European markets have done much better weathering the coronavirus storm than their global competitors, according to a new report.

IHS Markit put together a report entitled “The Investor Base in the EBRD Region” for the European Bank for Reconstruction and Development (EBRD) about equity markets in their region.

Along with the report, IHS Markit put together a webinar to present their findings.

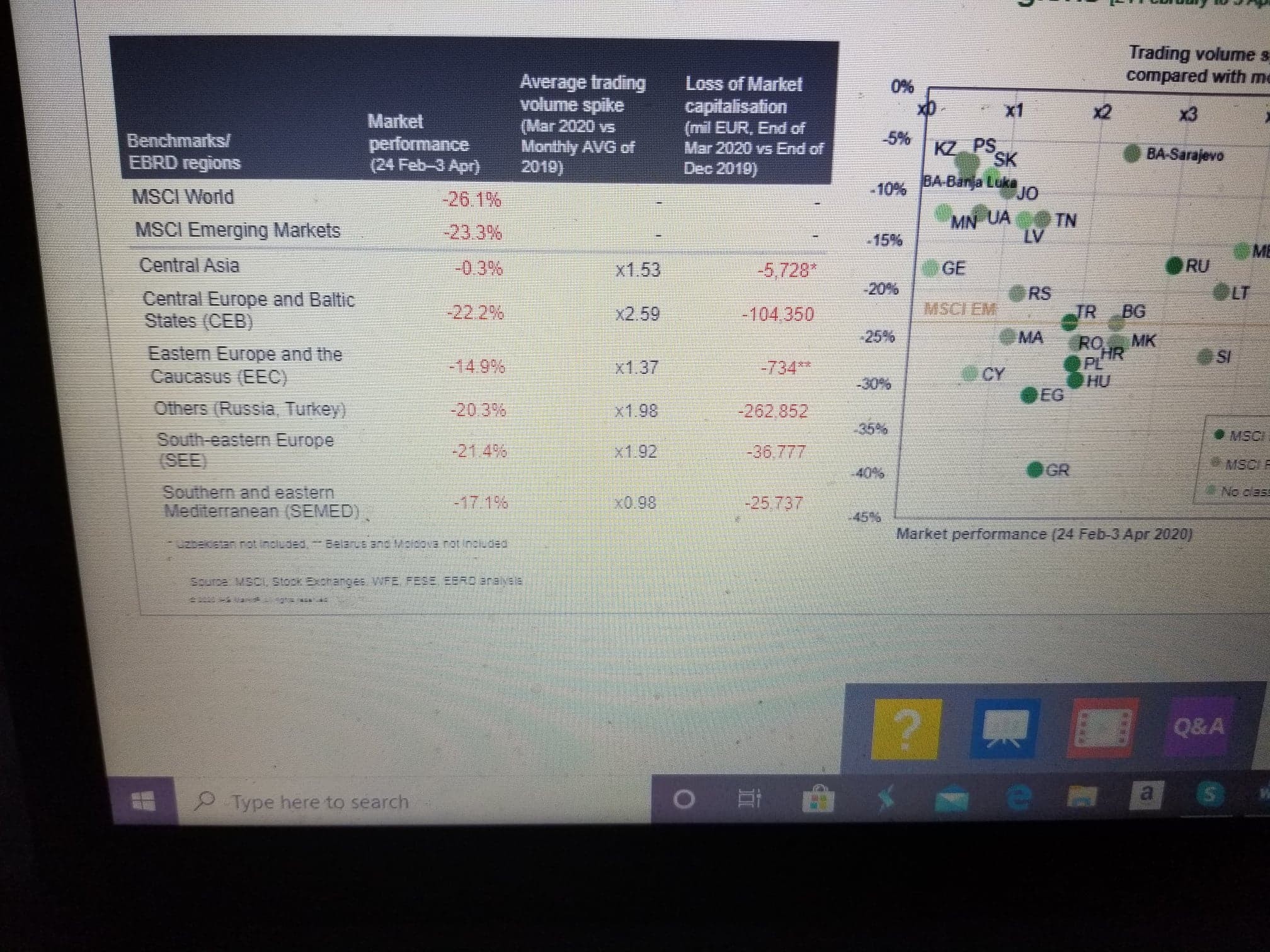

According to their analysis, the MSCI World Index lost 26.1% from February 24 through April 2 and the MSCI Emerging Market Index lost 23.3% over the same time period.

