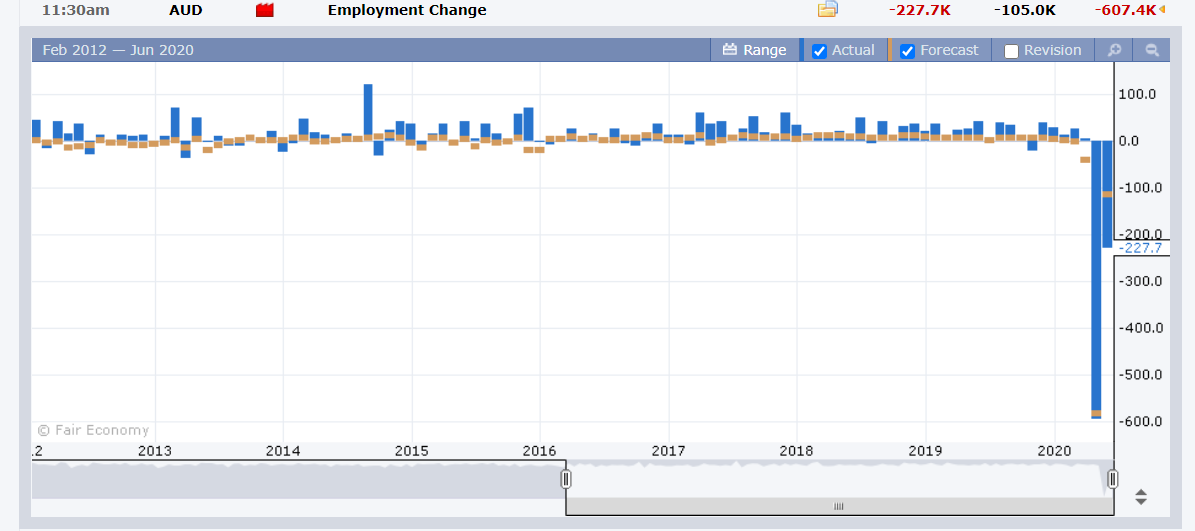

Summary: The US Dollar extended its gains as concerns of a rise in new Covid-19 cases globally and mixed US economic data drove demand for the Greenback. While Beijing claimed it was in control of the latest Covid-19 outbreak, statistics southern US states, Japan, Germany, and Portugal backed fears of another virus wave. US economic data was mixed with a surprise bounce in the Philly Fed Manufacturing Index offset by rising weekly Unemployment Claims. Wall Street stocks ended mixed. In a knee-jerk reaction, the British Pound soared initially to 1.25672 before plunging to 1.2402 after the Bank of England kept interest rates unchanged but added another GBP 100 billion to their bond buying program. BOE policy makers warned that there is a risk of “higher and more persistent unemployment” with repercussions for inflation and economic growth. The Euro hit two-week lows at 1.11855 finishing 0.35% weaker to 1.1210 (1.1242 yesterday). The Swiss National Bank left interest rates unchanged. USD/CHF climbed to 0.9515 (0.9490). Australia’s economy in May shed 227,700 jobs, underwhelming expectations of a jobs decline of 125,000 and April’s loss of 594,300. Australia’s Unemployment rate in May rose to 7.1%, worse than forecasts at 6.9% and the previous month’s 6.2%. The Aussie Dollar slumped to 0.68358 overnight lows before settling at 0.6850 (0.6885 yesterday) in late New York. Against the Japanese Yen, the Dollar was little changed at 106.95 (106.98) after the Bank of Japan kept it interest rates unchanged which was widely expected. The US Dollar rallied against the Canadian Loonie to finish at 1.3600 from 1.3563 yesterday. Bank of Canada Deputy Governor Larry Schembri said consumer spending will likely remain subdued until a coronavirus vaccine was found. Global Treasuries were mostly up and yields down. The key US 10-year bond yield was 3 basis points lower to 0.71%. Germany’s 10-year Bund yield closed at -0.44% from –0.40% yesterday.

Other data released yesterday saw Switzerland’s Trade Balance fall to +CHF 2.8 billion in May from CHF 4.04 billion the previous month. Canada’s Wholesale Sales slumped to -21.6% in May underwhelming forecasts of -11.6% and April’s -2.7%. Canada’s Payrolls rose to 208,400 in May from a downwardly revised -2.361 million. The US Philadelphia Fed Index rose to 27.5 in May beating median forecasts at -23.0 and April’s -43.1. Weekly Unemployment Claims fell to 1.508 million from the previous week’s 1.56 million, missing forecasts at 1.3 million.

