Summary: The Dollar finished the week lower against its rivals in dull trading on Friday even as the total death toll in the US topped 140,000. Daily new cases continued to rise in 43 out of 50 states over the past two weeks, according to a Reuters tally. More states have been forced to put a halt to, or roll-back their reopening measures. Meantime, across the Atlantic, European Union leaders had to extend their summit by one more day as they failed to agree on a massive stimulus fund to revive their Covid-19 struck economies. At the close of trading in New York, the Euro was up against the Dollar by 0.23% to 1.1427. Against the Japanese Yen, the Greenback slid to 107.03 from 107.35. Sterling failed to take advantage of the weaker Dollar, finishing little-changed at 1.2570 (1.2580) with traders still concerned that the UK’s ongoing reopening will result in a second wave of coronavirus infections. The Australian Dollar managed a 0.15% gain to 0.6995 despite a continuing rise in Covid-19 community transmissions in New South Wales, the most populous state. Yesterday the state reported 18 new cases. Victoria, Australia’s coronavirus epicentre, recorded 363 new cases and 3 deaths. Asian currencies led the rally against the Greenback, with the USD/CNH (Dollar-Offshore Chinese Yuan) maintain near March lows at 6.9900. The USD/ZAR (US Dollar-South African Rand) closed 0.70% lower to 16.6800. Wall Street stocks were mixed with the DOW down 0.18% to 26,665. The S&P 500 gained 0.54% to 3,225. Optimism for an eventual coronavirus vaccine and hopes for more stimulus measures to power a post-pandemic economic recovery continued to drive equities higher. The G20 virtual meeting over the weekend saw member nations pledge to use “all available policy tools” to fight the coronavirus outbreak.

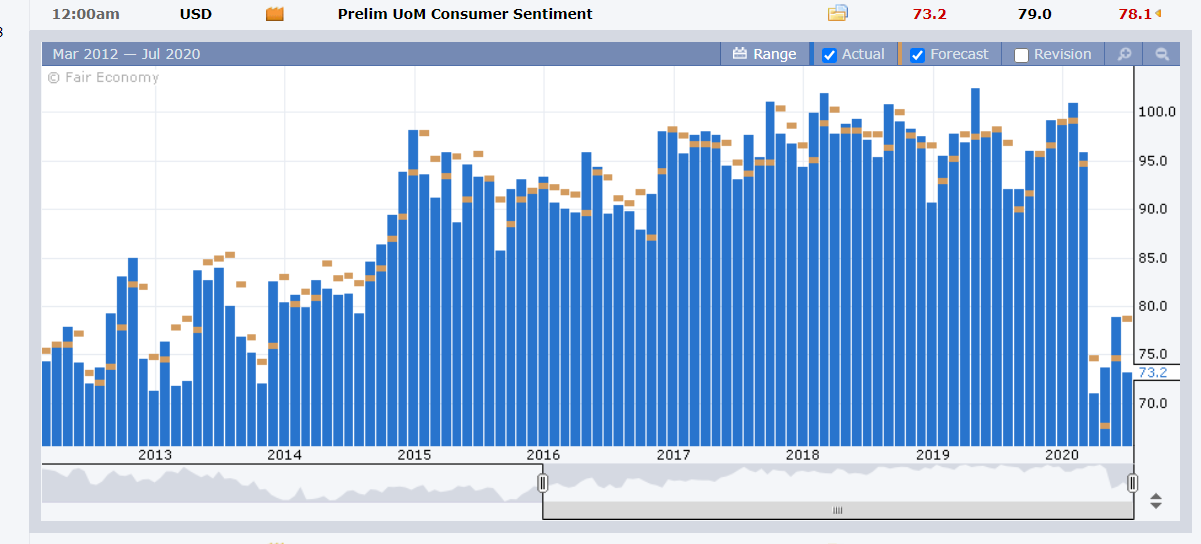

Data released on Friday saw Canada’s Wholesale Sales in June slump to 5.7%, missing forecasts at 7.4%. US Building Permits underwhelmed forecasts at 1.24 million against expectations of 1.30 million. The University of Michigan Preliminary Consumer Sentiment Index in July fell to 73.2 from a downwardly revised 78.1 in June.