Meanwhile, the EBRD region, which covers more than just Europe, saw losses which ranged from a drop of only .3% in Central Asia to a loss of 22.2% in the Central Europe and Baltic States region.

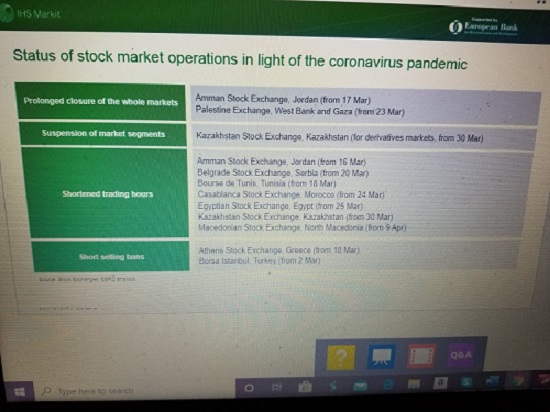

The individual stock exchanges in the region also some disruptions, according to another slide.

Both the Amman Stock Exchange and the Palestine Stock Exchange have been closed since the end of March while the Kazakhstan Stock Exchange suspended derivative trading for thirty days starting in March 30, according to the slide.

Here are some other highlights of the report.

- Respondents cited a number of topics that would increase the attractiveness of the EBRD regions. Interviewees noted that high growth rates in south-eastern Europe (SEE), reforms in Central Asia, the potential for “catch-up” in eastern Europe and low valuations in the southern and eastern Mediterranean (SEMED) region were key drivers. They also cited attractive demographic trends in Turkey (and in the wider BRICS countries – Brazil, Russia, India, China and South Africa), high dividends in Russia, the broadening of central European stock markets and the liberalisation of formerly closed-off economic systems across the EBRD’s regions as key factors that would increase investment allure.

- Of all the regions, EEC saw the most dramatic change in sentiment. More than 60 per cent of interviewees were bullish, compared with zero per cent in 2017. Even investors that were not actively buying there identified the region as the one that might benefit most from further market development. Standards of living were already improving, they said, in tandem with attractive growth rates. Political and macroeconomic volatility were cited as negatives in Russia and Turkey, but interviewees no longer spoke as frequently of sanctions in relation to Russia. They continued to mention attractive dividends. As a lot of Turkey’s institutional capital is perceived to have left the country, some investors said low valuations offered an opportunity for shrewd stock pickers. Although SEE countries continued to grow at attractive rates, interviewees said that some of the region’s stock markets had already performed very well, so were becoming less attractive. SEE is also heavily reliant on western Europe and Asia. Nonetheless, investors noted that these countries emerged from recession after the rest of Europe, so might have longer to run in terms of growth.

- As a whole, central Europe was deemed easier to trade in than other emerging markets, such as India. Participants said they appreciated countries making efforts to update settlement standards and reduce counterparty risk. They also noted that some level of trading difficulties and approval processes are naturally to be expected in frontier markets, though this also deters some mainstream institutional funds, resulting in valuation opportunities. Investors noted that even smaller markets usually had some securities with sufficient daily trading volumes for most funds. One investor added that in some countries, such as in the Slovak Republic, where equity markets were too shallow for its holding size, there was always satisfactory liquidity in government bonds. Participants that traded in currencies noted that as the number of market makers increased, more opportunities became available.

- Overall, there seemed to be a positive trend towards more investment activity and a shareholder focus on the economies in which the EBRD invests. According to the 2017 study, 1,748 individual firms had invested a net US$ 222.8 billion in the EBRD regions, while the 2019 survey identified net investment of US$ 249.5 billion, managed by 2,208 unique firms. Companies moved US$ 10.8 billion into the economies where the EBRD invests over the past two years, while unique investor exposure increased 26.3 per cent.

The EBRD region includes: Southeast Europe, Central Europe and the Baltic States, Eastern Europe and the Caucasus, Central Asia, Southern and Eastern Mediterranean, along with the countries of Russia and Turkey.

According to its website, the EBRD, “offers a wide range of financial instruments and takes a flexible approach in structuring its financial products.

“The principal forms of direct financing that the EBRD may offer are loans, equity and guarantees.”