Remember all that hype leading up to the Dencun upgrade? Lower fees, faster transactions, and Ethereum scaling into the sunset? Well, two days in, the picture’s a bit more… nuanced.

While the upgrade went smoothly without any major hiccups, the impact on fees has been underwhelming. Sure, there might be a slight dip here and there, but the dramatic reductions many hoped for haven’t materialized. Is this a sign of trouble, or just a case of overinflated expectations?

Let’s examine whether Dencun is living up to its promises or if there’s more work to be done.

Ethereum’s Upgrade Goes Live

Dencun, Ethereum’s biggest upgrade since its proof-of-stake (PoS) shift 18 months prior, launched on March 13. Touted as a game-changer for dApps on layer 2 platforms, it fundamentally alters data storage on Ethereum, making layer 2 transactions more accessible and cost-effective.

Dencun sets its sights on a revolutionary goal: making transactions on layer 2 scaling platforms more affordable and potentially near-free. This shift is expected to trigger a mass user exodus from the congested Ethereum mainnet. With less traffic on the mainnet, gas fees are expected to plummet, finally opening the door for widespread adoption of decentralized applications (dApps) and protocols.

Dencun isn’t just a minor improvement; it is Ethereum’s most significant upgrade since the Merge in 2022, which initiated the transition to proof-of-stake. This project aligns perfectly with Ethereum’s long-term vision: supporting many rollup solutions and achieving the mind-boggling feat of millions of transactions per second.

Ethereum Stumbles After Dencun Launch

Despite the pre-upgrade hype, Ethereum’s price has plunged since Dencun’s deployment, throwing a wet blanket on hopes of a quick surge toward $5,000.

Remember that Dencun test run back in January? The Sepoli run fueled a surge of optimism among traders, sending prices on a 70% tear over the next six weeks, peaking at $4,092 on March 12. But then, when the upgrade hit the mainnet, Ethereum’s price seemed to disconnect from the rest of the crypto market, and traders started hitting the sell button.

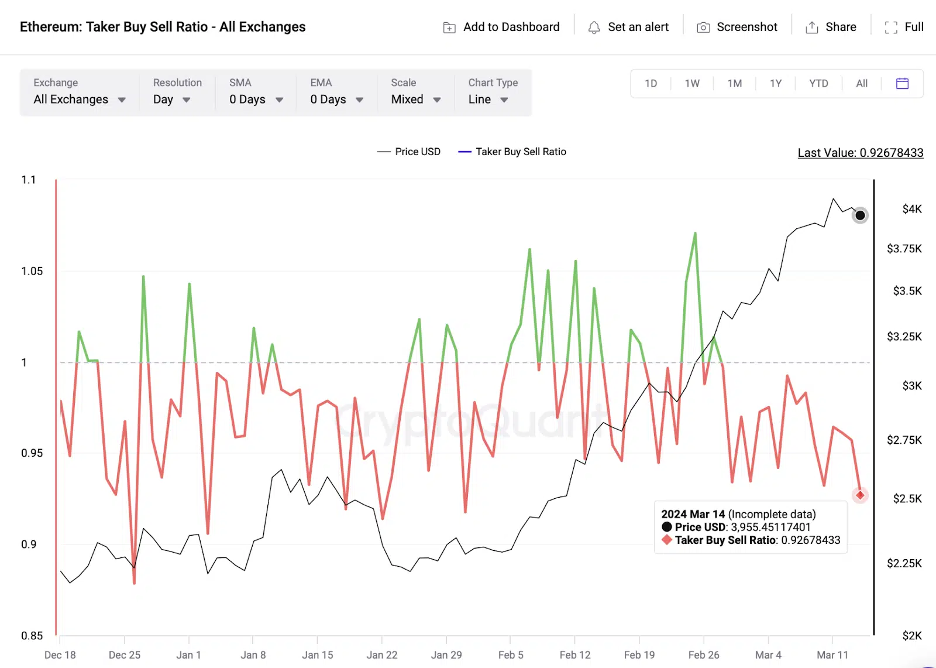

This shift in sentiment is reflected in a metric called the “taker buy/sell ratio.” Think of it as a way to gauge trading activity on exchanges. Well, this ratio plummeted to a 40-day low of just 0.93% on March 14, just a day after Dencun launched. Yikes!

Ethereum (ETH) taker/buy-sell ratio, March 2024 | Source: CryptoQuant

Here’s the deal with negative values in this ratio: they mean there’s more selling than buying happening in Ethereum’s perpetual swap markets. And when you see this trend happening alongside a price drop, it suggests that sellers might outnumber buyers for a while, potentially pushing prices even lower.

So, What’s Next for Ethereum’s Price?

Based on market data, that expected quick sprint to $5,000 after Dencun seems like a long shot. So far, things have been a little bumpy, with prices dipping below $3,900 as traders keep selling in reaction to the upgrade news.

There is a glimmer of hope, though! Many investors bought a ton of ETH (around 676,500) at an average price of $3,836. If these folks decide to buy more to avoid losing money, it could trigger a price bounce back up.

But here’s the catch: things could get messy if the price keeps going down. Many investors may be forced to sell automatically to limit their losses, which could put even more downward pressure on the price.

Now, let’s talk about the good stuff! If the bulls (investors who believe the price will go up) can push the price back above $4,050 and hold it there, that would be a great sign. It suggests confidence is returning to the market, and prices could start climbing again.

Final Thoughts

While Dencun hasn’t delivered the immediate fee reductions some hoped for, it represents a significant step forward for Ethereum’s scalability. As layer 2 adoption grows and the technology matures, users can expect a smoother and more affordable experience. The future of Ethereum remains bright, but it’s a marathon, not a sprint.