The UK financial industry watchdog sounds a warning over Bankman-Fried’s crypto exchange’s business into the country’s regulated financial market.

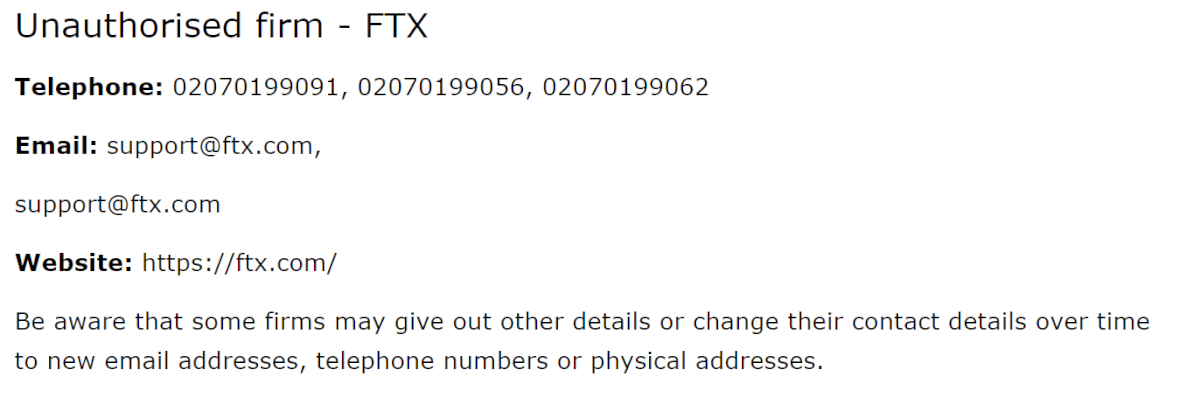

The Financial Conduct Authority (FCA) today issued several warnings to local investors highlighting unauthorized firms known to have been soliciting customers in the UK jurisdiction. The regulator pointed out that FTX was highlighted in the latest flurry against unauthorized firms for offering cryptocurrency-related services to British residents without being authorised to do so.

“This firm is not authorised by us and is targeting people in the UK. You will not have access to the Financial Ombudsman Service or be protected by the Financial Services Compensation Scheme (FSCS), so you are unlikely to get your money back if things go wrong,” the FCA said.

FTX has recently expanded to Europe after receiving approval from the Cyprus Securities and Exchange Commission (CySEC), but the FCA says the exchange’s offering makes it a great concern.

The warning comes even though FTX Europe has passporting rights to offer its products to clients across the European economic area. The European venture is headquartered in Switzerland along with a regional headquarters in Cyprus.

Per leaked financial documents, global trading revenue generated by FTX hit $1.02 billion in 2021, more than 10 times the $89 million recorded in 2020. Additionally, FTX’s operating income swallowed to $272 million throughout last year’s bull run from $14 million a year earlier.

The strong momentum seen in 2021 continued into the first quarter with $270 million in Q1 revenue. However, it was unclear how FTX held up in the second quarter as prices plunged and crypto platforms struggled to maintain momentum during the latest “crypto winter.”

The crypto giant, helmed by billionaire Sam Bankman-Fried, launched last month stock trading capabilities in the US.

UK tightens grip on crypto

Since January 2020, the City watchdog has become the anti-money laundering and counter terrorist financing supervisor of UK’s crypto asset firms. At the time, the FCA kicked off a registration scheme for crypto-asset firms with an initial deadline of one year.

However, nearly 70 crypto businesses had withdrawn earlier submitted filings for registration as the country tightens its regulation on the space. By retracting their applications, these firms had to cease operation in the UK, though more than 200 firms are still being assessed by the FCA.

Meanwhile, the UK Government plans to toughen up rules on crypto advertising that could be considered misleading. The Exchequer is proposing to bring the promotion of crypto-assets into the scope of the FCA’s existing oversight, rather than creating a new framework specifically for these products.

The City watchdog has already banned the sale of derivatives based on cryptocurrencies, in what was its first major intervention in the nascent market. The ban prohibits the sale of derivatives, including CFDs, options, and futures, based on cryptocurrency prices to retail investors.