“Complex licensing practices by MDVs and trade data providers who deliver their data through MDVs increase costs for data users. Many Market Data Vendor (MDV) users have to hold licences both from the data generator (such as a trading venue) and from the MDV through which they access data. We have seen an increasing proliferation of licences for similar data types and different use cases. Complexity also drives additional costs for data users, such as operating a compliance team.”

The UK Financial Conduct Authority has released the outcomes of its study on the wholesale data market, specifically focusing on credit ratings data, benchmarks, and market data vendor services.

The FCA has decided against major interventions in these markets due to concerns about potential negative impacts on data quality and availability, which are crucial for global investors.

Despite this, the FCA has pinpointed issues in all three markets where competition is lacking, leading to potentially higher costs for users than if competition were more effective. It must be noted that the UK financial watchdog has doubled down on its commitment to address anti-competitive behavior in all markets, including the wholesale data market, under the Competition Act.

FCA revising and replacing assimilated EU laws

The FCA said it plans to explore ways to ensure wholesale data is offered on fair, reasonable, and transparent terms. This initiative is part of the FCA’s broader effort to revise and replace assimilated EU laws, aiming to enhance the UK’s status as a global financial hub through investment, innovation, and sustainable growth.

Sheldon Mills, Executive Director of Consumers and Competition, said: “The quality and availability of wholesale data is integral to well-functioning wholesale financial markets. Our market study found that firms can access the data they need to make effective investment decisions. “We do not believe the case has been made for significant interventions. However, we will examine ways to help support wholesale data being provided on fair, reasonable, and transparent terms.”

The FCA’s report on the wholesale data market highlights three main areas: benchmarks, credit ratings data, and market data vendors (MDVs). It finds no evidence of firms being unable to access the wholesale data they need, with most data of sufficient quality. However, it identifies evidence of market power across all three markets, potentially leading to higher prices for data than if competition were more effective.

Key issues include market concentration with a few providers dominating, high profitability among these providers, essential data leading to limited alternatives, and barriers for new entrants. The study suggests that while data costs are a small part of total costs for most users, the impact on end investors is not easily quantifiable.

