Summary: The Dollar grinded higher in featureless, holiday-mode trade supported by a rise in US yields as improving economic data quelled the likelihood of a Fed rate cut in early 2020. A favourite gauge of the US Dollar’s value against a basket of foreign currencies, the Dollar Index (USD/DXY) advanced 0.17% to 97.387 (97.234). The Euro slipped 0.32% to 1.1120 (1.1150) while Sterling steadied just under 1.31, at 1.3087, following its spectacular dive yesterday. Ahead of today’s Bank of Japan policy rate meeting, the Dollar was modestly higher against the Yen at 109.60 (109.52). The BOJ is widely expected to keep policy unchanged at their meeting today. The Australian Dollar finished little changed at 0.6854 (0.6850). Meantime the Kiwi jumped 20 points from 0.6575 to 0.6595 following upbeat New Zealand Q3 GDP which rose to 0.7%, beating expectations of 0.5%. Australia’s Employment report is released later today (11.30 am Sydney time). US equity markets stumbled at the close as support for the impeachment of President Donald Trump grew in Congress. Meanti

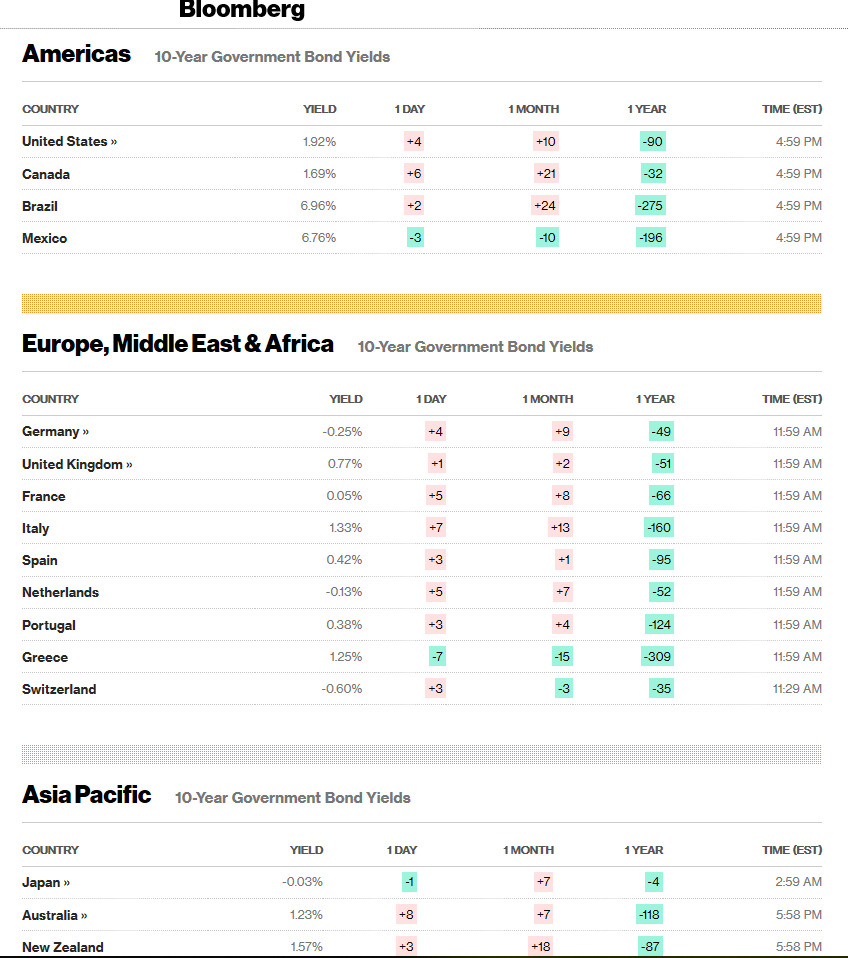

me the phase-one China-US trade deal has yet to be signed. The DOW finished at 28,275 (28,300 yesterday) while the S&P 500 was little changed at 3,196 in New York. Improving US economic reports (Industrial Production and Building Permits Tuesday) saw the US 10-year bond yield climb to 1.92% (from 1.89%).

