Summary: The US Dollar sell-off intensified as bearish sentiment toward the Greenback grew with no specific catalyst for the slide. European Union leaders agreed unanimously on a EUR 750 billion coronavirus recovery fund that had an ideal mix (almost 50/50) of loans and grants. The news lifted the EUR/USD to 1.15398 (1.1450) overnight and 18 months highs before settling to close at 1.1525, up 0.63%. There were no major US data releases yesterday but the inability of the country to control the alarming rises in new cases and new deaths due to Covid-19 has seen the economic outlook more uncertain than ever. Divergence between Europe, Australasia and the rest of the world versus the US in terms of virus control and growth has seen sentiment against the Greenback grow since it’s peak in March.

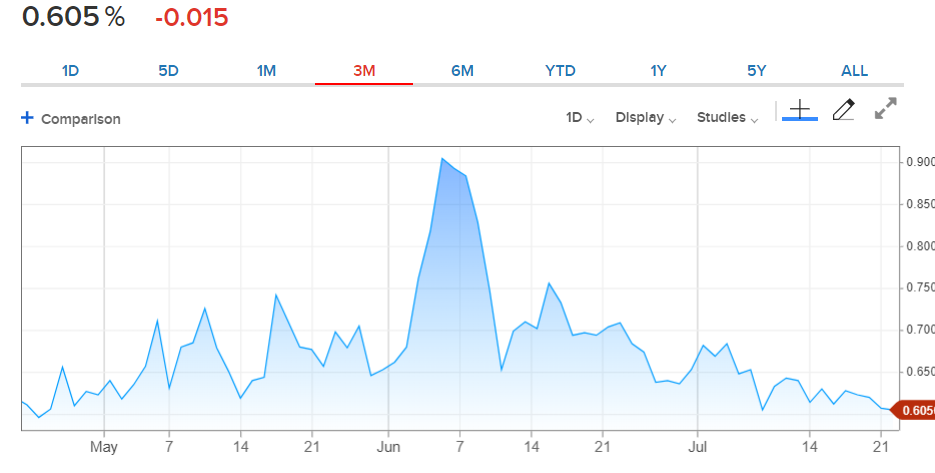

Risk leading currency, the Australian Dollar surged to 0.7147, its strongest level since April 2019, before easing to settle at 0.7130 (0.7017 yesterday) in late New York. Australian Prime Minister Scott Morrison extended the government’s wage subsidy (JobKeeper and JobSeeker) program for another 6 months until the end of March 2021. There will be a decline in the actual payment for the next few months and 2-tiers introduced for hours worked. RBA Governor Phillip Lowe expressed concerns about the restrictions in Victoria and the labour market in his speech on video. Sterling rallied to 1.2735 (1.2660) on the back of broad-based US Dollar weakness. The USD/JPY pair slipped to 106.80 from 107.30 as the benchmark US 10-year Treasury rate fell to 0.60%, the lowest level since late April. Against the Canadian Loonie, the Greenback lost 0.50% to 1.3455 (1.3537) despite a weaker than expected Canadian Retail Sales report. Wall Street stocks closed with modest gains. The DOW added 0.37% to 26,847 (26,740) while the S&P 500 gained 0.18% to 3,260 (3,252). Data released yesterday saw Canada’s Retail Sales climb to 18.7% in June from -26.4% the previous month, although it missed forecasts for a 20.2% rise. Core Retail Sales rose to 10.6% from -22%, also missing expectations at 11.9%.

On the Lookout: Data picks up a touch today with the US reporting its Existing Home Sales at the tail end of today. Australia kicks off with Westpac Leading Index for June. Japan follows with its Flash Manufacturing PMI report before Australia returns with June Retail Sales. Median forecasts are for a rise of +7.1% following May’s +16.9%. There are no European reports due out. Canada kicks off North America with its Headline, Core, Trimmed and Median CPI data. The US rounds up the day’s reports with its House Price Index (June) and Existing Home Sales.

