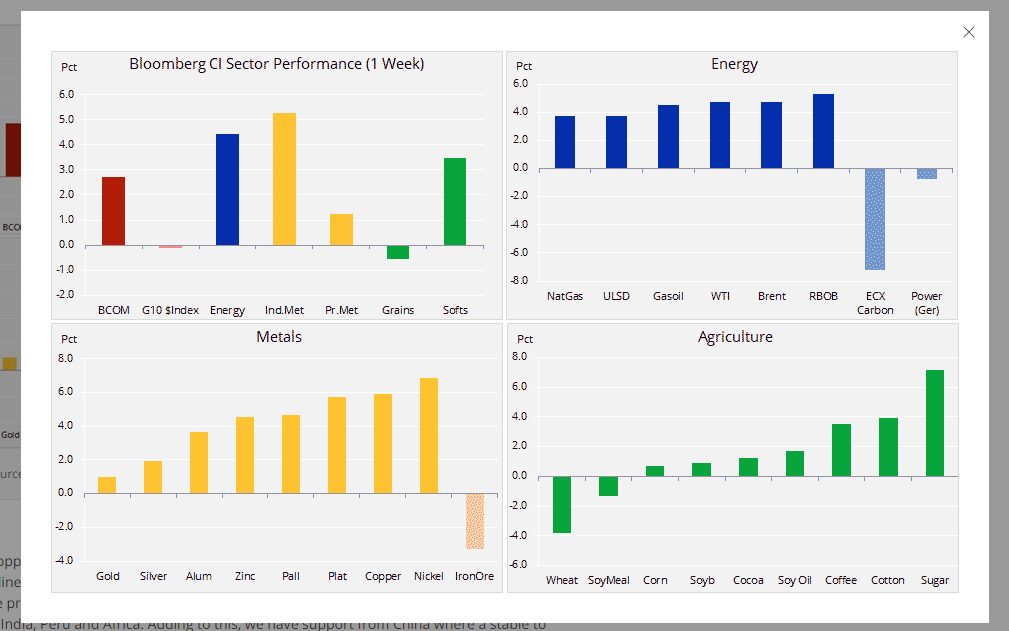

Summary: The Dollar remained confined to recent ranges, slipping to post moderate losses against its Rivals at the close. Trade talks and Brexit continued to dominate the agenda with both deadlines likely to be extended. The Euro finished flat at 1.1335 with a similar, albeit slightly lower trading range from the previous session. Resource currencies rallied as commodity prices traded higher for the second week running. The Australian Dollar rebounded to 0.7150 before settling at 0.7135 following its slide to 0.7080 on Friday. China denied it was banning Australian coal imports. The Canadian Dollar outperformed, climbing 0.7% against its US counterpart on higher resources. The Bloomberg Commodity Index reached a 10-week high with strong advances in energy, industrial metals and resources according to a Saxo Bank report.

The Dollar Index (USD/DXY) ended the week near 96.50, easing to 96.487 from 96.612 Friday.

The yield on the US 10-year Bond fell back 4 basis points to 2.65%. Positive sentiment enabled Wall Street stocks to finish higher.

- AUD/USD – the Australian Dollar rebounded to hit 0.7150 from its opening 0.7080 after China denied it was banning coal imports from the country. Base metal prices extended gains which supported the Aussie. Copper was up 1.7%, leading aluminium and zinc higher. AUD/USD finished at 0.7135.

- EUR/USD – The Single currency finished flat at 1.1335 after trading in a narrow range, practically mirroring the previous night’s session. The Euro remained confined in a 1.1280-1.1380 range last week. While economic data from the Euro area was disappointing, it didn’t fare much better in the US.

- USD/JPY – The Dollar was little-changed against the Yen, closing at 110.65 (110.70 Friday). The 4-basis point drop in the US 10-year bond yield limited any upside momentum for the Greenback.

On the Lookout: Expect another slow Monday start in Asia today. New Zealand Q4 Headline and Core Retail Sales released a few minutes ago exceeded expectations. Headline Retail Sales jumped to 1.7% against a forecast rise of 0.5%. Core Sales soared to 2.0% against an expected 0.8%. The Kiwi (NZD/USD) spiked to 0.6860 from 0.6845 following the release in early Sydney. The rest of today has little data. Tomorrow see UK Nationwide House Prices while the US reports on Housing Starts and Building Permits.

Fed Chair Jerome Powell testifies to the Senate Banking Committee on the Semi-annual Monetary Policy report on Tuesday (early Wednesday morning Sydney).

Trading Perspective: Expect the Dollar to continue its grind lower given the drop in the US 10-year bond yield. Last weeks US data disappointed and a relatively healthy risk appetite took away support from the Greenback. Stronger commodity prices will also weigh on the Dollar. The Dollar Index (USD/DXY) should grind lower.

- USD/DXY (Dollar Index) – Expect the Dollar Index to grind lower with initial support at 96.25/35. We can find stronger and medium-term support at 96.00, which would require a sustained break to move lower. Immediate resistance lies at 96.80 (overnight high 96.78). Look to sell any rallies to 96.70.

- AUD/USD – The Australian Dollar had a good bounce off the 0.70828 overnight low, trading to a high 0.71503 following China’s denial banning Australian Coal imports. The strong performance of metals also supported the Aussie. AUD/USD closed at 0.7135. Immediate resistance lies at 0.7150 followed by 0.7180. Immediate support can be found at 0.7100 and then 0.7080. Look to buy any dips to 0.7100/10 with the next target back at 0.72 cents.

- USD/JPY – This currency pair ended little changed and has traded above 110.00 all week. The momentum has shifted to the downside after the failure to break up through 111.00 which remains strong resistance. Immediate support can be found at 110.55 (overnight low). The next support level is at 110.25 followed by 110.00. With a lower US 10-year bond yield, look to sell USD/JPY on any rallies with a likely range today of 110.15-75. Look to sell rallies.

- EUR/USD – The Single currency finished flat, confined to a narrow trading range on Friday. Last week most Euro-area economic data fell below expectations. However, US data didn’t fare much better and we are stuck in limbo. Nevertheless, the momentum for the Euro, given a weaker US Dollar sentiment, should see EUR/USD attempt 1.1400 at some stage soon. EUR/USD has immediate resistance at 1.1360/70 followed by 1.1400. Immediate support can be found at 1.1315, followed by 1.1290. Look to buy dips today with a likely range of 1.1315-1.1365.

Have a good week ahead all.