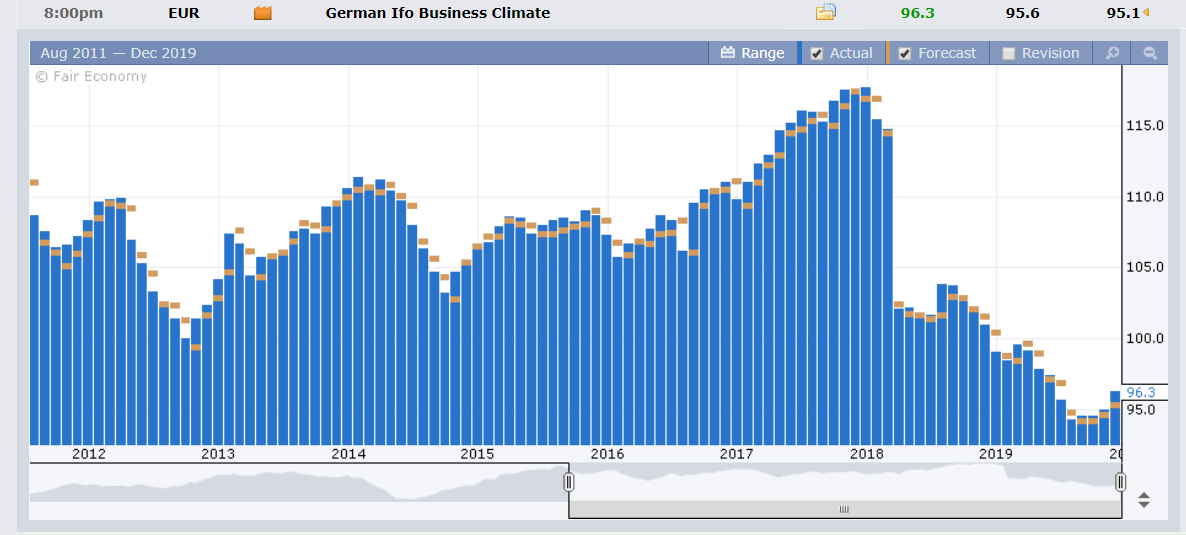

Yesterday, Germany’s IFO Business Climate Index improved to 96.3 beating forecasts at 95.6 while PPI slipped to -0.3%, missing expectations at 0.0%. UK Annual Headline CPI in November printed at 1.5%, beating expectations of 1.4%, and matching October’s 1.5%.

- EUR/USD – The Euro dipped against the US Dollar, closing at 1.1120 from 1.1150 yesterday despite a rise in German Business confidence. Trading was mostly dull within a 1.1110-54 range.

- GBP/USD – Following its spectacular slide which began in early trade yesterday, the British Pound settled at 1.3085. Fears that Britain could leave the EU without a trade deal saw Sterling lose all its election gains, and then some. Higher UK inflation numbers steadied Sterling, which held at 1.3060 overnight lows.

- USD/JPY – The Dollar saw modest gains versus the Yen to 109.60 from 109.52. The higher US 10-year bond yield support this currency pair.

- AUD/USD – The Australian Dollar fell to 0.68386 which was the low traded after release of the RBA’s latest meeting minutes suggested a rate cut early next year. AUD/USD edged back up to close at 0.6855.

On the Lookout: Today sees an increase in economic reports, the biggest data dump ahead of the upcoming Christmas holiday week. The BOJ and BOE rate policy meeting decisions are also due today.

Australia’s Employment Change (November) is expected to show an increase of around 15,000 jobs from October’s loss of 19,000. The Unemployment rate is forecast unchanged at 5.3%.

The BOJ is expected to keep its Discount rate at -0.1% and monetary policy steady. BOJ President Kuroda holds his press conference later in the Tokyo afternoon.

Europe sees Switzerland’s Trade Balance. The UK reports on its Retail and CBI Realised Sales. The Bank of England is expected to keep its rates and policy on hold. US reports finish off the day with Philadelphia Fed Manufacturing Index, US Current Account, Weekly Unemployment Claims, Conference Board Leading Indicators, and Existing Home Sales.

US data tonight will be crucial to see if the current improvement can extend.

Trading Perspective: After last night’s moves, we can expect more consolidation within the recent ranges established. The focus remains on Boris Johnson and his Brexit plans, progress or lack of progress on the China-US phase one trade deal, movement to impeach US President Trump plus any surprises from the BOJ or BOE later today (unlikely). US economic data releases will also be monitored. A disappointment in the Philly Fed Manufacturing Index or Existing Home Sales could see US yields head back down and a softer Dollar. Bear in mind as well that the current market’s position is still short of currencies (Euro, Pound, Yen, Aussie, Kiwi).

- EUR/USD – The Euro traded within a relatively tight range of 1.1111-1.1154, closing at 1.1120. The short-term momentum for the shared currency is lower with immediate support at 1.1100 expected to hold. The next support level lies at 1.1075. Immediate resistance can be found at 1.1150 and 1.1180. Overnight, Germany’s 10-year Bund yield climbed 5 basis points to -0.25% (against a 3 basis points climb for the US 10-year rate). This should provide modest support for the Euro at the 1.1100 level. There are no major Euro area data reports today, the focus will be on the US economy. Look to trade a likely range today of 1.1100-1.1150.

- GBP/USD – Sterling fell to an overnight low at 1.3060 before edging up to finished at 1.3085, down 0.3% from 1.3115 yesterday. Higher UK Inflation numbers were supportive of the Pound, but they are still within the lower bank of the Bank of England’s target. The focus remains Brexit. Boris Johnson announces his governments legislative priorities today (UK time) with Brexit the priority. GBP/USD has immediate support at 1.3060 and 1.3010. The next support lies at 1.2980. Immediate resistance can be found at 1.3120 and 1.3170. Look for consolidation in a likely 1.3050-1.3150 range today. Just trade the range shag on this one.

- USD/JPY – The Dollar edged up against the Yen to 109.60 from 109.52. USD/JPY is supported by the higher US 10-year bond yield. The BOJ is expected to keep interest rates and policy steady amidst the current global environment. Risk sentiment remains positive but the longer the phase one trade deal goes without further details and signatures, things will sour. And USD/JPY will head south. Immediate resistance lies at 109.65 (overnight high 109.62) followed by 109.85. Immediate support can be found at 109.40 followed by 109.10. Look for consolidation within a likely 109.20-70 range. Prefer to sell rallies.

- AUD/USD – The Aussie closed at 0.6853 after trading in a familiar 0.68386-0.68643 range. Australia’s Employment report is expected to see a gain of 15,000 jobs in November following October’s shock loss of 19,000 jobs. The Jobless rate is expected to remain at 5.3%. An employment gain of 20,000 or more jobs will see the Aussie trade higher toward 0.69 cents. A disappointment would be a gain of 5,000 jobs to -5,000. AUD/USD would test 0.68 cents. Immediate support lies at 0.6840 followed by 0.6810. Immediate resistance can be found at 0.6870 followed by 0.6900. Would prefer to buy any weakness on the Aussie towards the 0.6800/30 area. Would not be a seller until above 0.6910.

Happy trading all.