The UK Financial Conduct Authority (FCA) has concluded its investigation into Odey Asset Management (OAM) and will not be taking any action, according to an announcement by the investment fund.

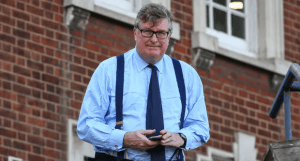

OAM, founded by Crispin Odey, closed down earlier in the year following allegations of sexual assault and harassment against its founder. The FCA’s investigation into OAM has been closed, but the investigation into Crispin Odey’s conduct is still ongoing.

Odey denies the allegations, and the FCA stated that it reserves the right to consider enforcement action in the future based on new information.

“I am writing to inform you that we have closed our investigation into OAM. The firm has announced that it is winding down its business and we continue to supervise the firm as it does so. It remains open to us to consider taking enforcement action in the future in relation to matters concerning our investigation into OAM, should new information come to our attention. Our investigation into Mr Odey remains ongoing, given the conduct under investigation relates to him,” said Nikhil Rathi, the FCA’s chief executive.

Odey Asset Management and its affiliates announced in November its closure five months after founder Crispin Odey faced allegations of sexual misconduct from junior female staff members.

The hedge fund, founded by Odey 32 years ago, has been in turmoil since these allegations emerged, leading to a massive outflow of investors and the severing of ties by key financial partners.

The crisis deepened after the Financial Times reported claims from 13 women accusing Odey of abuse or harassment over several decades. The number of allegations eventually rose to 20, including 12 former employees of the firm.

At its peak, OAM managed $13.3 billion in assets, which dwindled to $3.8 billion last year. Accusations have also surfaced that senior executives at OAM were aware of some misconduct allegations for up to 16 years before formally investigating Odey’s conduct.

Odey, a prominent figure in London’s hedge fund scene and a Conservative party donor, denied the initial allegations of misconduct. However, he admitted to one incident when the 20th woman came forward, attributing it to the effects of an anesthetic from a dental procedure.

Two of Odey’s alleged victims have filed a lawsuit against him and the firm for personal injury and psychological harm, a case yet to receive a formal response and currently filed in London’s High Court.

Earlier in June, Plus500 Ltd (LON:PLUS) bought back 7.3 million shares, which represents 8.2% of its issued share capital, from the beleaguered hedge fund.

Odey Asset Management has invested in Plus500 since disclosing a stake in the company in August 2015. Since then, it raised its holdings many times, particularly in 2019 when the CFD provider’s shares lost nearly one-third of its value amid material operational and financial impact from ESMA’s regulations.