On the Lookout: After summer-like doldrums hit FX most of last week with tight trading ranges developing, the US Dollar was still weaker overall at the end of the week. Economic data in the week ahead is considerably light as we head into the middle of the northern hemisphere summer season. Markets will look to another round of stimulus measures from various governments, led by the US as the resurgence of the coronavirus continues to grow at alarming rates in many areas around the globe. Monday’s reports kick off with Japan’s Trade Balance and the BOJ’s latest meeting minutes release. European data starts with Germany’s PPI (June) as well as the Bundesbank report. The Eurozone releases its Current Account data. The US has no major economic releases scheduled. The week ahead sees The RBA’s meeting minutes release on Tuesday, Australian Retail Sales (Wednesday). On Thursday, Euro area, Eurozone, UK and US Manufacturing PMI’s are scheduled for release.

Trading Perspective: There may be some gaps this morning in early Asia with the Dollar clawing back some of its losses following the weekend news. The EU should have had a decision by now on the massive stimulus fund. The delay will weigh on the shared currency and see a short-term bounce on the US Dollar. Market sentiment has been leaning against the Greenback as Europe’s success in dealing with Covid-19 contrasts starkly with that of the US. The economies will reflect this as markets digest upcoming data.

Meantime the virus outbreak and efforts to contain it seems to have taken a turn for the worse as growing infections continue to surge in various pockets around the globe. The US Dollar may benefit from it’s safe-haven status which has grown since the start of the pandemic. Could be an interesting start for this week today and the catalyst to see some volatility return to FX.

GBP/USD – Struggling, Low Rates and Brexit Weigh, Pullback in Sight

The British Pound remained the weakest among the major currencies, failing to gain ground on Friday with a close at 1.2568, 0.14% lower than its Thursday close at 1.2580. Traders see the prospect for negative rates growing after recent comments from Bank of England Governor Bailey that “interest rates will stay very low”. Brexit talks have yet to gain any meaningful progress. The UK’s economic reopening amidst surging coronavirus cases around the globe have markets concerned that Britain may experience its own surge in the virus infections.

GBP/USD has immediate resistance at 1.2600 followed by 1.2640. Immediate support can be found at 1.2550 followed by 1.2510. Look for Sterling to drift lower in a likely range today of 1.2510-1.2610. Prefer to sell on any rallies to 1.2600.

EUR/USD – Four-week Rally in Danger as EU Struggles to Agree Recovery Plan

The Euro advanced further on Friday to close in New York at 1.1427, a gain of 0.23%. The shared currency continued to grind its way higher against the US Dollar. The stark contrast between Europe’s efforts to contain the coronavirus with that of the United States has started to impact the economies. The yield gap between US and German key 10-year treasuries in a month has narrowed by 10 basis points.

This morning’s report of a delay by the European Union in agreeing a coronavirus recovery fund will weigh on the shared currency. The disagreement stems from a breakdown in the funding between grants and loans. The more conservative members prefer more loans than grants while the others want it the other way around. There is a possibility, according to diplomats (from a Reuters report) that the members would abandon the summit and try again for an agreement next month. ECB President Christine Lagarde said that it would be better for the leaders to agree an “ambitious” package than to have a quick deal at any cost.

EUR/USD opens in Asia a few points lower at 1.1419. Immediate resistance can be found at 1.1440 followed by 1.1470. Immediate support lies at 1.1400, 1.1370 and 1.1340. Look for the shared currency to drift lower with a likely range today of 1.1340-1.1440. Prefer to sell rallies.

AUD/USD – Firming But 0.70 Cent Cap Remains Solid on Virus Setback

The Australian Dollar is firming but is unable to break convincingly above the 0.7000 cent barrier as the country deals with a second wave of coronavirus infections. On Friday, broad-based US Dollar weakness buoyed the Aussie Battler as the US refused to return to strict lockdowns despite surging Covid-19 cases. Markets are concerned with the longer lasting effects on the US economy.

Australia’s two largest states, Victoria and New South Wales are seeing a second wave of coronavirus cases. This morning, the Daily Telegraph reported a fresh outbreak in regional NSW. Six people have tested positive for Covid-19 in Bateman’s Bay in the states south coast. The New South Wales government has urged residents to wear a face mask in public areas, avoid non-essential travel and high-risk venues. The state’s economy can ill afford a return to a partial lockdown.

AUD/USD has immediate resistance at 0.7000 followed by 0.7030. Immediate support can be found at 0.6960 and 0.6930. Expect a corrective move lower to 0.6950 first up. Likely range today will be 0.6920-0.7020. Prefer to sell rallies.