FCA’s take on Market Data Vendors

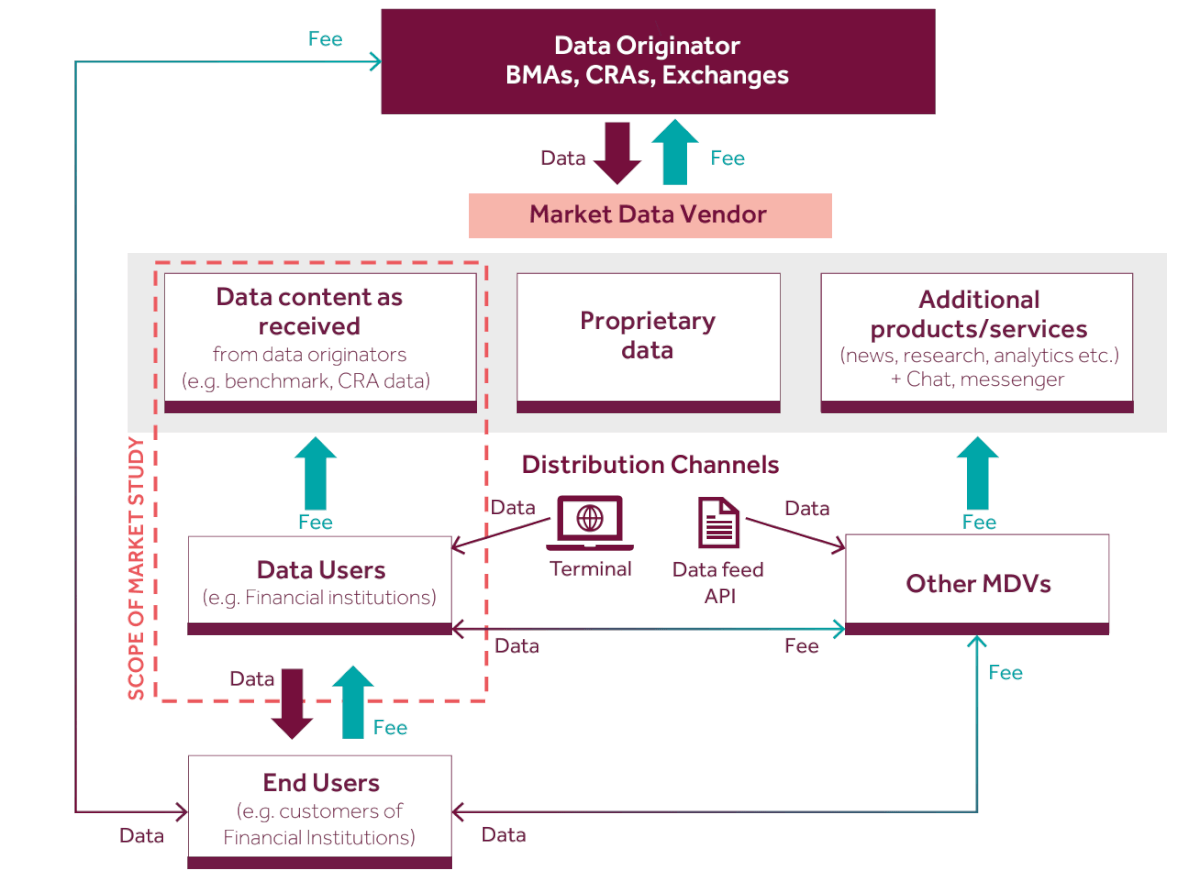

Market Data Vendors (MDVs) play a key role in the distribution of wholesale data, said the FCA in its report. “While MDVs’ formatting, aggregating, and distributing wholesale data to end users is largely unregulated, many firms use MDV services to inform their decisions about regulated activities. In 2022, the UK revenue of our sample of MDVs was £3.3 billion.

The regulator explained the different types of MDVs, providing a wide range of services which reflect different business models. “The main differentiating factor revolves around the source of the data being sold. On one side, there are MDVs whose core offering involves buying and re-selling of third-party data. On the other, there are vendors whose primary services involve the sale of proprietary data, such as trade data and credit ratings data. We have focused on firms that license wholesale data from data generators (which may also include entities within the same group as the MDV we looked at) and then distribute this data to users.”

The key findings of the Wholesale Data Market Study in regard to Market Data Vendors (MDVs) in the FCA’s words:

- “Overall, we found that users have a choice of MDVs who compete in data coverage, pricing, customer service, reputation, fee structure and how data can be used, among others. Around 60% of our surveyed users believe that there are credible alternatives to their current provider; around 40% have switched or partially switched, and more than 80% multi-source.

- “There are high levels of concentration and recent consolidation in MDV markets. The UK MDV market is highly concentrated in terms of revenue generated, with 2 firms accounting for most of it. Other firms’ contribution to aggregate revenue is in the low single-digit percentage range. In the past 5 years the MDV market has seen significant consolidation through mergers and acquisition activity. However, existing firms in the market have entered new market segments and developed new products and services.

- “It may be difficult for some MDV users to switch provider. Around 70% of respondents suggested switching was difficult or identified a barrier to switching. Some respondents suggested that there was a lack of alternative providers who could provide the same data coverage, quality or equivalent functionalities and services as their existing provider. This indicates that alternative MDV providers are not completely interchangeable. However, we did also see a considerable level of switching – around 40% of users told us they had switched or partially switched provider in the last 5 years.

- “MDVs’ pricing practices can lead to some users paying more for the data. MDVs bundle different products and sell them together, which reduces transparency and can increase costs. However, users can also benefit from bundled options. Users highlighted examples where previously bundled functionalities were unbundled and for which they had to purchase additional licences.

- “Complex licensing practices by MDVs and trade data providers who deliver their data through MDVs increase costs for data users. Many MDV users have to hold licences both from the data generator (such as a trading venue) and from the MDV through which they access data. We have seen an increasing proliferation of licences for similar data types and different use cases. Complexity also drives additional costs for data users, such as operating a compliance team.”