On the Lookout: Fears about fresh coronavirus outbreaks will continue to be the relevant factor for markets. The number of cases in several US states keeps rising, specially in the south. New COVID-19 cases keep rising in third world countries like India, Pakistan and much of Latin America. Germany and Portugal reported an increase in new cases.

Today’s economic calendar kicks off with Japan’s National Core CPI report followed by the Bank of Japan’s Monetary Policy Meeting Minutes (May). Australia reports its Retail Sales data. The European Union holds its Economic Summit on video. European reports start with Germany’s PPI and Eurozone Current Account. The UK follows with its Retail Sales (May) and Public Sector Net Borrowing reports. Canada follows with its May Headline and Core Retail sales. The US sees its Current Account data. Fed Chair Jerome Powell and Cleveland Federal Reserve President Loretta Mester speak at a virtual panel discussion in a youth community event in Ohio.

Trading Perspective: The US Dollar should retain its bid bias as we head into the last day of this week. The combination of risk aversion and mixed US economic data supported the Greenback against its rivals yesterday. A total of 8,565,219 people have been reported to be infected with Covid-19 globally resulting in 455,470 deaths. This serves as a reminder of the risks of reopening economic activity before a vaccine is found. It is a long and winding road back to recovery. In these current circumstances, the Dollar will benefit from safe-haven flows.

AUD/USD – Pressured by Weak Jobs, Risk Aversion Continues to Weigh

The Australian Dollar managed to bounce off its overnight lows at 0.68358 to finish in late New York at 0.6855. The Battler was pressured by the weaker-than-expected fall in Australian Employment and worse than expected rise in the Unemployment rate to 7.1%. Another 227,700 jobs were axed in May following April’s losses of a 607,400 which were revised higher from 594,300. According to the Australian Business Insider, “had masses of unemployed Australians not simply given up looking for a job, the unemployment rates would actually be above 11%”.

Growing fears of a rising second wave concerning the deadly coronavirus continued to drive risk aversion up. Cases in US states Florida and Texas spiked with Texas marking a record jump to total 100,000. Numbers were also up in developing countries led by Brazil, Mexico, Chile, Pakistan and India.

AUD/USD has immediate resistance at 0.6870 followed by 0.6900. Immediate support can be found at 0.6830 followed by 0.6800 and 0.6770. Expect consolidation today within a likely range of 0.6780-0.6880. The pressure remains lower but it’s a Friday and trading the range is the best strategy.

EUR/USD – Slip-Sliding Away, 1.1170 Support Next Target

The Euro continued its corrective grind lower following reports of a rise in new Covid-19 cases in Germany and Portugal. EUR/USD closed 0.36% weaker to 1.1210 from 1.1240 yesterday. The shared currency is down 1% since Monday (1.1330). Traders were also questioning whether the European Union would be able to pass an ambitious stimulus plan proposed to the European Commission with some countries opposed to handing out such grants.

We highlighted earlier this week the net speculative long Euro bets were at their biggest since May 2018 (+EUR 95,649 contracts). That number has been growing steadily since the start of this month. The current market positioning will continue to weigh on the shared currency.

EUR/USD has immediate support at 1.1200 followed by 1.1170, which is strong. A break of 1.1170 would see 1.1130 and 1.1100. Immediate resistance can be found at 1.1240 and 1.1270. Look for consolidation today with a likely range of 1.1170-1.1240. Prefer to sell rallies.

USD/CAD – Grinding Higher as Virus Risk Renews Upside

The US Dollar rose against the Canadian Loonie to finish just above the 1.3600 mark. Higher oil prices kept the USD/CAD pair capped after a rise in risk aversion lifted the Greenback to 1.3616 overnight highs. Canadian economic data released yesterday mostly underwhelmed. The rise in new Covid-19 cases globally will weigh on the Loonie.

USD/CAD has immediate resistance at 1.3620 followed by 1.3650 and 1.3700. Immediate support can be found at 1.3570 followed by 1.3520 and 1.3480. Canada’s Retail Sales report is due out today where falls are expected in both Headline and Core numbers. Any number that is worse than forecast will weigh on the Canadian Dollar. A good number will provide temporary reprieve.

Look to buy dips in a likely range today of 1.3575-1.3725.