Finance Magnates London Summit 2023.

Nikolai Isayev, editor-in-chief of FinanceFeeds, asked Andrew Mreana about his comments at the FX Expo International in Cyprus regarding My Forex Funds’ collapse and the fragility of the prop trading industry. He also inquired whether its implosion could trigger a domino effect, and how the industry might be preserved.

Mreana clarified that his comments at the FX Expo were based on the hype in the market and concerns about the professionalism and regulation within the prop trading industry. He observed that many individuals involved in prop trading lack professional market knowledge and that the industry is largely unregulated.

The key issue, according to Mreana, is trust. If retail traders lose trust in the prop trading ecosystem or if regulators step in and regulate it as they did with CFDs, it could negatively impact the business. He noted that the risk on the client side in prop trading is relatively low, but the industry’s lack of transparency and uncertainty about the ability of companies to support large liquidity pools are concerning.

Mreana suggested that implementing stringent professional standards within the industry might incentivize Forex brokers to incorporate proprietary trading into their existing businesses. He believes that as long as prop trading is treated with a regulatory mindset, it doesn’t pose a massive problem.