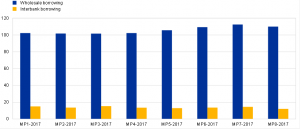

- The daily average borrowing turnover in the unsecured segment decreased from €112 billion in the seventh maintenance period to €110 billion in the eighth maintenance period of 2017

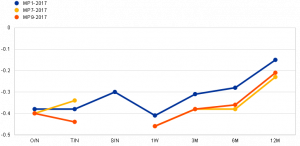

- The weighted average overnight rate on borrowing transactions remained unchanged at −0.40% for the wholesale sector and decreased from −0.39% to −0.42% for the interbank sector

Daily average nominal borrowing amount in the unsecured segment for the wholesale and interbank sectors, by maintenance period

Weighted average rate for wholesale sector borrowing in the unsecured segment by tenor and maintenance period

(Percentage)

In the latest maintenance period, which started on 20 December 2017 and ended on 30 January 2018, the borrowing turnover in the unsecured segment averaged €110 billion per day, compared to €112 billion in the previous period. The total borrowing turnover for the period as a whole was €2,969 billion. Borrowing from other credit institutions, i.e. on the interbank market, represented a turnover of €325 billion, i.e. 11% of the total borrowing turnover, and lending to other credit institutions amounted to €286 billion. Borrowing overnight transactions represented 48% of the total borrowing nominal amount. The weighted average overnight rate for borrowing transactions was −0.42% for the interbank sector and −0.40% for the wholesale sector, compared with −0.39% and −0.40% respectively in the previous maintenance period.