Thursday sees global Manufacturing PMI’s which will dictate the tone of FX.

As the domestic Covid-19 situation in the US continues to worsen, the market’s risk-on profile, despite stimulus hopes, will come to an end soon. Markets will need to see the contrast between the in growth continue to favour the rest of the world as opposed to the US. More upcoming data releases toward the end of this week will be closely monitored.

The US is in the middle of negotiating a fiscal stimulus package totalling between USD 1-2 trillion. Lawmakers will need to get this through soon. Which could see safe haven demand return and break the Greenback’s fall.

Trading Perspective: The US Dollar is slip sliding away with little to attract traders to the Greenback. What could save the Greenback and slow the slide? Apart from a US agreement to a fresh stimulus package, currently being negotiated, short term market positioning is decidedly US Dollar short against most currencies. Every man and his dog are bullish currencies, bearish on the Dollar. We could see correction of sorts before the trend continues.

Expect consolidation in Asian trading today. We look at a few currencies.

The Dollar Index (USD/DXY), a favoured gauge of the Greenback against 6 major currencies plunged to March 2020 lows at 95.047 before closing at 95.209. Immediate support at the 95.00 level should hold while FX consolidates this strong move lower in the Greenback. Immediate resistance can be found at 95.50 and then 95.80. Look for a likely trading range today of 95.10-95.80. Prefer to buy on dips, the move lower looks a touch overdone and we can expect a pullback shortly.

EUR/USD – Surges Past 1.15 on EU Historic Agreement – What Next?

The Euro surged past the 1.1500 level as European leaders reached a historic agreement to trade to overnight and February 2019 highs at 1.15398 before settling at 1.1535. EUR/USD grinded higher to1.1542 in early Asian trade this morning. The historic agreement of the EU leaders, while anticipated, still lifted the shared currency. The market’s risk-on tone plus the growing contrast between Europe’s ability to contain the recent coronavirus outbreak with the United States has added lustre to the EUR/USD pair. The Dollar’s slump has also been broad based, and this also played into the Euro’s favour.

Expect consolidation today with no major Euro area releases today. The US sees its Existing Home Sales. Tomorrow global Manufacturing PMI reports will be released, and this could set the tone for either a correction or further gains. Speculative short-term market positioning has been long in the EUR/USD pair for some time now and this has yet to see a decent pullback. With every man and his dog bullish on the Euro, there is a strong possibility of this occurrence.

EUR/USD has immediate resistance at 1.1550 followed by 1.1600. Immediate support can be found at 1.1500 and 1.1470. Look for consolidation within a likely range of 1.1450-1.1550. Look to sell on rallies, a pullback is around the corner.

AUD/USD – Takes a Breather, Spotlight on Aussie Retail Sales

The Australian Dollar surged past the 0.7070 resistance level to 0.71470 overnight and 23 April 2019 high before easing to settle at 0.7125 in late New York. Despite an alarming rise of 374 new cases in Victoria, the country’s coronavirus hotspot, it paled in comparison to the continuing upsurge in both infections and death from Covid-19 in the United States. The market’s risk-on tone also fuelled the Aussie’s surge as did strong metals prices.

Yesterday RBA Governor Philip Lowe gave the green light to the government to lock in a budget deficit by large spending to support the economy. Lowe said though that policymakers will not “print money” to support the spend. Lowe also said that he was concerned about the labour situation and signalled possible rate cuts.

Australia’s Retail Sales report today is forecast to climb 7.1% in June following May’s 16.9% rise. Anything lower than 7.1% could see a corrective move lower in the Aussie. Market positioning at the last COT report was basically square on the Battler. That would have changed to a long net position considering the Aussie’s climb.

AUD/USD has immediate resistance at 0.7150 followed by 0.71280. Immediate support can be found at 0.7080 followed by 0.7040. Look for a likely range today between 0.7040-0.7140. Prefer to sell rallies at current levels as a likelihood for a corrective move south builds.